DWS, a property administration company possessed by Deutsche Financial institution, is preparing to introduce the very first euro-denominated stablecoin controlled by Germany’s Federal Financial Supervisory Authority (BaFin).

This campaign notes a substantial action for the European economic market as DWS handles properties worth EUR941 billion ($ 1.02 billion) worldwide.

MiCA Structure Spurs Industry-Wide Conformity Initiatives

DWS intends to present this stablecoin by 2025 with its recently created firm, AllUnity. This unique entity is a collaboration in between DWS, Circulation Investors, and Galaxy Digital. Nevertheless, at the time of posting, the company has yet to give additional information concerning this property.

Find Out More: Stablecoin Laws Around The Globe

Stefan Hoops, Chief Executive Officer of DWS, introduced that the stablecoin will certainly deal with electronic property financiers and commercial applications. Additionally, Hoops stressed the prepared for wide need for controlled electronic money.

” In the short-term, we anticipate need from financiers in electronic properties, however by the tool term we anticipate bigger need, as an example from commercial business dealing with ‘web of points’ constant repayments,” Hoops said.

This step straightens with the more comprehensive regulative phase formed by the Markets in Crypto-Assets (MiCA) structure in Europe. Considering that its intro on June 30, the structure has actually established detailed requirements for stablecoin issuance, consisting of demands for whitepaper magazine, administration, get administration, and prudential requirements.

Significant market gamers have actually made needed modifications to comply with MiCA guidelines. BeInCrypto reported that Circle, the company of USDC and EURC stablecoins, safeguarded an Electronic cash Establishment (EMI) permit on July 1. This permit is a demand for any type of company seeking to supply crypto symbols with buck and euro parity within the EU.

In addition, noticeable crypto exchanges like Binance have actually delisted non-compliant stablecoins for European clients to make certain conformity with these brand-new guidelines.

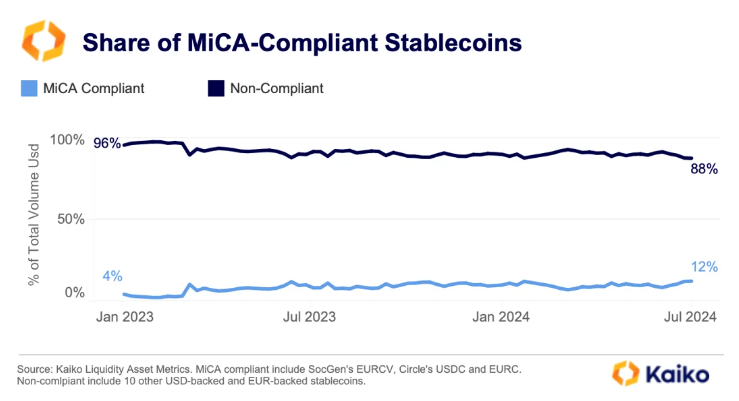

A current record from Kaiko exposed that the share of certified stablecoins has actually raised over the previous year. This recommends a raised need for openness and controlled choices.

Find Out More: What Is Markets in Crypto-Assets (MiCA)?

Regardless of this growth, the record additionally reveals that non-compliant stablecoins stay controling the marketplace. This group make up 88% of the overall stablecoin quantity.

Please Note

All the details had on our site is released in excellent belief and for basic details functions just. Any type of activity the viewers takes upon the details discovered on our site is purely at their very own danger.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.