This is The Takeaway from today’s Early morning Short, which you can register to obtain in your inbox every early morning in addition to:

The S&P 500 is up 17% until now this year.

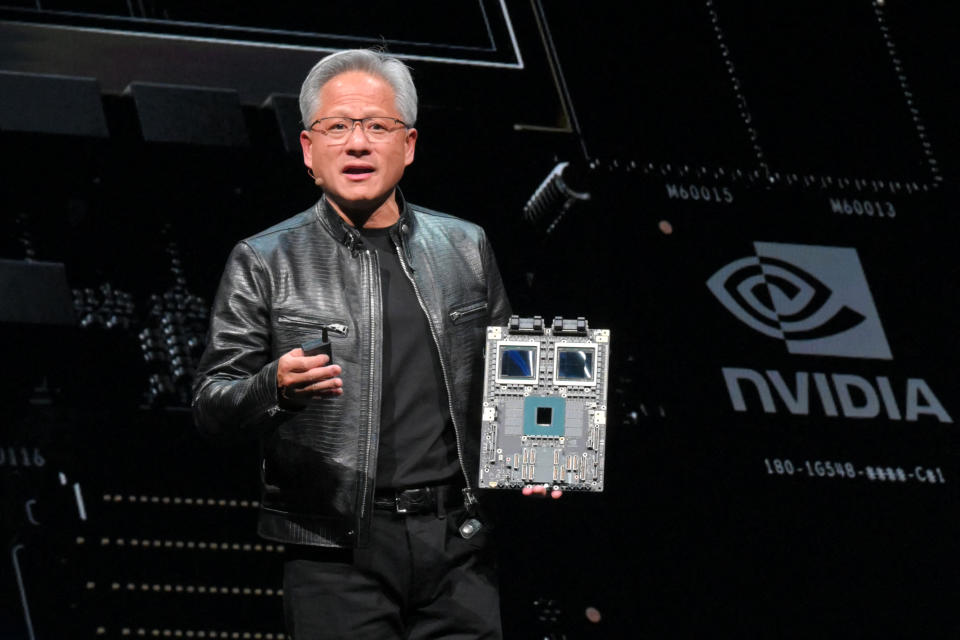

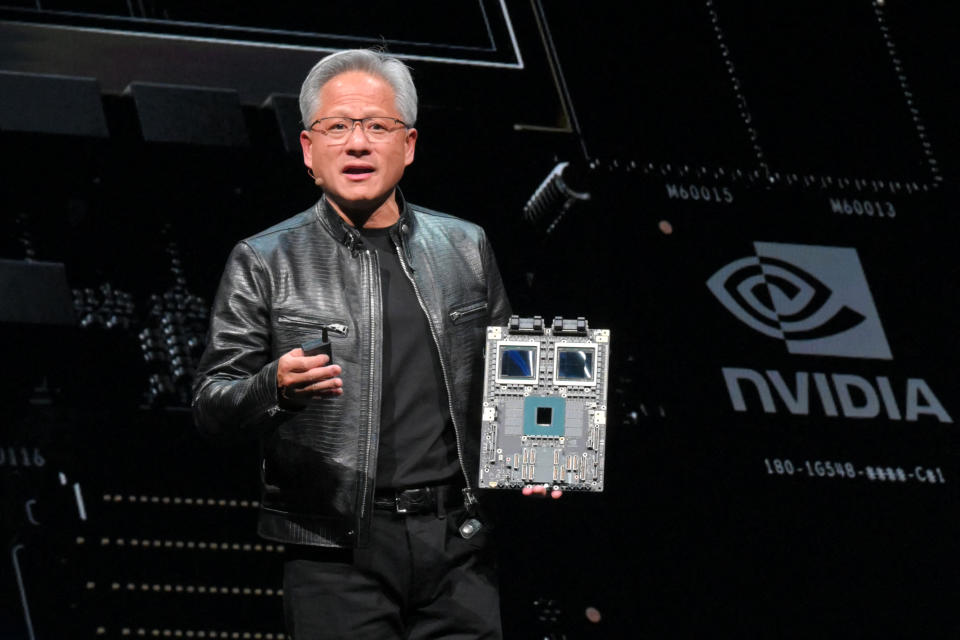

Yet as capitalists have actually listened to time after time, this efficiency can be mainly credited to simply a handful of supplies tracking one motif– the Wonderful 7 and AI. Since late June, as an example, Nvidia (NVDA) alone had actually represented greater than a 3rd of the S&P 500’s gains this year.

For the various other 493 supplies in the benchmark index, both incomes development and investor returns have actually been extra gauged. Actually, as the group at Financial institution of America explained in a note on Tuesday, these continuing to be participants of the S&P 500 have actually remained in an incomes economic downturn because the start of in 2015.

According to information from BofA’s United States equity method group, incomes for the S&P 493 have not signed up year-over-year development because the 4th quarter of 2022.

After a yearly decrease of 2% in the very first quarter of ’23 and a 7% yearly decrease in the 2nd quarter of in 2015, incomes development has actually been level for this team in each of the last 3 quarters, the company’s job programs.

The upcoming 2nd quarter incomes duration, nonetheless, must note completion of what’s been a stealth incomes economic downturn for the large bulk of business in the S&P 500. For the 493 non-Mag 7 supplies, incomes development is anticipated to appear at 6%, 7%, and 13% every year over the 2nd, 3rd, and 4th quarters of 2024.

Currently, this development is still anticipated to delay the index’s general incomes development, as the lion’s share of this earnings development will certainly be created by the Modern technology (XLK) and Communications Provider (XLC) markets, which residence AI recipients like Nvidia, Microsoft (MSFT), Meta (META), and Alphabet (GOOGL, GOOG). (Healthcare, significantly, is likewise readied to see incomes increase by dual figures in each of the following 3 quarters, though BofA warns these are driven by single things rolling off guides for Pfizer (PFE) and Merck (MRK).)

Some on Wall surface Road have actually expanded disappointed by the bifurcated efficiency in between the riches (AI names) and have-nots (every person else) in the S&P 500. Yet we assume these numbers assist us comprehend just how we obtained right here and where we’re headed.

When 2024 started, among the agreement sights on Wall surface Road was that the marketplace rally would expand out after a 2023 rise specified by the AI motif. To day, this profession has actually not been a function of this market. The basics– i.e., incomes development– aid describe why.

In each of the last 2 quarters, the previously mentioned Modern technology field has actually seen incomes development of 25% and 27%, specifically; for Communications Provider, incomes development has actually been a lot more tasteless at 53% and 43% over those durations.

It’s little marvel, after that, why these markets– and one of the most prominent parts within them– have actually gone to the facility of both the marketplace discussion and the majority of the returns.

And some planners picking to relocate far from discussing the supposed benchmark index as a valuable criteria for the majority of capitalists is likewise greater than practical in this atmosphere.

As Piper Sandler’s Michael Kantrowitz informed Yahoo Money on Monday, the relationship in between the S&P 500 index and its components has actually approached a 25-year reduced. And if the S&P 500 is to be an alternate for “the marketplace” and most supplies aren’t selling line with this market, after that what are we actually discussing?

Yet, as commonly takes place in the investing globe, this height of disappointment with a market atmosphere that has actually concerned appear like star society, in which simply a couple of celebrities attract the headings, shows up readied to surge. Whereupon supplies that consist of “anything else” will certainly satisfy a capitalist neighborhood excited to consider simply that.

Go Here for the most recent stock exchange information and comprehensive evaluation, consisting of occasions that relocate supplies

Review the most recent economic and service information from Yahoo Money

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.