Reflecting on analog semiconductors supplies’ Q1 revenues, we analyze this quarter’s finest and worst entertainers, consisting of Skyworks Solutions (NASDAQ: SWKS) and its peers.

Need for analog chips is usually connected to the general degree of financial development, as analog chips work as the foundation of many digital items and devices. Unlike electronic chip developers, analog chip manufacturers have a tendency to generate most of their very own chips, as analog chip manufacturing does not need costly cutting edge nodes. Much less based on significant nonreligious development motorists, analog item cycles are a lot longer, usually 5-7 years.

The 15 analog semiconductors supplies we track reported a slower Q1; typically, earnings defeat expert agreement price quotes by 1.9%. while following quarter’s profits advice remained in line with agreement. Rising cost of living advanced in the direction of the Fed’s 2% objective at the end of 2023, causing solid securities market efficiency. The beginning of 2024 has actually been a bumpier trip, as the marketplace changes in between positive outlook and pessimism around price cuts as a result of combined rising cost of living information, however analog semiconductors supplies have actually done well, with the share rates up 14.1% typically considering that the previous revenues outcomes.

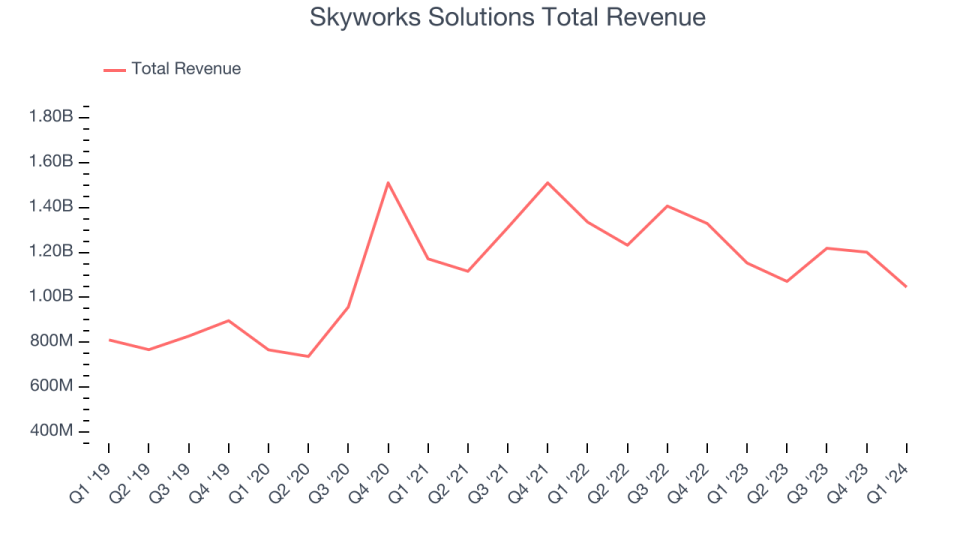

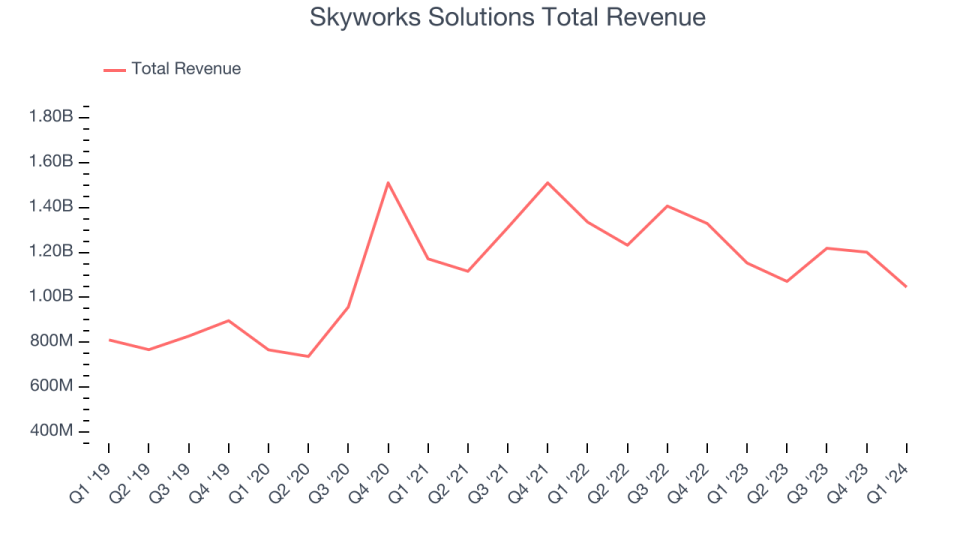

Skyworks Solutions (NASDAQ: SWKS)

Outcome of a merging of Alpha Industries and the cordless interactions department of Conexant, Skyworks Solutions (NASDAQ: SWKS) is a developer and supplier of chips made use of in smart devices, automobiles, and commercial applications to intensify, filter, and procedure cordless signals.

Skyworks Solutions reported earnings of $1.05 billion, down 9.3% year on year, inline with experts’ assumptions. It was a weak quarter for the business, with underwhelming profits advice for the following quarter and a decrease in its operating margin.

” Skyworks supplied strong outcomes and solid cash money generation in a tough macroeconomic atmosphere,” claimed Liam K. Lion, chairman, ceo and head of state of Skyworks.

The supply is down 2.2% considering that the outcomes and presently trades at $104.23.

Read our full report on Skyworks Solutions here, it’s free

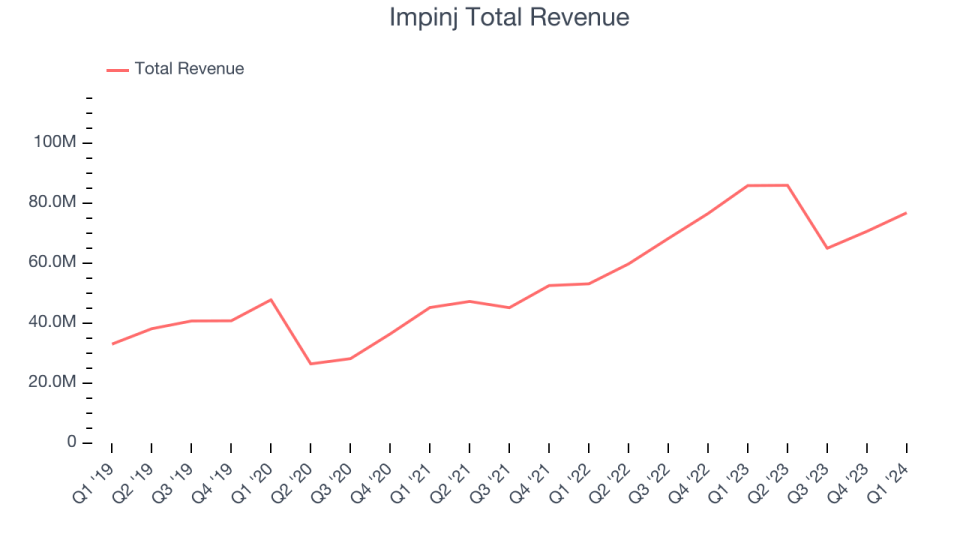

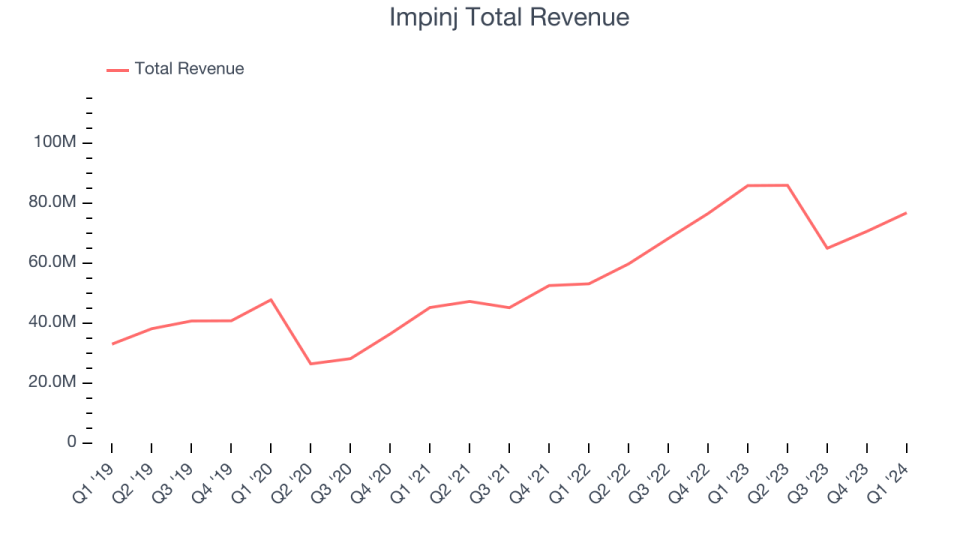

Ideal Q1: Impinj (NASDAQ: PI)

Started by Caltech teacher Carver Mead and among his trainees Chris Diorio, Impinj (NASDAQ: PI) is a manufacturer of radio-frequency recognition (RFID) software and hardware.

Impinj reported earnings of $76.83 million, down 10.6% year on year, surpassing experts’ assumptions by 4.4%. It was an extremely solid quarter for the business, with a considerable renovation in its supply degrees and a remarkable beat of experts’ EPS price quotes.

The supply is up 31.7% considering that the outcomes and presently trades at $159.02.

Is currently the moment to get Impinj? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Integrated Circuit Innovation (NASDAQ: MCHP)

Drawn Out from General Tool in 1987, Integrated Circuit Innovation (NASDAQ: MCHP) is a leading carrier of microcontrollers and incorporated circuits made use of generally in the automobile globe, specifically in electrical cars and their billing tools.

Silicon chip Innovation reported earnings of $1.33 billion, down 40.6% year on year, disappointing experts’ assumptions by 1.2%. It was a weak quarter for the business, with underwhelming profits advice for the following quarter and a decrease in its operating margin.

Integrated Circuit Innovation had the weakest efficiency versus expert price quotes and slowest profits development in the team. The supply is up 1.1% considering that the outcomes and presently trades at $94.83.

Read our full analysis of Microchip Technology’s results here.

ON Semiconductor (NASDAQ: ON)

Drawn Out of Motorola in 1999 and constructed with a collection of purchases, ON Semiconductor (NASDAQ: ON) is a worldwide carrier of analog chips focusing on automobiles, commercial applications, and power administration in cloud information facilities.

ON Semiconductor reported earnings of $1.86 billion, down 4.9% year on year, in accordance with experts’ assumptions. It was a weak quarter for the business, with underwhelming profits advice for the following quarter and a boost in its supply degrees.

The supply is up 7.3% considering that the outcomes and presently trades at $73.

Read our full, actionable report on ON Semiconductor here, it’s free.

Power Assimilations (NASDAQ: POWI)

A leading provider of components for electronic devices such as home devices, Power Assimilations (NASDAQ: POWI) is a semiconductor developer and designer focusing on items made use of for high-voltage power conversion.

Power Assimilations reported earnings of $91.69 million, down 13.7% year on year, going beyond experts’ assumptions by 1.9%. It was a suitable quarter for the business, with a remarkable beat of experts’ EPS price quotes however a decrease in its operating margin.

The supply is up 0.6% considering that the outcomes and presently trades at $70.68.

Read our full, actionable report on Power Integrations here, it’s free.

Sign Up With Paid Supply Financier Study

Aid us make StockStory a lot more useful to capitalists like on your own. Join our paid customer research study session and obtain a $50 Amazon present card for your viewpoints. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.