Rail transport firm Greenbrier (NYSE: GBX) missed out on experts’ assumptions in Q2 CY2024, with earnings down 21% year on year to $820.2 million. On the various other hand, the firm’s expectation for the complete year was close to experts’ quotes with earnings led to $3.55 billion at the navel. It made a GAAP revenue of $1.06 per share, enhancing from its revenue of $0.63 per share in the exact same quarter in 2014.

Is currently the moment to get Greenbrier? Find out in our full research report.

Greenbrier (GBX) Q2 CY2024 Emphasizes:

-

Earnings: $820.2 million vs expert quotes of $920.9 million (10.9% miss out on)

-

Complete year earnings advice decreased to $3.55 billion from $3.60 billion formerly (small miss out on vs existing expert quotes)

-

EPS: $1.06 vs expert assumptions of $1.13 (6.2% miss out on)

-

Gross Margin (GAAP): 15.1%, up from 12.3% in the exact same quarter in 2014

-

Totally Free Capital was -$ 49.8 million contrasted to -$ 23.1 million in the previous quarter

-

Sales Quantities increased 37% year on year (-8% in the exact same quarter in 2014)

-

Market Capitalization: $1.51 billion

” Greenbrier proceeded favorable energy in the 3rd quarter of monetary 2024,” stated Lorie L. Tekorius, Chief Executive Officer and Head of state.

Having actually created the market’s initial double-decker railcar in the 1980s, Greenbrier (NYSE: GBX) provides the products rail transport market with railcars and relevant solutions.

Hefty Transport Tools

Hefty transport devices firms are purchasing computerized automobiles that boost performances and linked equipment that gathers workable information. Some are likewise creating electrical automobiles and wheelchair services to resolve consumers’ issues concerning carbon exhausts, producing brand-new sales possibilities. Furthermore, they are significantly supplying computerized devices that boosts performances and linked equipment that gathers workable information. On the various other hand, hefty transport devices firms go to the impulse of financial cycles. Rates of interest, for instance, can substantially affect the building and construction and transportation quantities that drive need for these firms’ offerings.

Sales Development

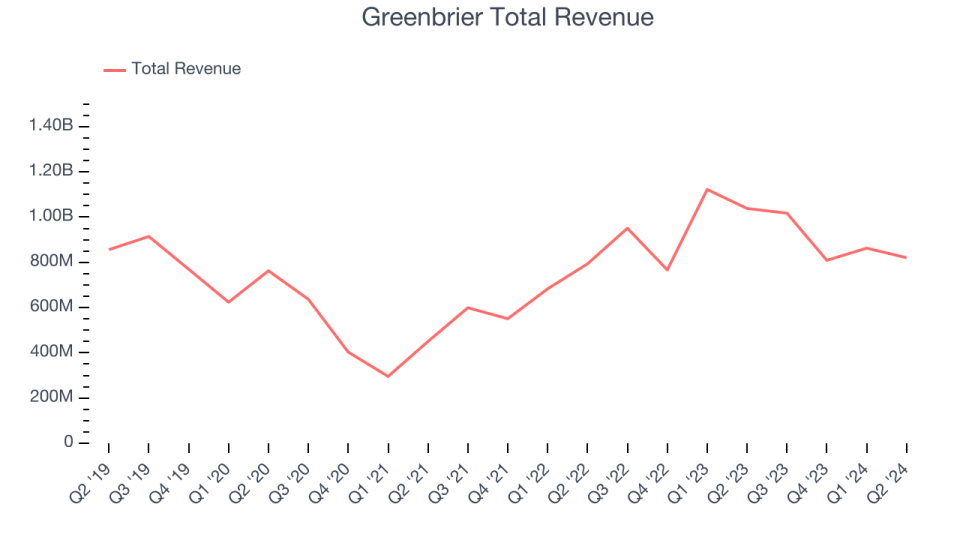

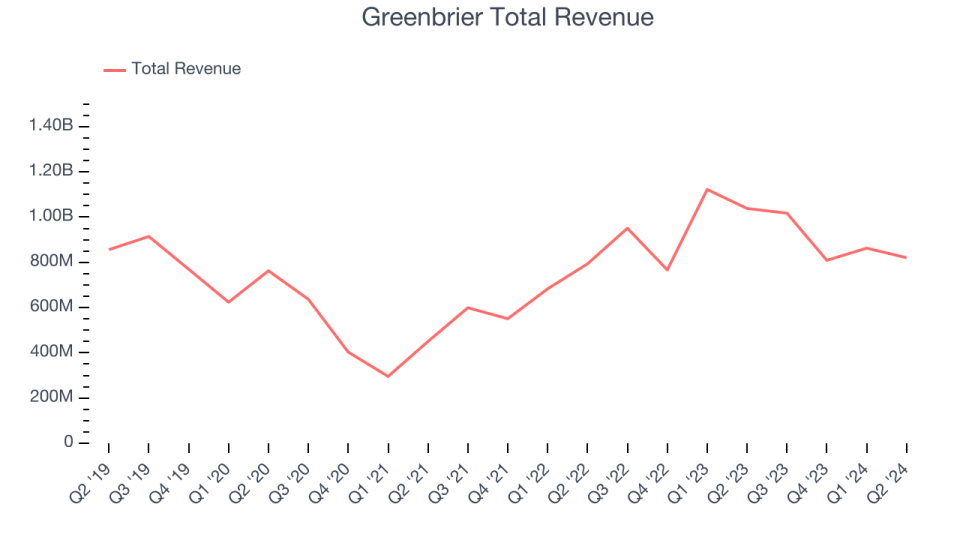

A business’s long-lasting efficiency is an indication of its total organization high quality. While any kind of organization can experience temporary success, top-performing ones appreciate continual development for several years. However, Greenbrier’s 4.6% annualized earnings development over the last 5 years was slow-moving. This reveals it fell short to broaden in any kind of significant means and is a harsh beginning factor for our evaluation.

Long-lasting development is one of the most essential, however within industrials, a half-decade historic sight might miss out on brand-new market patterns or need cycles. Greenbrier’s annualized earnings development of 15.6% over the last 2 years is over its five-year pattern, recommending its need lately increased.

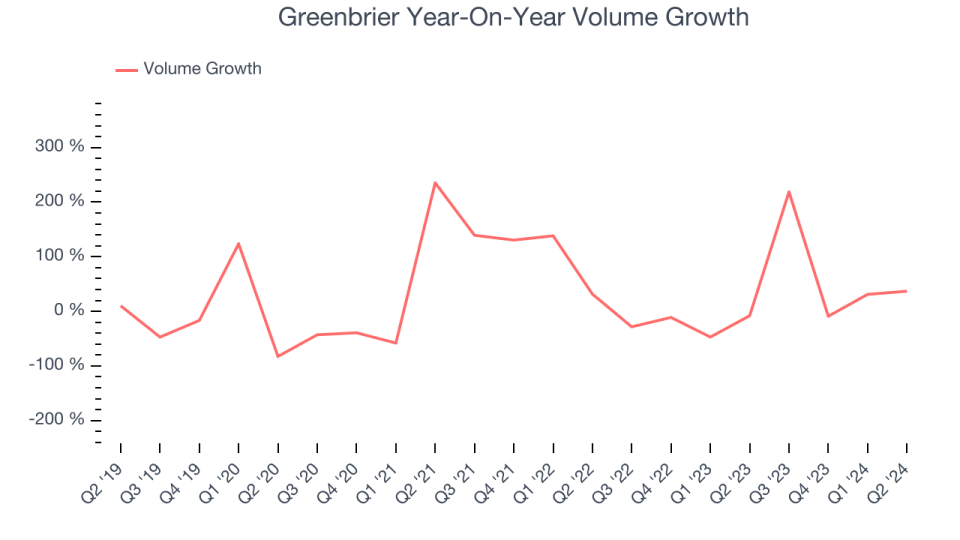

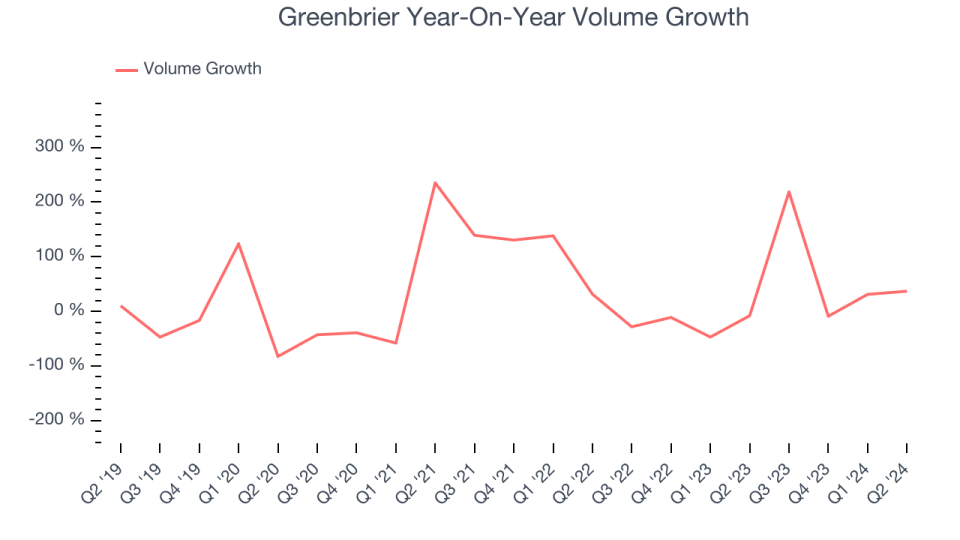

Greenbrier likewise reports its sales quantities, which got to 6,300 in the current quarter. Over the last 2 years, Greenbrier’s sales quantities balanced 22.9% year-on-year development. Since this number is far better than its earnings development, we can see the firm’s ordinary asking price reduced.

This quarter, Greenbrier missed out on Wall surface Road’s quotes and reported an instead unexciting 21% year-on-year earnings decrease, creating $820.2 countless earnings. Looking in advance, Wall surface Road anticipates sales to expand 2.4% over the following one year, a velocity from this quarter.

When a firm has even more cash money than it understands what to do with, redeeming its very own shares can make a great deal of feeling– as long as the cost is right. Fortunately, we have actually discovered one, a discounted supply that is spurting totally free capital AND redeeming shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

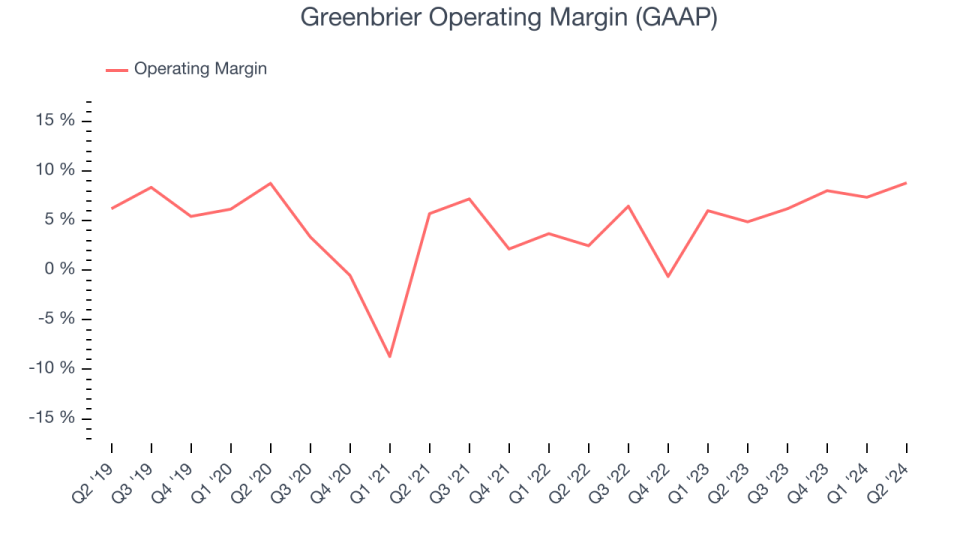

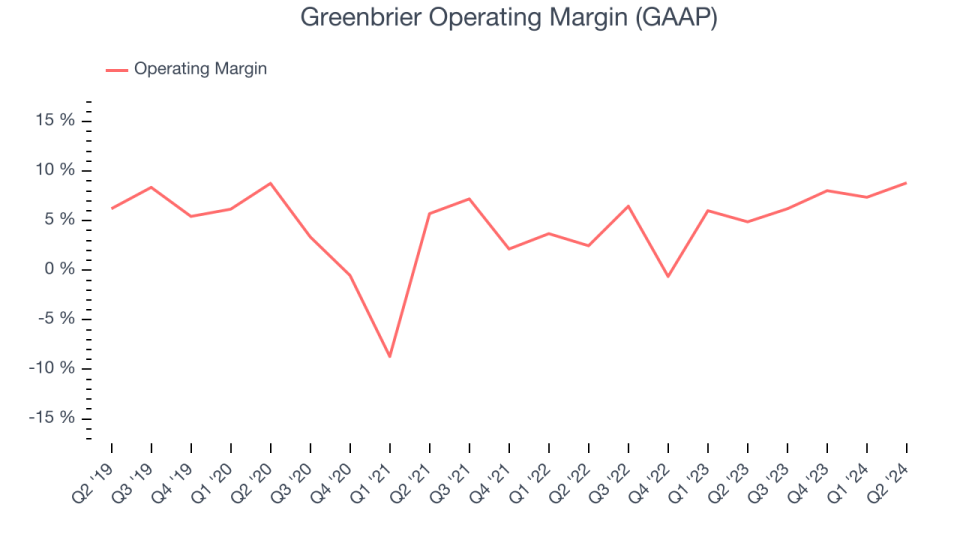

Operating Margin

Greenbrier paid over the last 5 years however kept back by its big expenditure base. It showed modest earnings for an industrials organization, generating a typical operating margin of 5.3%. This isn’t also shocking offered its reduced gross margin as a beginning factor.

Examining the pattern in its earnings, Greenbrier’s yearly operating margin could have seen some variations however has actually normally remained the exact same over the last 5 years, which does not assist its reason.

In Q2, Greenbrier produced an operating revenue margin of 8.8%, up 3.9 portion factors year on year. This boost was motivating, and given that the firm’s operating margin increased greater than its gross margin, we can presume it was lately a lot more reliable with its basic costs like sales, advertising and marketing, and management expenses.

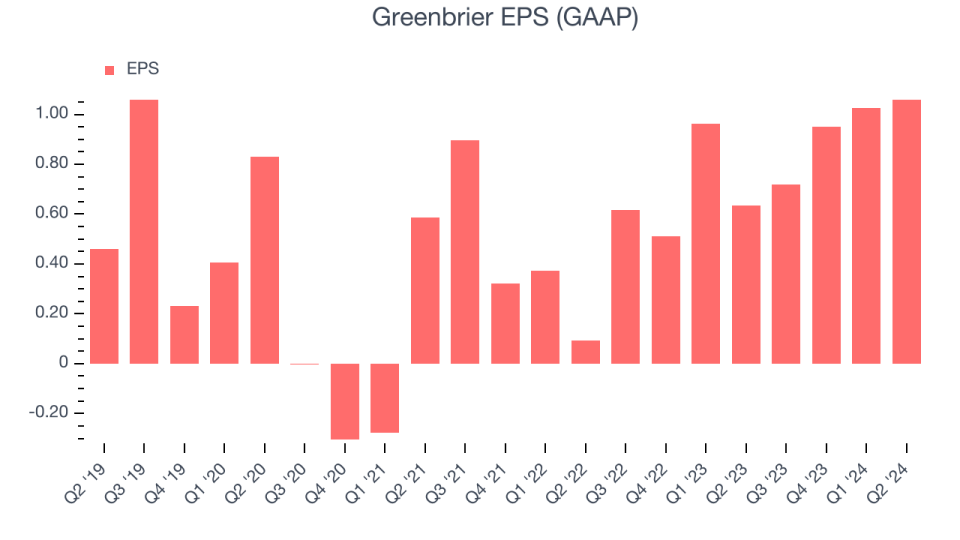

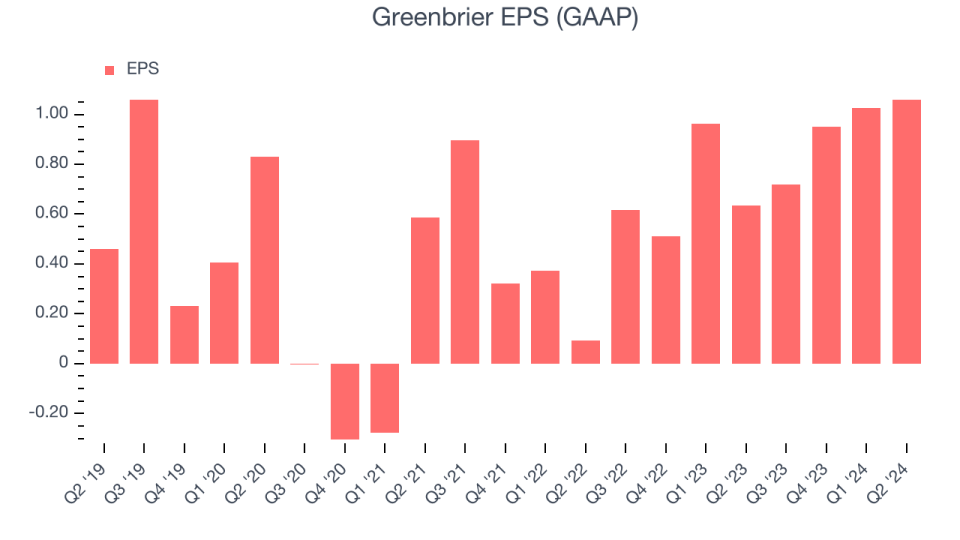

EPS

We track the long-lasting development in incomes per share (EPS) for the exact same factor as long-lasting earnings development. Contrasted to earnings, nevertheless, EPS highlights whether a firm’s development paid.

Greenbrier’s EPS expanded at an impressive 13.2% intensified yearly development price over the last 5 years, greater than its 4.6% annualized earnings development. Nonetheless, this alone does not inform us a lot concerning its daily procedures since its operating margin really did not broaden.

Diving right into Greenbrier’s high quality of incomes can provide us a much better understanding of its efficiency. A five-year sight reveals that Greenbrier has actually bought its supply, diminishing its share matter by 3.5%. This informs us its EPS exceeded its earnings not due to boosted functional performance however economic design, as buybacks increase per share incomes.

Like with earnings, we likewise evaluate EPS over a much shorter duration to see if we are missing out on a modification in business. For Greenbrier, its two-year yearly EPS development of 49.5% was greater than its five-year pattern. We enjoy it when incomes development increases, specifically when it increases off a currently high base.

In Q2, Greenbrier reported EPS at $1.06, up from $0.63 in the exact same quarter in 2014. Regardless of expanding year on year, this print missed out on experts’ quotes, however we care a lot more concerning long-lasting EPS development than temporary activities. Over the following one year, Wall surface Road anticipates Greenbrier to expand its incomes. Experts are predicting its EPS of $3.76 in the in 2014 to climb up by 15.4% to $4.34.

Trick Takeaways from Greenbrier’s Q2 Outcomes

Greenbrier’s earnings sadly missed out on and its EPS disappointed Wall surface Road’s quotes. The firm likewise decreased its complete year earnings advice at the navel, which is never ever an excellent indication. In general, this was a poor quarter for Greenbrier. The supply traded down 6.3% to $45.50 promptly after reporting.

Greenbrier may have had a difficult quarter, however does that in fact develop a chance to spend now? When making that choice, it is very important to consider its evaluation, organization high qualities, along with what has actually taken place in the current quarter. We cover that in our actionable full research report which you can read here, it’s free.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.