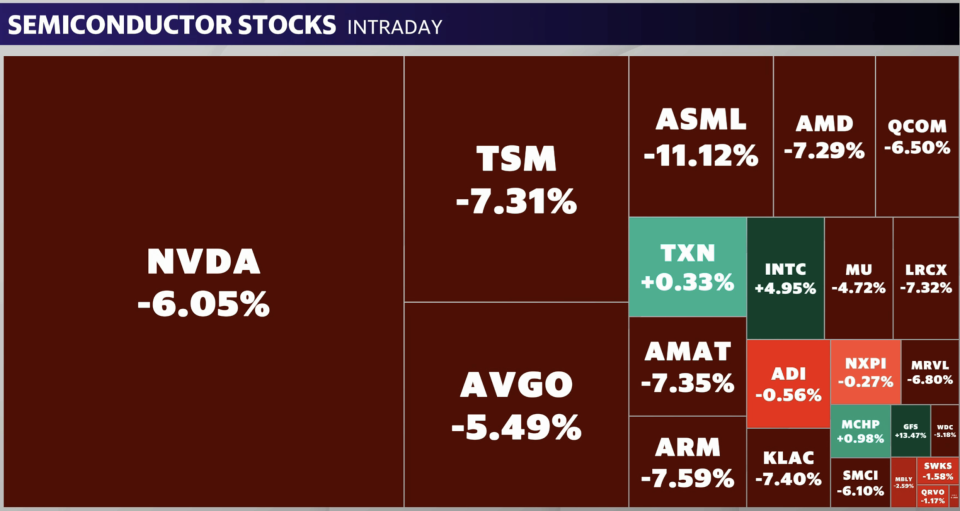

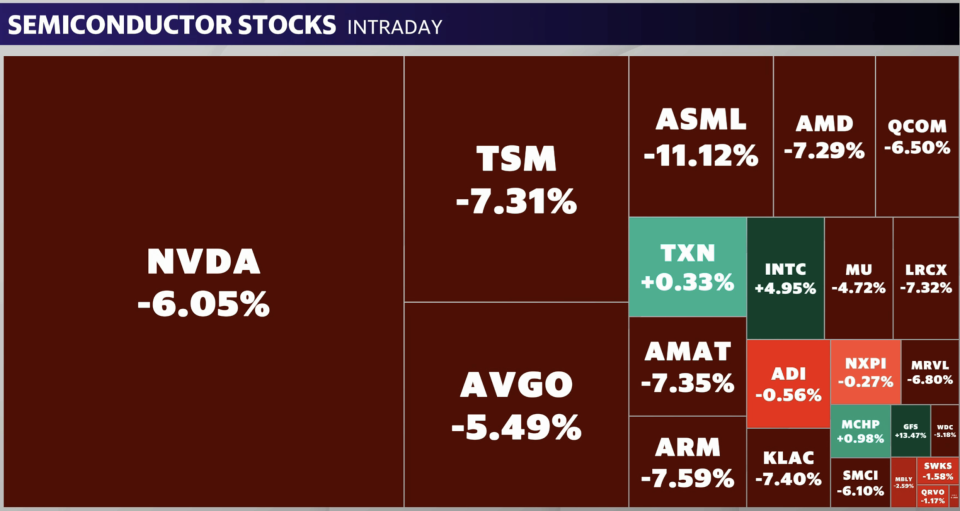

Chip supplies Nvidia (NVDA), Taiwan Semiconductor Production (TSM), and ASML (ASML) have all rose this year many thanks to capitalist bank on the expert system boom. On Wednesday, their energy involved a shrilling stop.

The 3 supplies were down greater than 5% in noontime trading on Wednesday for factors varying from capitalist issue over export constraints to a wider turning out of technology supplies.

One headwind that arised was the possibility for tighter constraints on exports of semiconductor technology to China.

Bloomberg reported the Biden management is taking into consideration executing a much more extreme visual including controls on foreign-manufactured items that make use of also the tiniest quantity of American innovation.

Present constraints have actually currently affected US-based firms’ capability to offer to China. Nvidia sales to China reduced as a percent of overall information facility profits from 19% in 2023 to 14% in 2024.

ASML supply saw the steepest decrease on Wednesday, dropping as long as 11%.

Shares of the Netherlands-based chip tools manufacturer were additionally pushed following its 3rd quarter assistance.

While ASML defeated its 2nd quarter top- and fundamental assumptions, its profits projection for the present quarter was available in timid of the agreement expert quote.

The firm additionally stated it anticipates quarterly gross margin in the series of 50% to 51% versus Wall surface Road assumptions of 51.1%.

Likewise dragging down chip supplies were remarks from previous head of state Donald Trump, that stated Taiwan “ought to pay” the United States for defense versus any type of aggressiveness from China.

” You recognize, we’re no various than an insurer. Taiwan does not provide us anything,” Trump informed Bloomberg Businessweek in a meeting released on Tuesday.

He additionally stated Taiwan took “around 100%” of the United States chip company.

Trump’s remarks sent out shares of chip production and layout gigantic TSMC dropping greater than 7% on Wednesday.

Lots of chipmakers, consisting of Nvidia, depend upon Tawain for production. The island situated eastern of China is a significant semiconductor center with approximately 92% of the globe’s most innovative chipmaking ability, according to the United States International Profession Payment.

It deserves keeping in mind shares of semiconductor firms Intel (INTC) and GlobalFoundries (GFS) were up throughout the session. Both firms are seen recipients of the Biden management’s press to onshore chip manufacturing to the United States.

The semis sell-off comes as capitalists have actually just recently revolved out of big-cap names right into small-cap supplies.

The turning out innovation started recently after the most up to date rising cost of living print offered capitalists a lot more positive outlook that the Federal Get would certainly begin reducing prices in September.

The Russell 2000 (^ RUT) surpassed large-cap supplies on the Nasdaq 100 (^ NDX) for 5 straight days since Tuesday’s close.

On Wednesday the small-cap index was down greater than 1% while the tech-heavy Nasdaq 100 was down greater than 2%.

Ines Ferre is an elderly company press reporter for Yahoo Financing. Follow her on X at @ines_ferre.

Go here for thorough evaluation of the most up to date stock exchange information and occasions relocating supply costs

Review the most up to date monetary and company information from Yahoo Financing

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.