Incomes results frequently show what instructions a business will certainly absorb the months in advance. With Q1 currently behind us, allow’s take a look at Tetra Technology (NASDAQ: TTEK) and its peers.

Numerous ecological and center solutions are non-discretionary (sporting activities arenas require to be cleansed after occasions), reoccuring, and executed via longer-term agreements. This creates even more foreseeable and stickier earnings streams. In addition, there has actually been a raising concentrate on exhausts and water preservation over the last years, driving advancement in the field and need for brand-new solutions. In spite of these tailwinds, ecological and center solutions firms are still at the impulse of financial cycles. Rates of interest, for instance, can significantly affect business building and construction tasks that drive step-by-step need for these solutions.

The 8 ecological and centers solutions supplies we track reported a respectable Q1; typically, profits defeat expert agreement quotes by 0.6%. while following quarter’s earnings support was 0.6% over agreement. Supplies– particularly those trading at greater multiples– had a solid end of 2023, yet 2024 has actually seen durations of volatility. Blended signals concerning rising cost of living have actually brought about unpredictability around price cuts, yet ecological and centers solutions supplies have actually revealed strength, with share rates up 8.6% typically given that the previous incomes outcomes.

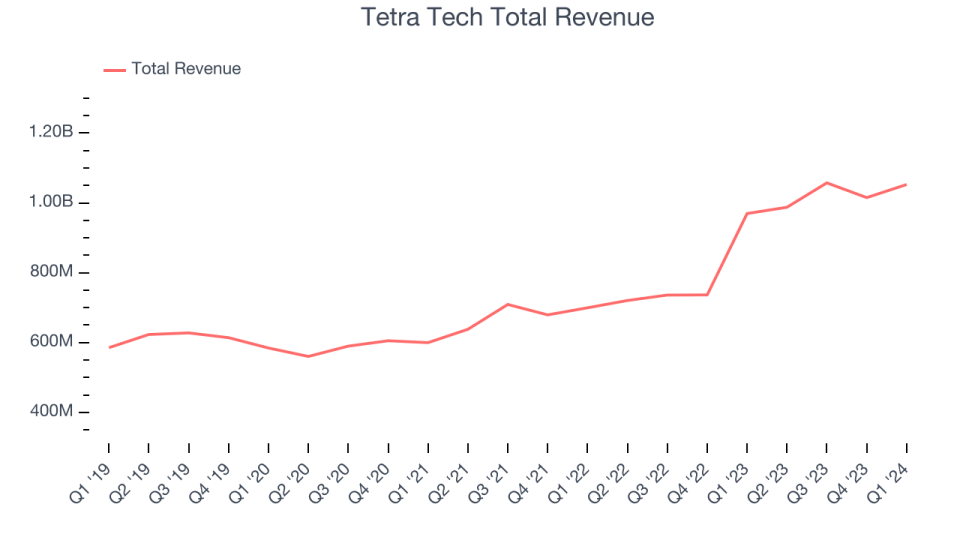

Tetra Technology (NASDAQ: TTEK)

Initially established to concentrate on Alaska’s oil pipes, Tetra Technology (NASDAQ: TTEK) gives consulting and design solutions to the water and framework markets.

Tetra Technology reported profits of $1.05 billion, up 8.6% year on year, covering experts’ assumptions by 2.7%. It was a combined quarter for the business, with a respectable beat of experts’ incomes quotes yet a miss out on of experts’ stockpile sales quotes.

Tetra Technology racked up the highest possible full-year support raising of the entire team. The supply is up 5.7% given that the outcomes and presently trades at $203.5.

Is currently the moment to purchase Tetra Technology? Access our full analysis of the earnings results here, it’s free.

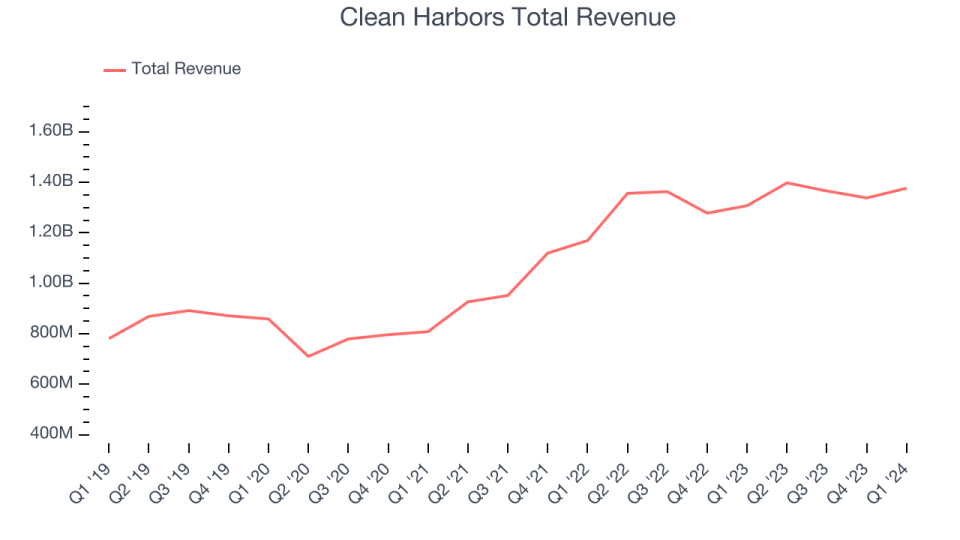

Finest Q1: Clean Harbors (NYSE: CLH)

Having actually contributed in the cleaning of numerous historic oil spills, Clean Harbors (NYSE: CLH) gives ecological solutions like dangerous and non-hazardous garbage disposal.

Clean Harbors reported profits of $1.38 billion, up 5.3% year on year, outshining experts’ assumptions by 3%. It was a really solid quarter for the business, with a strong beat of experts’ natural earnings quotes and a respectable beat of experts’ incomes quotes.

Tidy Harbors attained the largest expert approximates defeat amongst its peers. The supply is up 18.3% given that the outcomes and presently trades at $224.31.

Is currently the moment to purchase Clean Harbors? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Stericycle (NASDAQ: SRCL)

Having actually finished 500 procurements given that its creation, Stericycle (NASDAQ: SRCL) gives garbage disposal and delicate info damage solutions.

Stericycle reported profits of $664.9 million, down 2.8% year on year, disappointing experts’ assumptions by 1.7%. It was a weak quarter for the business, with a miss out on of experts’ natural earnings quotes.

Stericycle had the weakest efficiency versus expert quotes and slowest earnings development in the team. The supply is up 17.1% given that the outcomes and presently trades at $58.41.

Read our full analysis of Stericycle’s results here.

Waste Monitoring (NYSE: WM)

Established In 1968, Waste Monitoring (NYSE: WM) focuses on waste collection, disposal, reusing, and ecological solutions throughout The United States and Canada.

Waste Monitoring reported profits of $5.16 billion, up 5.5% year on year, disappointing experts’ assumptions by 1.2%. It was an alright quarter for the business, with a strong beat of experts’ incomes quotes.

The supply is down 0.1% given that the outcomes and presently trades at $210.2.

Read our full, actionable report on Waste Management here, it’s free.

Rollins (NYSE: ROL)

Operating under several brand names like Orkin and HomeTeam Parasite Protection, Rollins (NYSE: ROL) gives parasite and wild animals control solutions to domestic and business clients.

Rollins reported profits of $748.3 million, up 13.7% year on year, exceeding experts’ assumptions by 1.2%. It was a really solid quarter for the business, with an excellent beat of experts’ natural earnings quotes and a slim beat of experts’ incomes quotes.

The supply is up 17.2% given that the outcomes and presently trades at $50.29.

Read our full, actionable report on Rollins here, it’s free.

Sign Up With Paid Supply Financier Research Study

Assist us make StockStory a lot more handy to financiers like on your own. Join our paid customer study session and obtain a $50 Amazon present card for your viewpoints. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.