Finishing up Q1 revenues, we take a look at the numbers and vital takeaways for the cpus and graphics chips supplies, consisting of Allegro MicroSystems (NASDAQ: ALGM) and its peers.

The most significant need chauffeurs for cpus (CPUs) and graphics chips right now are nonreligious fads connected to 5G and Web of Points, self-governing driving, and high efficiency computer in the information facility area, especially around AI and artificial intelligence. Like all semiconductor business, electronic chip manufacturers show a level of cyclicality, driven by supply and need discrepancies and direct exposure to computer and Smart device item cycles.

The 9 cpus and graphics chips supplies we track reported an ok Q1; typically, earnings defeat expert agreement quotes by 1.6%. while following quarter’s earnings assistance was 4.7% listed below agreement. Supplies, particularly development supplies where capital even more in the future are more crucial to the tale, had a great end of 2023. Yet the start of 2024 has actually seen extra unstable supply efficiency as a result of blended rising cost of living information, yet cpus and graphics chips supplies have actually executed well, with the share rates up 13.3% typically given that the previous revenues outcomes.

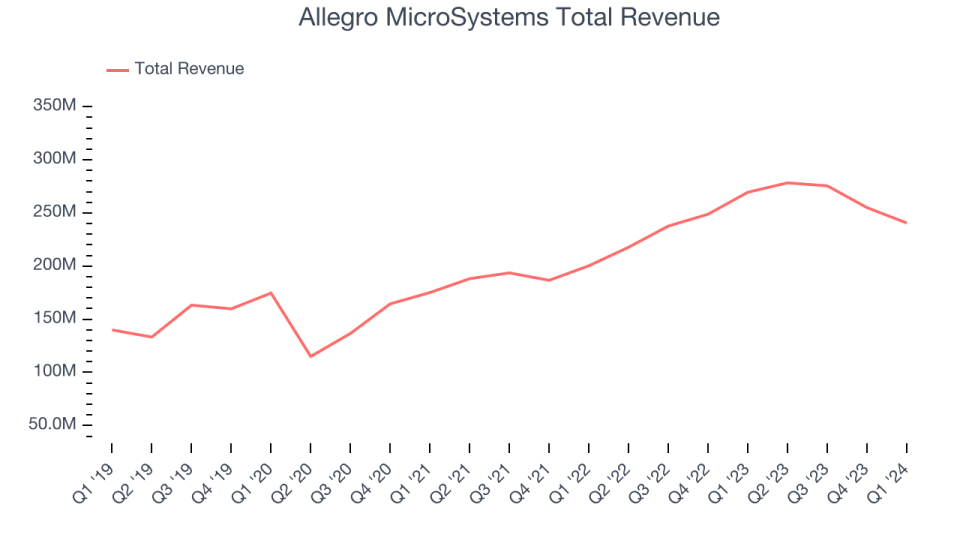

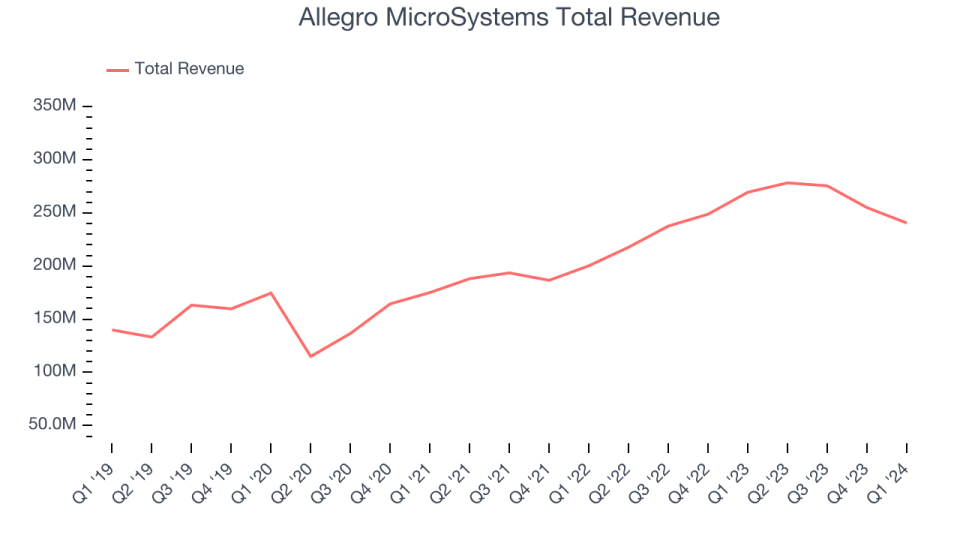

Allegro MicroSystems (NASDAQ: ALGM)

The outcome of an offshoot from Sanken in Japan, Allegro MicroSystems (NASDAQ: ALGM) is a developer of power administration chips and range sensing units utilized in electrical cars and information facilities.

Allegro MicroSystems reported earnings of $240.6 million, down 10.7% year on year, surpassing experts’ assumptions by 2.4%. Regardless of the top-line beat, it was a weak quarter in general for the firm with underwhelming earnings assistance for the following quarter and a decrease in its operating margin.

” Proceeded solid energy in e-Mobility drove document 2024 sales to greater than $1 billion and document non-GAAP revenues per share of $1.35. We likewise accomplished a document degree of style success of greater than $1 billion. I wish to say thanks to the whole Allegro group for their payments which allowed us to accomplish these considerable landmarks,” claimed Vineet Nargolwala, Head Of State and Chief Executive Officer of Allegro.

The supply is up 9.6% given that reporting and presently trades at $32.20.

Read our full report on Allegro MicroSystems here, it’s free

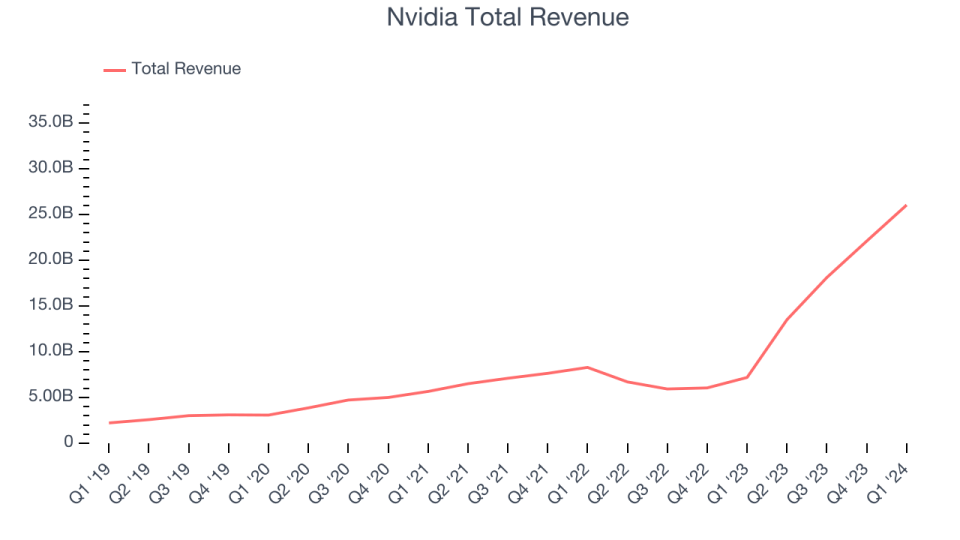

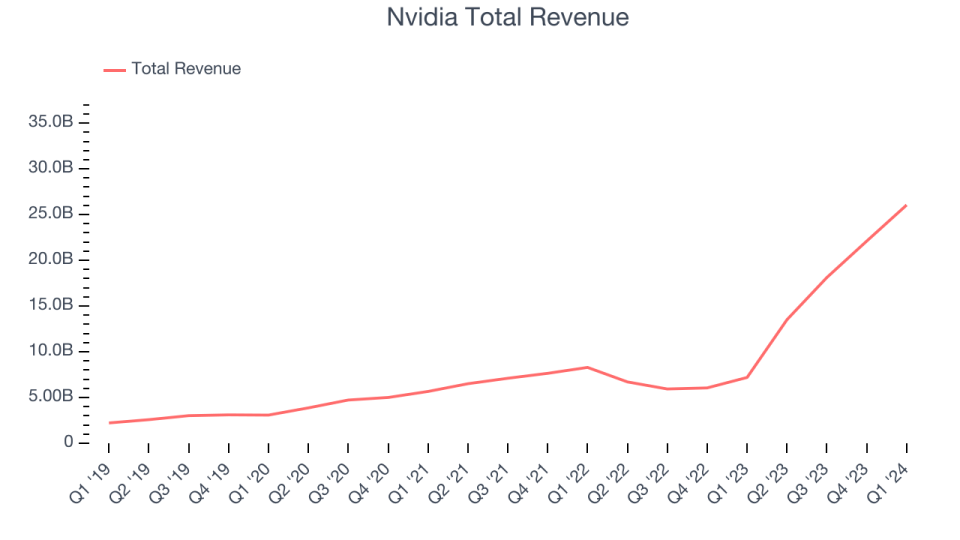

Finest Q1: Nvidia (NASDAQ: NVDA)

Established In 1993 by Jensen Huang and 2 previous Sunlight Microsystems designers, Nvidia (NASDAQ: NVDA) is a leading fabless developer of chips utilized in video gaming, Computers, information facilities, vehicle, and a range of end markets.

Nvidia reported earnings of $26.04 billion, up 262% year on year, surpassing experts’ assumptions by 6%. It was a remarkable quarter for the firm with a considerable enhancement in its gross margin and an excellent beat of experts’ EPS quotes.

Nvidia carried out the most significant expert approximates beat and fastest earnings development amongst its peers. The marketplace appears satisfied with the outcomes as the supply is up 35.6% given that coverage. It presently trades at $128.60.

Is currently the moment to get Nvidia? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Latticework Semiconductor (NASDAQ: LSCC)

A worldwide leader in its group, Latticework Semiconductor (NASDAQ: LSCC) is a semiconductor developer focusing on customer-programmable chips that improve CPU efficiency for extensive jobs such as artificial intelligence.

Latticework Semiconductor reported earnings of $140.8 million, down 23.6% year on year, in accordance with experts’ assumptions. It was a weak quarter for the firm with underwhelming earnings assistance for the following quarter and a decrease in its operating margin.

Latticework Semiconductor published the slowest earnings development in the team. As anticipated, the supply is down 20.8% given that the outcomes and presently trades at $60.90.

Read our full analysis of Lattice Semiconductor’s results here.

Qorvo (NASDAQ: QRVO)

Developed by the merging of TriQuint and RF Micro Instruments, Qorvo (NASDAQ: QRVO) is a developer and producer of RF chips utilized in mostly all mobile phones internationally, in addition to a range of chips utilized in networking tools and facilities.

Qorvo reported earnings of $941 million, up 48.7% year on year, exceeding experts’ assumptions by 1.6%. Taking a go back, it was a strong quarter for the firm with a considerable enhancement in its gross margin and an excellent beat of experts’ EPS quotes.

The supply is up 14.4% given that reporting and presently trades at $127.91.

Read our full, actionable report on Qorvo here, it’s free.

CLEVER (NASDAQ: SGH)

Based in the United States, SMART Global Holdings (NASDAQ: SGH) is a varied semiconductor firm using memory, electronic, and LED items.

SMART reported earnings of $300.6 million, down 12.7% year on year, in accordance with experts’ assumptions. Taking a go back, it was a weak quarter for the firm with underwhelming earnings assistance for the following quarter and a miss out on of experts’ EPS quotes.

The supply is up 27.7% given that reporting and presently trades at $29.65.

Read our full, actionable report on SMART here, it’s free.

Sign Up With Paid Supply Capitalist Research Study

Aid us make StockStory extra handy to financiers like on your own. Join our paid customer research study session and obtain a $50 Amazon present card for your viewpoints. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.