Reflecting on shopping software program supplies’ Q1 revenues, we analyze this quarter’s finest and worst entertainers, consisting of VeriSign (NASDAQ: VRSN) and its peers.

While shopping has actually been around for over twenty years and delighted in purposeful development, its general infiltration of retail still stays reduced. Just around $1 in every $5 invested in retail acquisitions originates from electronic orders, leaving over 80% of the retail market still ripe for on the internet disturbance. It is these big swathes of the retail where shopping has actually not yet held that drives the need for different shopping software program options.

The 6 shopping software program supplies we track reported an ok Q1; generally, profits defeat expert agreement quotes by 1.5%. while following quarter’s profits advice remained in line with agreement. Rising cost of living proceeded in the direction of the Fed’s 2% objective at the end of 2023, resulting in solid securities market efficiency. The begin of 2024 has actually been a bumpier adventure, as the marketplace switches over in between positive outlook and pessimism around price cuts because of blended rising cost of living information, yet shopping software program supplies have actually revealed durability, with share costs up 8.8% generally because the previous revenues outcomes.

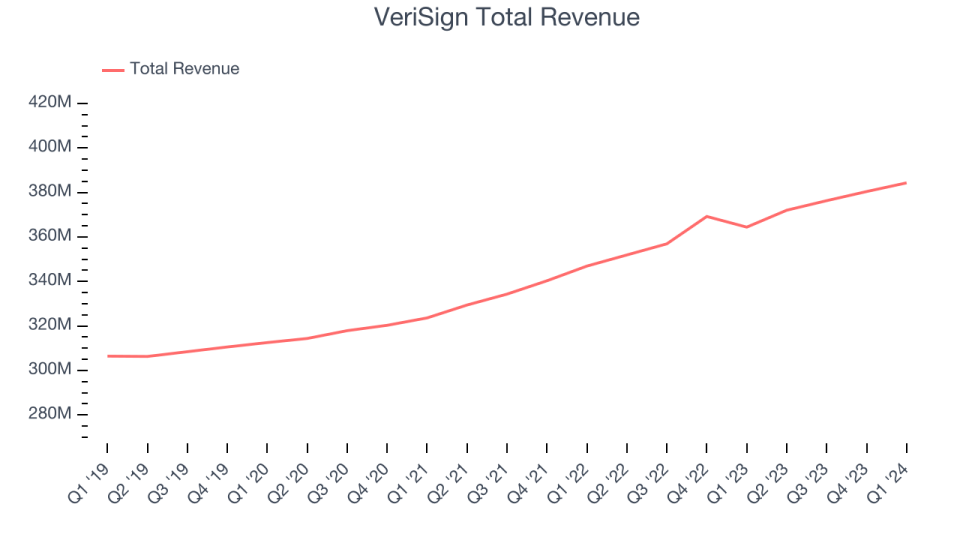

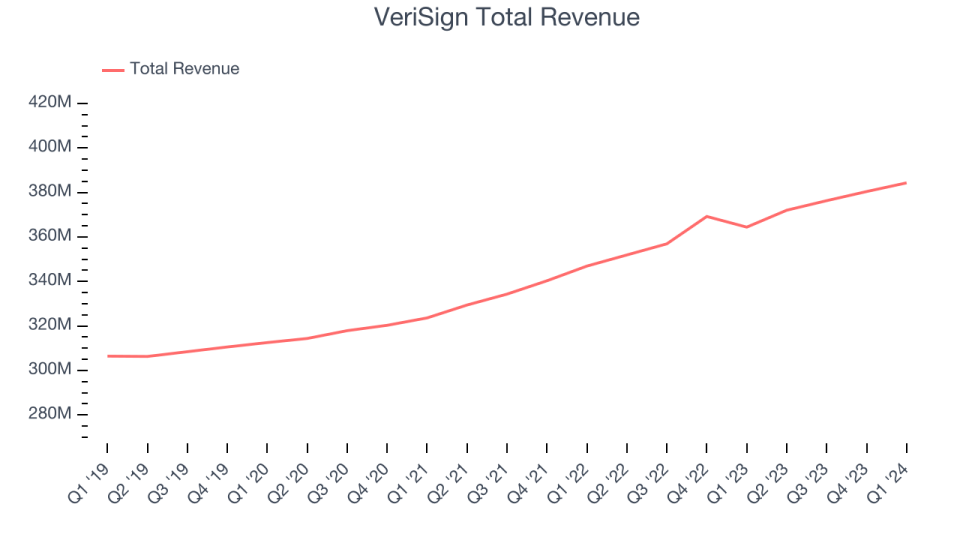

VeriSign (NASDAQ: VRSN)

While the business is not a domain name registrar and does not straight offer domain to finish individuals, Verisign (NASDAQ: VRSN) runs and preserves the framework to sustain domain such as.com and.net.

VeriSign reported profits of $384.3 million, up 5.5% year on year, in accordance with experts’ assumptions. It was an okay quarter for the business, with profits and EPS somewhat going beyond experts’ quotes.

” These outcomes note one more quarter of strong, regular economic efficiency to begin 2024,” stated Jim Bidzos, Exec Chairman, Head Of State and President.

VeriSign provided the slowest profits development of the entire team. The supply is down 3.6% because the outcomes and presently trades at $176.06.

Is currently the moment to purchase VeriSign? Access our full analysis of the earnings results here, it’s free.

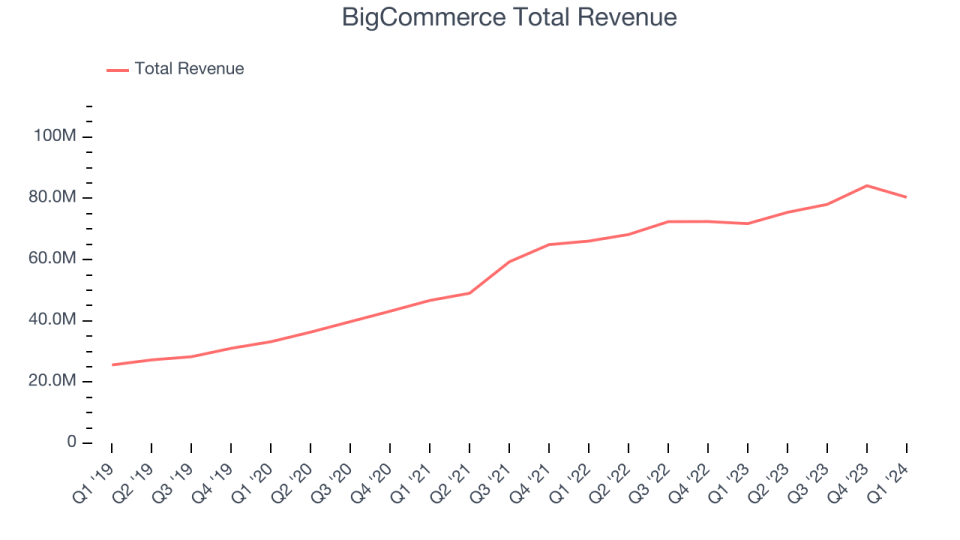

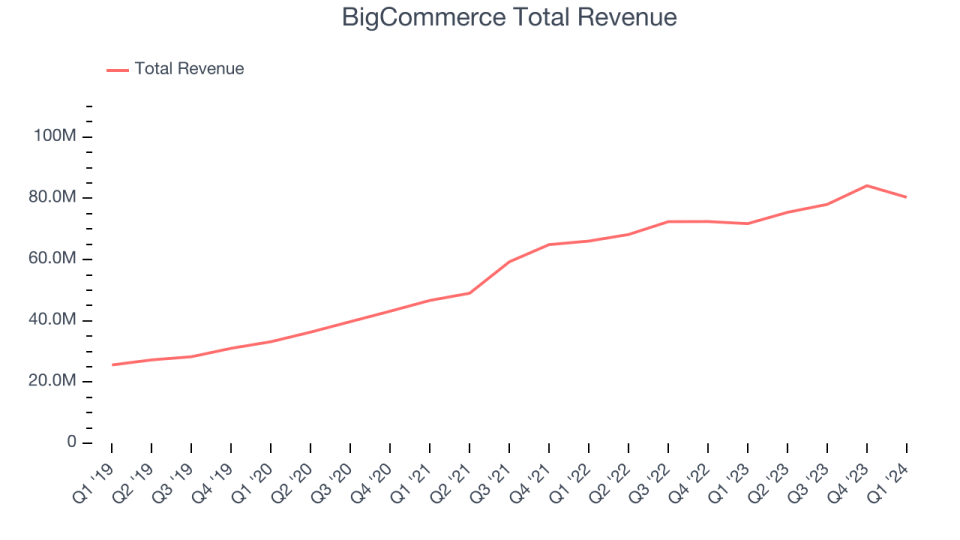

Finest Q1: BigCommerce (NASDAQ: BIGC)

Established In Sydney, Australia in 2009 by Mitchell Harper and Eddie Machaalani, BigCommerce (NASDAQ: BIGC) supplies software program for services to quickly produce online shops.

BigCommerce reported profits of $80.36 million, up 12% year on year, outmatching experts’ assumptions by 4.1%. It was a strong quarter for the business, with a remarkable beat of experts’ invoicings quotes and full-year profits advice covering experts’ assumptions.

BigCommerce accomplished the largest expert approximates defeat amongst its peers. The supply is up 15.3% because the outcomes and presently trades at $7.72.

Is currently the moment to purchase BigCommerce? Access our full analysis of the earnings results here, it’s free.

Wix (NASDAQ: WIX)

Established In 2006 in Tel Aviv, Wix.com (NASDAQ: WIX) supplies a free-and-easy to run internet site structure system.

Wix reported profits of $419.8 million, up 12.2% year on year, in accordance with experts’ assumptions. It was a blended quarter for the business, with a respectable beat of experts’ invoicings quotes yet a decrease in its gross margin.

Wix had the weakest efficiency versus expert quotes and weakest full-year advice upgrade in the team. The supply is up 14.8% because the outcomes and presently trades at $156.03.

Read our full analysis of Wix’s results here.

Squarespace (NYSE: SQSP)

Established In New York City City in 2003, Squarespace (NYSE: SQSP) is a system for local business and makers to construct their electronic existences online.

Squarespace reported profits of $281.1 million, up 18.6% year on year, going beyond experts’ assumptions by 1.7%. It was a respectable quarter for the business, with a remarkable beat of experts’ invoicings quotes yet a decrease in its gross margin.

Squarespace racked up the highest possible full-year advice raising amongst its peers. The supply is up 23.5% because the outcomes and presently trades at $43.78.

Read our full, actionable report on Squarespace here, it’s free.

GoDaddy (NYSE: GDDY)

Started by Bob Parsons after offering his very first business to Intuit, GoDaddy (NYSE: GDDY) supplies tiny and mid-sized services with the capacity to purchase an internet domain name and devices to produce and take care of an internet site.

GoDaddy reported profits of $1.11 billion, up 7% year on year, going beyond experts’ assumptions by 1.1%. It was an okay quarter for the business, with a strong beat of experts’ reservations quotes yet a decrease in its gross margin.

The supply is up 15.9% because the outcomes and presently trades at $143.99.

Read our full, actionable report on GoDaddy here, it’s free.

Sign Up With Paid Supply Capitalist Research Study

Aid us make StockStory a lot more valuable to capitalists like on your own. Join our paid customer study session and obtain a $50 Amazon present card for your viewpoints. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.