On-chain information recommends Satoshi’s initial vision lives and kicking as the Bitcoin network has actually changed in the direction of smaller sized deals.

Bitcoin P2P Repayment Transfers Have Actually Been Getting Heavy Steam Lately

In a brand-new post on X, CryptoQuant creator and chief executive officer Ki Youthful Ju has actually spoken about a pattern change on the BTC network relating to deals that might be identified as peer-to-peer (P2P) repayments.

First, Ju has actually reviewed the fad in the deal costs on the Bitcoin network. The “deal costs” right here normally describe the costs that senders on the blockchain need to affix with their steps as payment for the validators.

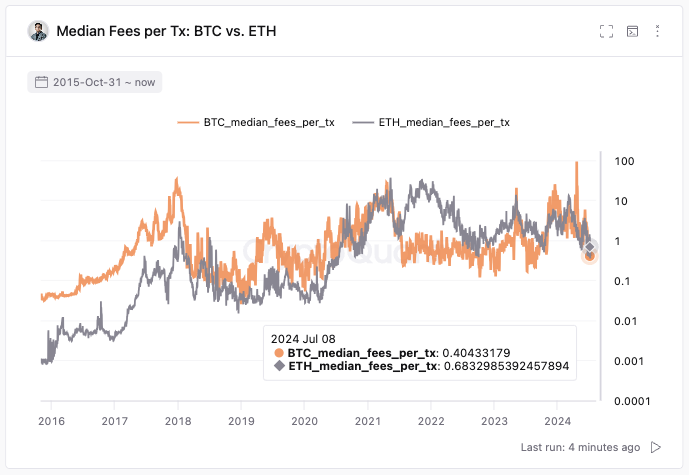

Below is the graph shared by the CryptoQuant chief executive officer that demonstrates how the average deal costs on the BTC network have actually contrasted to those on Ethereum over the previous years.

Both the networks show up to have actually seen a cooldown in costs in current months|Resource: @ki_young_ju on X

As the chart reveals, average deal costs on Bitcoin had actually been above on Ethereum pre-2021, yet ever since, the statistics has actually typically been reduced for BTC. As Ju notes,

As opposed to the typical idea that Bitcoin tx costs are constantly more than Ethereum’s, BTC tx costs have actually been less costly than ETH’s for a lot of the moment considering that 2021.

The average cost on BTC is around $0.40, while that on ETH has to do with $0.68. Currently, if individuals need to utilize Bitcoin as a setting of settlement, they would just utilize it for transfers big sufficient to make this cost worth it.

” Taking into consideration the 1-3% Tx cost price in establishing nations, $13-40 would certainly be the reduced restriction,” claims the CryptoQuant creator. Therefore, to filter the information for just transfers most likely to stand for P2P repayments on the network, the expert has actually selected deals dropping within the $40 to $1,000 array.

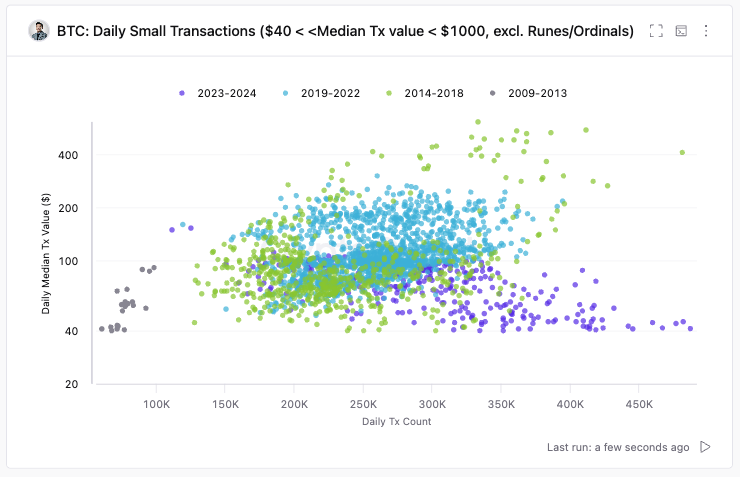

Below is a chart outlined in between the day-to-day average deal worth (USD) and the day-to-day deal matter for numerous durations.

Appears like deals have actually lately been obtaining smaller sized in dimension|Resource: @ki_young_ju on X

The deals right here leave out the Runes and Ordinals-related steps considering that transfers associated with these methods do not precisely represent real-life P2P repayments.

From the graph, it appears that the average dimension of these deals had actually been in the direction of the top end in between 2019 and 2022, yet considering that 2023, the transfers have actually diminished.

Not simply that, the variety of deals has actually additionally raised at the same time, recommending numerous little steps are occurring currently. Ju thinks this is likely because of real-life P2P repayments.

As A Result, while some might believe that Bitcoin hasn’t measured up to Satoshi’s vision when making the cryptocurrency, information would certainly recommend Bitcoin has actually been establishing in the appropriate instructions lately.

BTC Rate

Bitcoin hasn’t had the ability to recuperate a lot thus far, as its cost is still trading at around the $57,800 degree.

The cost of the coin shows up to have actually been gliding over the previous month|Resource: BTCUSD on TradingView

Included photo from Dall-E, CryptoQuant.com, graph from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.