Allow’s explore the family member efficiency of Woodward (NASDAQ: WWD) and its peers as we unwind the now-completed Q1 aerospace revenues period.

Aerospace business commonly have technological competence and have actually made substantial capital expense to generate complicated items. It is a sector where advancement is very important, and recently, discharges and automation remain in emphasis, so business that flaunt breakthroughs in these locations can take market share. On the various other hand, need for aerospace items can ups and downs with financial cycles and geopolitical stress, which can be specifically uncomfortable for business with high dealt with expenses.

The 14 aerospace supplies we track reported a strong Q1; typically, incomes defeat expert agreement quotes by 2%. while following quarter’s income advice was 1.8% over agreement. Supplies, specifically development supplies where capital better in the future are more crucial to the tale, had a great end of 2023. However the start of 2024 has actually seen a lot more unstable supply efficiency because of blended rising cost of living information, yet aerospace supplies have actually revealed strength, with share costs up 7.7% typically because the previous revenues outcomes.

Woodward (NASDAQ: WWD)

At first creating controls for water wheels in the very early 1900s, Woodward (NASDAQ: WWD) layouts, solutions, and produces power control items and optimization remedies.

Woodward reported incomes of $835.3 million, up 16.3% year on year, covering experts’ assumptions by 3.3%. It was a sensational quarter for the firm, with an excellent beat of experts’ natural income quotes and confident revenues advice for the complete year.

” Our concentrate on functional quality remains to make it possible for substantial sales development and margin growth, many thanks to the initiatives of all our participants,” specified Chip Blankenship, Chairman and President.

Woodward accomplished the highest possible full-year advice raising of the entire team. The supply is up 15.3% because the outcomes and presently trades at $174.08.

Is currently the moment to purchase Woodward? Access our full analysis of the earnings results here, it’s free.

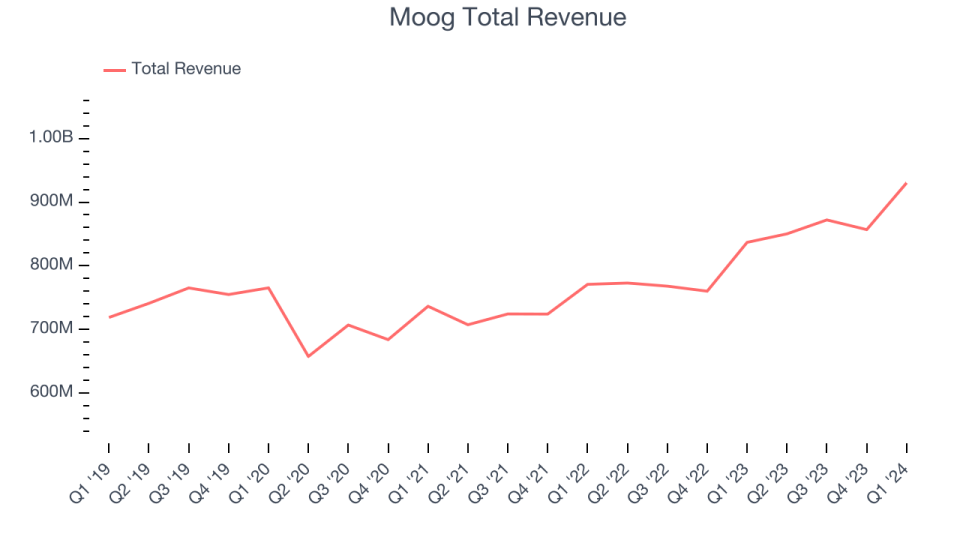

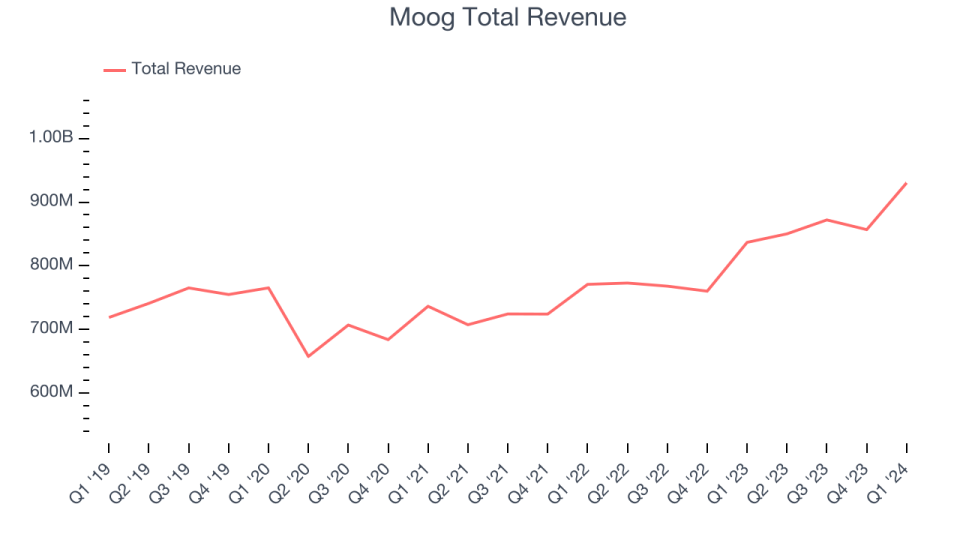

Finest Q1: Moog (NYSE: MOG.A)

In charge of the trip control actuation system incorporated in the B-2 stealth bombing plane, Moog (NYSE: MOG.A) offers accuracy movement control remedies made use of in aerospace and protection applications.

Moog reported incomes of $930.3 million, up 11.2% year on year, surpassing experts’ assumptions by 6.5%. It was an unbelievable quarter for the firm, with income and EPS going beyond experts’ assumptions.

The supply is up 8.3% because the outcomes and presently trades at $170.37.

Is currently the moment to purchase Moog? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Textron (NYSE: TXT)

Noted on the NYSE in 1947, Textron (NYSE: TXT) offers services and products in the aerospace, protection, commercial, and money fields.

Textron reported incomes of $3.14 billion, up 3.7% year on year, disappointing experts’ assumptions by 4%. It was a weak quarter for the firm, with a miss out on of experts’ natural income quotes.

Textron had the weakest efficiency versus expert quotes in the team. The supply is down 8.3% because the outcomes and presently trades at $86.21.

Read our full analysis of Textron’s results here.

Howmet (NYSE: HWM)

Developing the very first built light weight aluminum vehicle wheel, Howmet (NYSE: HWM) focuses on light-weight steels design and production multi-material parts made use of in lorries.

Howmet reported incomes of $1.82 billion, up 13.8% year on year, exceeding experts’ assumptions by 5.1%. It was an excellent quarter for the firm, with a strong beat of experts’ income quotes and a good beat of experts’ revenues quotes.

The supply is up 18.8% because the outcomes and presently trades at $79.33.

Read our full, actionable report on Howmet here, it’s free.

Curtiss-Wright (NYSE: CW)

Created from a merging of 12 business, Curtiss-Wright (NYSE: CW) offers a variety of services and products to the aerospace, commercial, digital, and maritime markets.

Curtiss-Wright reported incomes of $713.2 million, up 13% year on year, exceeding experts’ assumptions by 7.4%. It was a really solid quarter for the firm, with a strong beat of experts’ revenues quotes and full-year income advice somewhat covering experts’ assumptions.

Curtiss-Wright racked up the largest expert approximates defeat amongst its peers. The supply is up 6% because the outcomes and presently trades at $272.25.

Read our full, actionable report on Curtiss-Wright here, it’s free.

Sign Up With Paid Supply Capitalist Research Study

Aid us make StockStory a lot more useful to financiers like on your own. Join our paid individual study session and obtain a $50 Amazon present card for your viewpoints. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.