Reviewing net of points supplies’ Q1 revenues, we analyze this quarter’s ideal and worst entertainers, consisting of Rockwell Automation (NYSE: ROK) and its peers.

Industrial Web of Points (IoT) firms are buoyed by the nonreligious fad of an extra linked globe. They typically focus on incipient locations such as equipment and solutions for manufacturing facility automation, fleet monitoring, or clever home modern technologies. Those that play their cards right can create repeating registration incomes by offering cloud-based software application solutions, increasing their margins. On the various other hand, if the modern technologies these firms have actually bought do not work out, they might need to make pricey pivots.

The 7 net of points supplies we track reported a blended Q1; generally, incomes defeat expert agreement price quotes by 1%. while following quarter’s income assistance was 2.6% listed below agreement. Supplies– particularly those trading at greater multiples– had a solid end of 2023, however 2024 has actually seen durations of volatility. Blended signals regarding rising cost of living have actually resulted in unpredictability around price cuts, however net of points supplies have actually revealed strength, with share costs up 5.3% generally because the previous revenues outcomes.

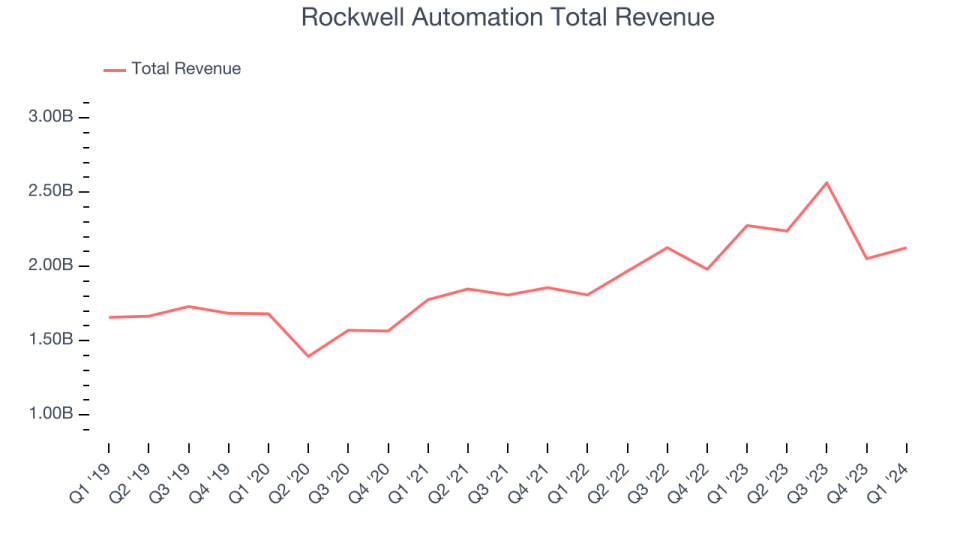

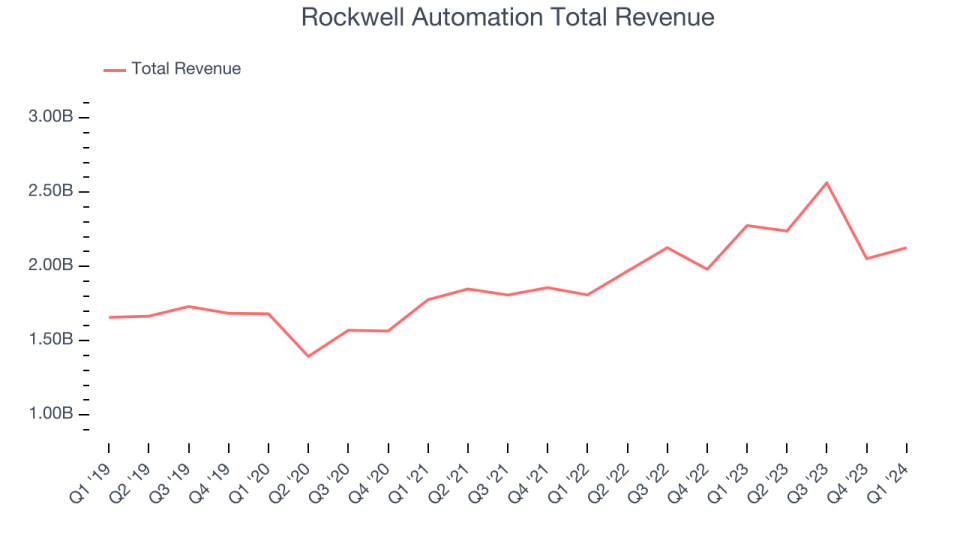

Ideal Q1: Rockwell Automation (NYSE: ROK)

Among the initial firms to deal with commercial automation, Rockwell Automation (NYSE: ROK) offers items that aid consumers remove even more effectiveness from their equipment.

Rockwell Automation reported incomes of $2.13 billion, down 6.6% year on year, going beyond experts’ assumptions by 3.5%. Generally, it was an extraordinary quarter for the firm with an outstanding beat of experts’ natural income price quotes and a respectable beat of experts’ revenues price quotes.

” Implementation in the 2nd quarter was strong, and we remain to see consecutive order enhancement. Nonetheless, there is even more excess supply at our consumers, especially device home builders, than we initially anticipated. Consequently, we are not yet seeing the increased order ramp this and are minimizing our full-year assistance. Regardless of the reduced FY24 expectation, we are acquiring share throughout most of our essential line of product and in The United States and Canada, our biggest market,” claimed Blake Moret, Chairman and chief executive officer.

The supply is up 4.2% because reporting and presently trades at $289.20.

Is currently the moment to acquire Rockwell Automation? Access our full analysis of the earnings results here, it’s free.

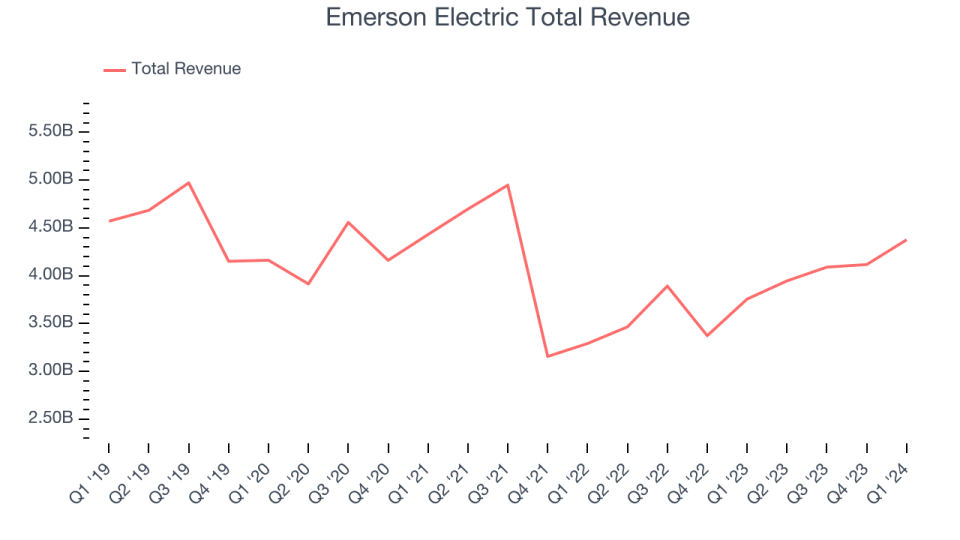

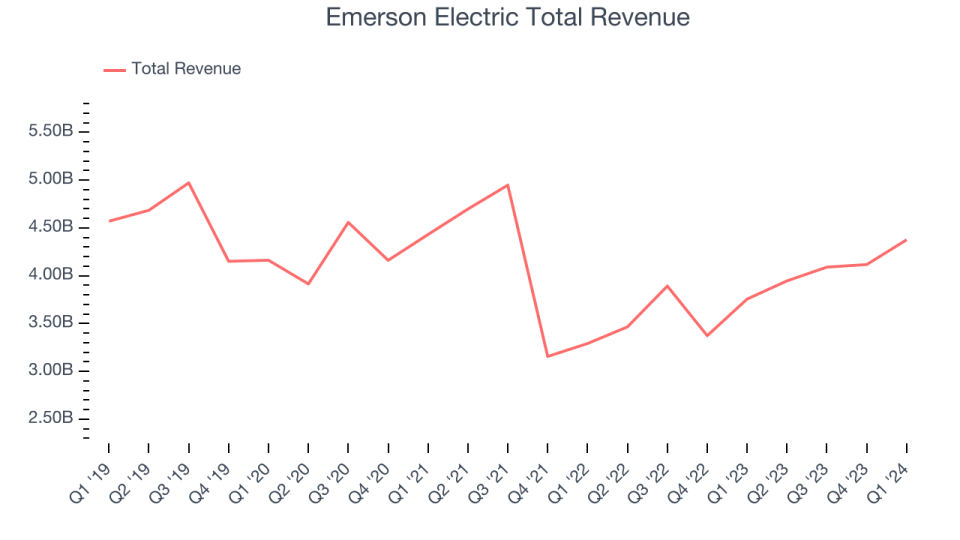

Emerson Electric (NYSE: EMR)

Established In 1890, Emerson Electric (NYSE: EMR) is an international modern technology and design firm offering remedies in the commercial, business, and domestic markets.

Emerson Electric reported incomes of $4.38 billion, up 16.5% year on year, outmatching experts’ assumptions by 2%. It was an extremely solid quarter for the firm with a respectable beat of experts’ revenues price quotes.

Emerson Electric racked up the fastest income development amongst its peers. The marketplace appears satisfied with the outcomes as the supply is up 9.3% because coverage. It presently trades at $117.38.

Is currently the moment to acquire Emerson Electric? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: SmartRent (NYSE: SMRT)

Established by a staff member at a realty rental firm, SmartRent (NYSE: SMRT) gives clever home tools and software application for multifamily houses, single-family rental homes, and trainee real estate neighborhoods.

SmartRent reported incomes of $50.49 million, down 22.4% year on year, disappointing experts’ assumptions by 1.2%. It was a weak quarter for the firm with a miss out on of experts’ revenues price quotes.

SmartRent published the slowest income development in the team. Remarkably, the supply is up 2% because the outcomes and presently trades at $2.50.

Read our full analysis of SmartRent’s results here.

Trimble (NASDAQ: TRMB)

Contributing in the building of the Paris Grand, Trimble (NASDAQ: TRMB) provides geospatial tools and modern technology to the farming, building, transport, and logistics sectors.

Trimble reported incomes of $953.3 million, up 4.1% year on year, exceeding experts’ assumptions by 4.5%. Zooming out, it was a strong quarter for the firm with a respectable beat of experts’ revenues price quotes.

Trimble supplied the largest expert approximates defeat amongst its peers. The supply is down 3.3% because reporting and presently trades at $58.10.

Read our full, actionable report on Trimble here, it’s free.

Arlo (NYSE: ARLO)

With its name originating from the Old English acceptation “to see,” Arlo (NYSE: ARLO) gives home safety and security items and various other devices to secure homes and companies.

Arlo reported incomes of $124.2 million, up 11.9% year on year, according to experts’ assumptions. Generally, it was a weak quarter for the firm with a miss out on of experts’ revenues price quotes.

The supply is up 23.1% because reporting and presently trades at $17.16.

Read our full, actionable report on Arlo here, it’s free.

Sign Up With Paid Supply Capitalist Study

Aid us make StockStory a lot more useful to capitalists like on your own. Join our paid customer study session and get a $50 Amazon present card for your point of views. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.