Inflows right into Ethereum (ETH) electronic financial investment items have actually currently gotten to the greatest worth given that March. This brand-new document recommends that ETH’s cost might proceed recouping as it has within the previous week.

ETH’s cost since this writing is $3,338, standing for a 4.12% rise in the last 1 day. Yet will the altcoin cost remain to relocate northward?

Much More Cash for Ethereum Is Much More Profits for Owners

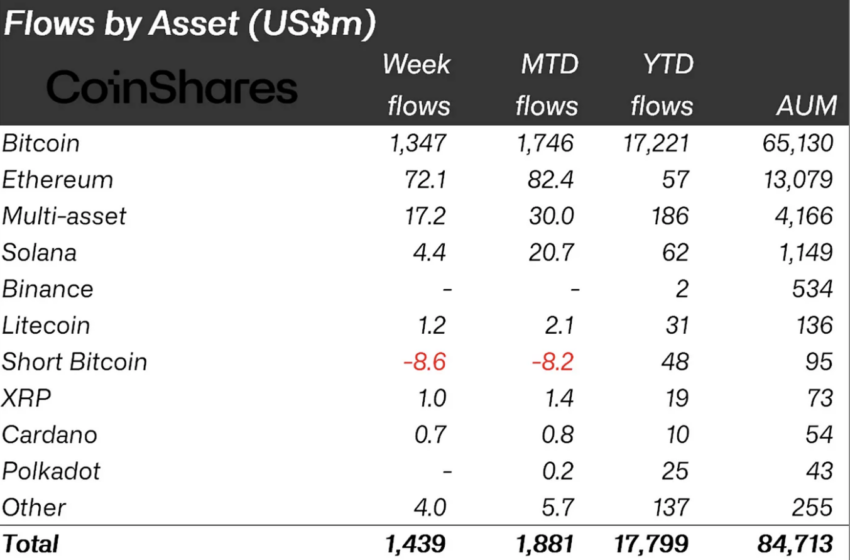

According to CoinShares, the crypto once a week inflows amounted to $1.44 billion. This worth makes it the 5th biggest the item has actually seen given that its beginning. As anticipated, Bitcoin (BTC) had the lion’s share.

Nonetheless, with $72 million, Ethereum has actually had the ability to sign up constant inflows over the previous couple of weeks while striking the greatest number in 4 months.

” A large range of altcoins saw inflows, the majority of significant being Ethereum, which saw US$ 72m inflows recently, being the biggest inflows given that March and most likely in expectancy of the unavoidable authorization of the spot-based ETF in the United States.” James Butterfill, CoinShares Head of Study, composed.

Lately, BeInCrypto reported that a variety of experts anticipate the area Ethereum ETFs to introduce today.

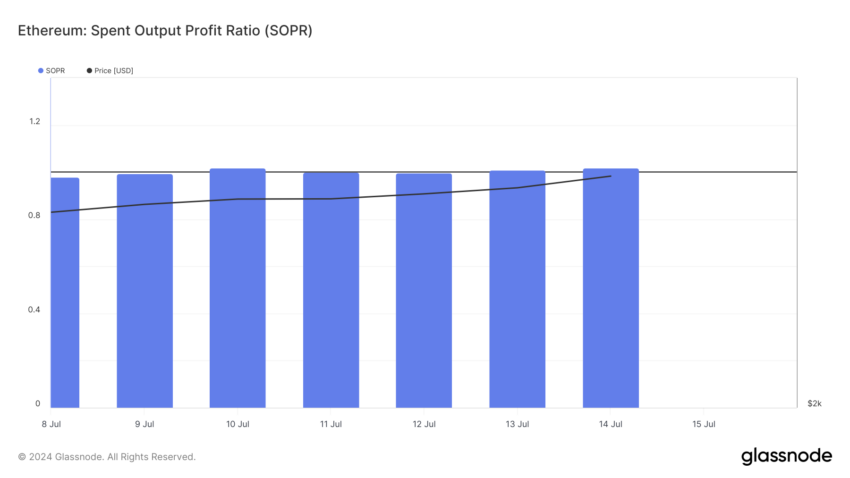

Additionally, according to Glassnode, ETH owners have actually started to experience some kind of break. This is as a result of the signs exposed by the Spent Result Revenue Proportion (SOPR).

The SOPR takes a look at market costs habits, supplying understandings right into revenues and losses over a time period. When the worth of the SOPR is 1, relocated coins are cost revenue on a certain day.

Learn More: Ethereum (ETH) Cost Forecast 2024/2025/2030

Yet when it is less than 1, it suggests sell-offs muddle-headed, and if it is specifically 1, it indicates owners are costing the breakeven factor.

As revealed over, Ethereum’s SOPR is 1.01 at press time. If continual, succeeding optimals will certainly suggest that the invested coins are returned right into blood circulation, raising the likelihood of a cost rally.

ETH Cost Forecast: $3,300 Holds, Yet Exactly how Around $4,000?

Like the SOPR, Ethereum’s Open Passion (OI) offers indicators that recommend that the cost will certainly raise as the worth is $7.72 billion.

OI describes the amount of the worth of open agreements on the market. When it enhances, it indicates that market individuals are raising their direct exposure to a coin. Nonetheless, a decline suggests that individuals are shutting their internet placements.

From a trading and historic point of view, an increase in OI backs a rise in ETH’s area worth. Consequently, if passion in the cryptocurrency remains to leap, so will certainly the cost. If this stays the situation, ETH might get to $3,474 in the short-term.

Additionally, if inflows right into the ETFs get to $1 billion, as has actually been anticipated in some edges, ETH might retest $4,000.

Nonetheless, the In/Out of Cash Around Cost (IOMAP) reveals that there is a possibility of invalidation. The IOMAP categorizes addresses based upon those earning money, those out of cash, and those at the breakeven factor.

If the variety of addresses in the cash is greater, the cost area will certainly supply assistance. Yet if it is vice versa, crypto will certainly encounter resistance.

Learn More: Exactly How to Purchase Ethereum (ETH) and Whatever You Required to Know

At press time, we discovered that 3.57 million addresses acquired 2.83 million ETH at a typical cost of $3,385. On the other hand, 2.04 million acquired 1.15 countless the cryptocurrency around $3,282.

Given That there is a bigger variety of addresses out of the cash, it indicates Ethereum will certainly discover it testing to appear $3,385.

This is because as soon as ETH reaches this worth, some owners might choose to offer. If this takes place, the cost of Ethereum might go down listed below $3,300 and also go as reduced as $3,233.

Please Note

According to the Depend on Task standards, this cost evaluation post is for informative objectives just and ought to not be taken into consideration monetary or financial investment guidance. BeInCrypto is devoted to precise, impartial coverage, yet market problems go through transform without notification. Constantly perform your very own research study and seek advice from an expert prior to making any type of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.