As the Q1 incomes period covers, allow’s explore this quarter’s finest and worst entertainers in the recreation centers market, consisting of European Wax Facility (NASDAQ: EWCZ) and its peers.

Recreation centers business usually offer experiences as opposed to concrete items, and in the last decade-plus, customers have actually gradually moved their costs from “points” to “experiences”. Recreation centers look for to profit however should introduce to do so due to the market’s high competitors and funding strength.

The 13 recreation centers supplies we track reported a weak Q1; generally, incomes defeat expert agreement quotes by 1.6%. while following quarter’s profits advice was 5.2% listed below agreement. Assessment multiples for lots of development supplies have actually not yet returned to their very early 2021 highs, however the marketplace was hopeful at the end of 2023 because of cooling down rising cost of living. The beginning of 2024 has actually been a various tale as combined signals have actually caused market volatility, however recreation centers supplies have actually executed well, with the share rates up 10.1% generally considering that the previous incomes outcomes.

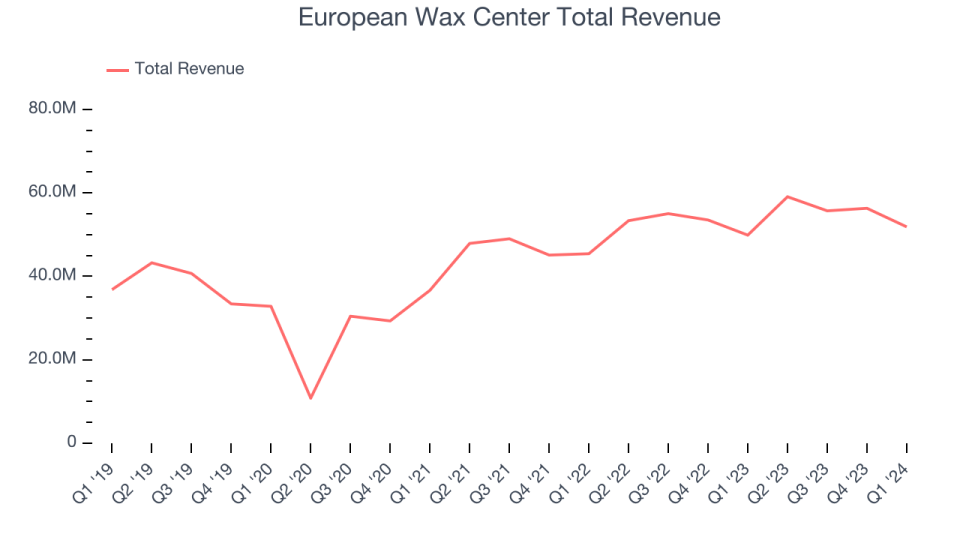

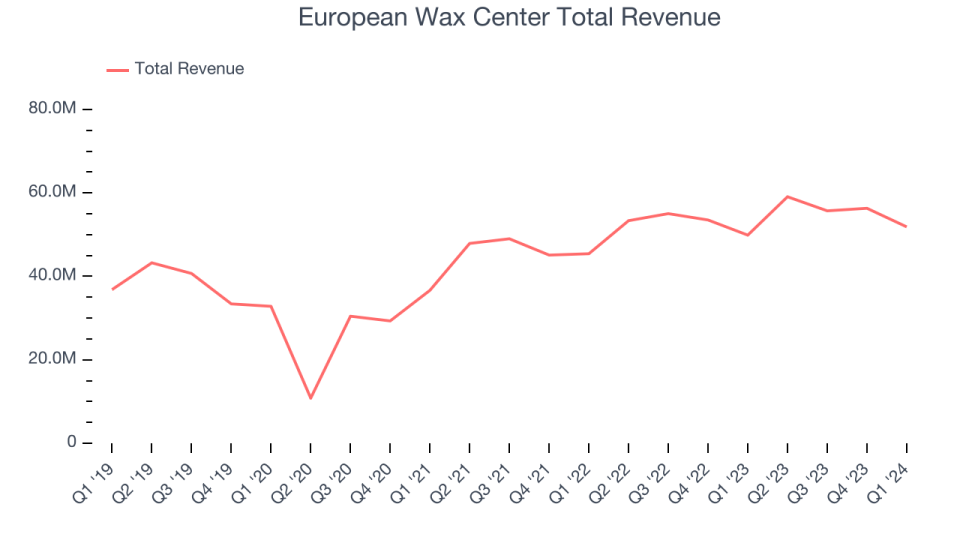

European Wax Facility (NASDAQ: EWCZ)

Started by 2 brother or sisters, European Wax Facility (NASDAQ: EWCZ) is an elegance and waxing hair salon chain concentrating on specialist wax solutions and skin care items.

European Wax Facility reported incomes of $51.87 million, up 4% year on year, disappointing experts’ assumptions by 0.3%. It was a weak quarter for the firm, with and full-year profits advice missing out on experts’ assumptions.

David Willis, President of European Wax Facility, Inc. mentioned, “We started 2024 with secure regularity and invest amongst our existing visitors which caused favorable system-wide sales and profits development in the initial quarter and underpins our foreseeable, persisting organization version. Even more, proceeded franchisee need drove brand-new facility development in-line with our assumptions. We delight in that our advancement pipe continues to be durable and sustained by our well-capitalized and dedicated franchisees.”

The supply is down 10.5% considering that the outcomes and presently trades at $9.75.

Read our full report on European Wax Center here, it’s free

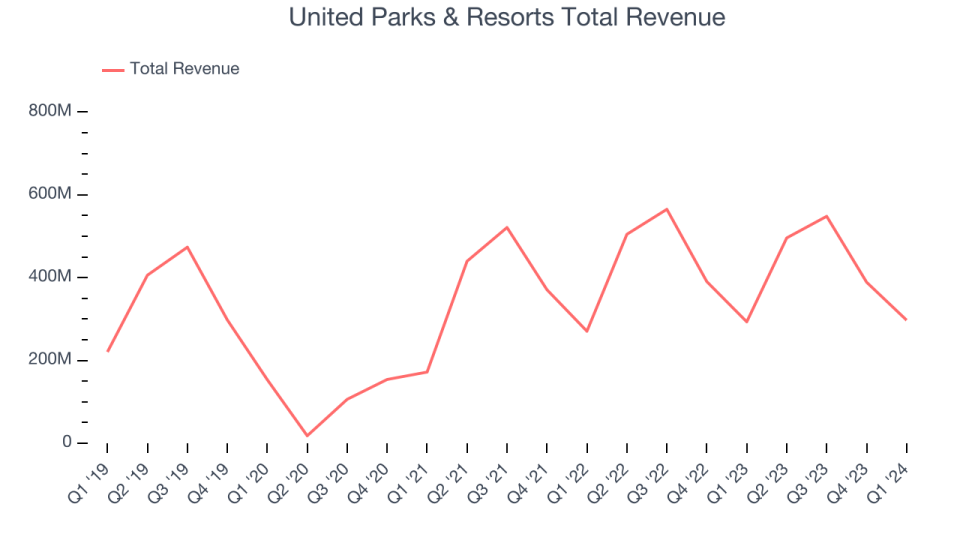

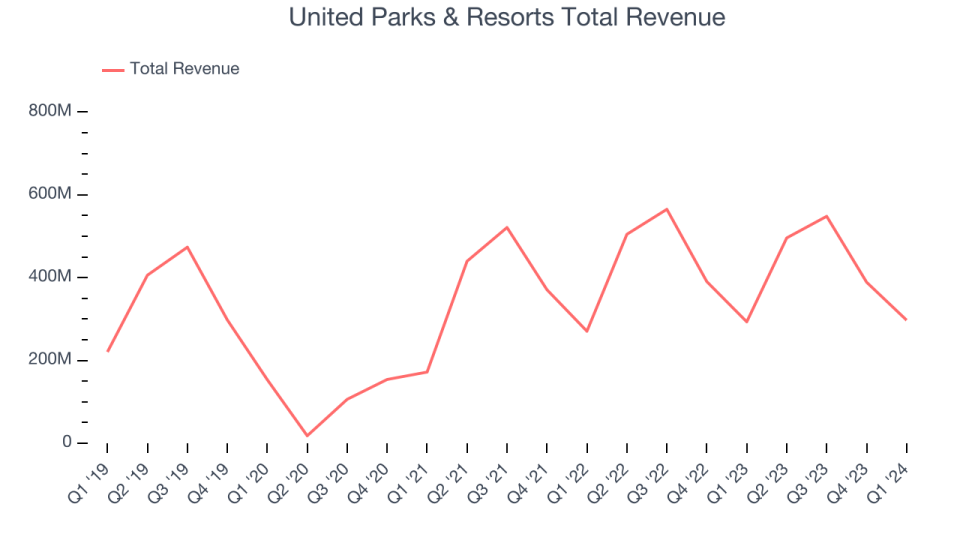

Finest Q1: United Parks & & Resorts (NYSE: PRKS)

Moms and dad firm of SeaWorld and home of the world-famous Shamu, United Parks & & Resorts (NYSE: PRKS) is an amusement park chain including aquatic life, live enjoyment, roller rollercoasters, and waterparks.

United Parks & & Resorts reported incomes of $297.4 million, up 1.4% year on year, surpassing experts’ assumptions by 4.5%. It was a really solid quarter for the firm, with an excellent beat of experts’ incomes quotes and a slim beat of experts’ site visitors quotes.

The supply is up 11.6% considering that the outcomes and presently trades at $54.84.

Is currently the moment to acquire United Parks & & Resorts? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Dave & & Buster’s (NASDAQ: PLAY)

Started by a previous video game shop and bar driver, Dave & & Buster’s (NASDAQ: PLAY) runs a chain of games offering immersive enjoyment experiences.

Dave & & Buster’s reported incomes of $588.1 million, down 1.5% year on year, disappointing experts’ assumptions by 4.5%. It was a weak quarter for the firm, with a miss out on of experts’ incomes quotes.

Dave & & Buster’s had the weakest efficiency versus expert quotes in the team. The supply is down 23% considering that the outcomes and presently trades at $38.78.

Read our full analysis of Dave & Buster’s results here.

Topgolf Callaway (NYSE: MODG)

Created in between the merging of Callaway and Topgolf, Topgolf Callaway (NYSE: MODG) markets golf tools and runs technology-driven golf enjoyment locations.

Topgolf Callaway reported incomes of $1.14 billion, down 2% year on year, disappointing experts’ assumptions by 1.1%. It was an alright quarter for the firm, with an excellent beat of experts’ incomes quotes however full-year profits advice missing out on experts’ assumptions.

Topgolf Callaway had the weakest full-year advice upgrade amongst its peers. The supply is down 8.3% considering that the outcomes and presently trades at $14.98.

Read our full, actionable report on Topgolf Callaway here, it’s free.

6 Flags (NYSE: 6)

Sporting the fastest rollercoaster in the USA, 6 Flags (NYSE: 6) is a local amusement park driver offering thrilling trips, enjoyment, and family-friendly tourist attractions.

6 Flags reported incomes of $133.3 million, down 6.3% year on year, disappointing experts’ assumptions by 2.5%. It was a weak quarter for the firm, with a miss out on of experts’ incomes quotes.

6 Flags had the slowest profits development amongst its peers. The supply is up 30.3% considering that the outcomes and presently trades at $32.66.

Read our full, actionable report on Six Flags here, it’s free.

Sign Up With Paid Supply Capitalist Study

Aid us make StockStory extra useful to financiers like on your own. Join our paid customer study session and get a $50 Amazon present card for your viewpoints. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.