Quarterly profits outcomes are a great time to sign in on a firm’s progression, particularly contrasted to its peers in the exact same field. Today we are checking out Vicor (NASDAQ: VICR) and the most effective and worst entertainers in the digital elements market.

Like numerous devices and part makers, digital elements firms are buoyed by nonreligious fads such as connection and commercial automation. Extra details pockets of solid need consist of information facilities and telecoms, which can profit firms whose optical and transceiver offerings fit those markets. However like the more comprehensive industrials field, these firms are additionally at the impulse of financial cycles. Customer costs, as an example, can significantly affect these firms’ quantities.

The 10 digital elements supplies we track reported a good Q1; typically, profits defeat expert agreement quotes by 0.8%. while following quarter’s income advice remained in line with agreement. Supplies– particularly those trading at greater multiples– had a solid end of 2023, yet 2024 has actually seen durations of volatility. Combined signals regarding rising cost of living have actually caused unpredictability around price cuts, yet digital elements supplies have actually revealed strength, with share costs up 8% typically given that the previous profits outcomes.

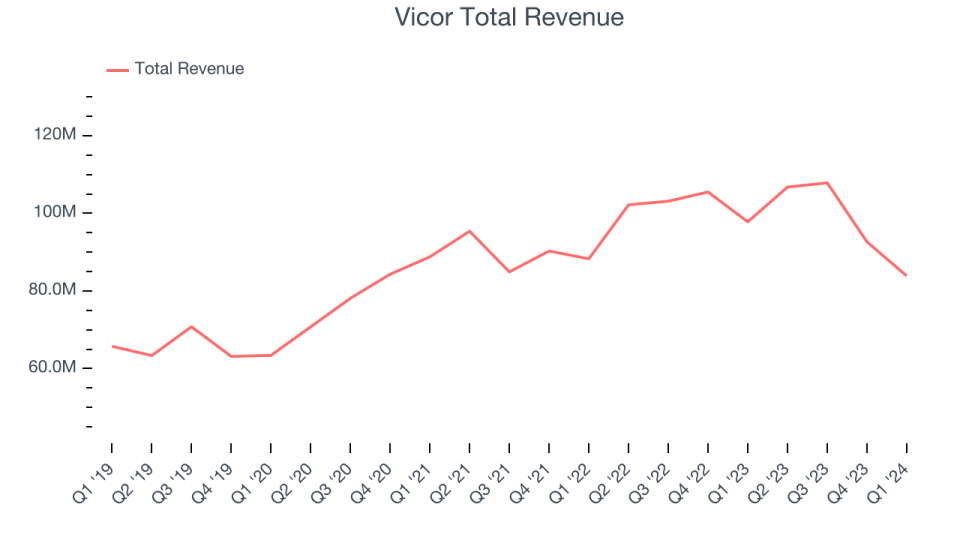

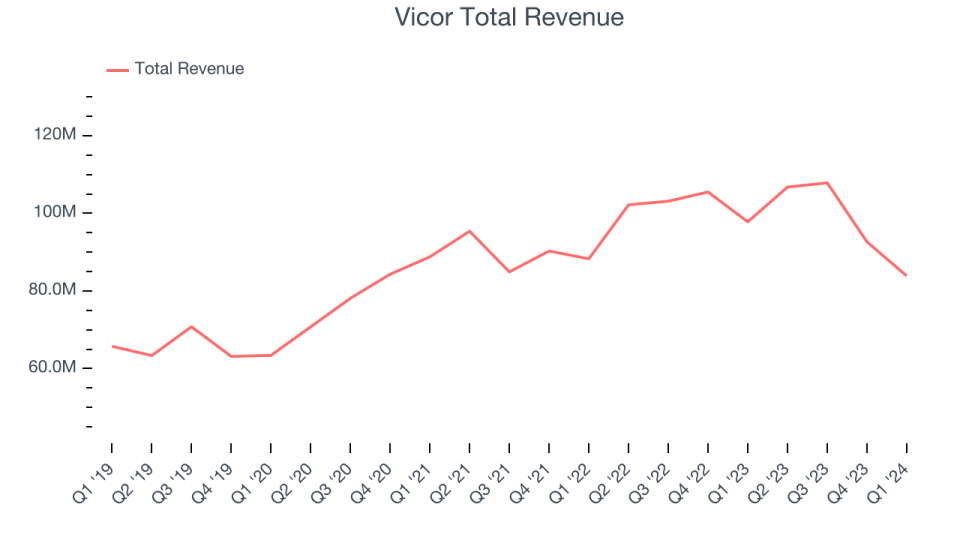

Vicor (NASDAQ: VICR)

Started by a scientist at MIT, Vicor (NASDAQ: VICR) offers electric power conversion and shipment items for a series of markets.

Vicor reported profits of $83.87 million, down 14.3% year on year, disappointing experts’ assumptions by 1.1%. It was a weak quarter for the firm with income and EPS missing out on experts’ assumptions.

Discussing very first quarter efficiency, Ceo Dr. Patrizio Vinciarelli specified: “Q1 gross margins and general expenses mirror an action up in aristocracy earnings and lawful expenditures connecting to our project to insist Vicor Copyright. Licenses to OEMs, admitting to trademarked power system innovation from or else infringing distributors, will certainly match future profits from our 5G line of product and ChiP factory. These capacities placement Vicor in advance of needs for rising existing and power thickness, with remarkable efficiency and factory capability that prepare for market needs.”

The supply is down 4.9% given that the outcomes and presently trades at $33.44.

Read our full report on Vicor here, it’s free

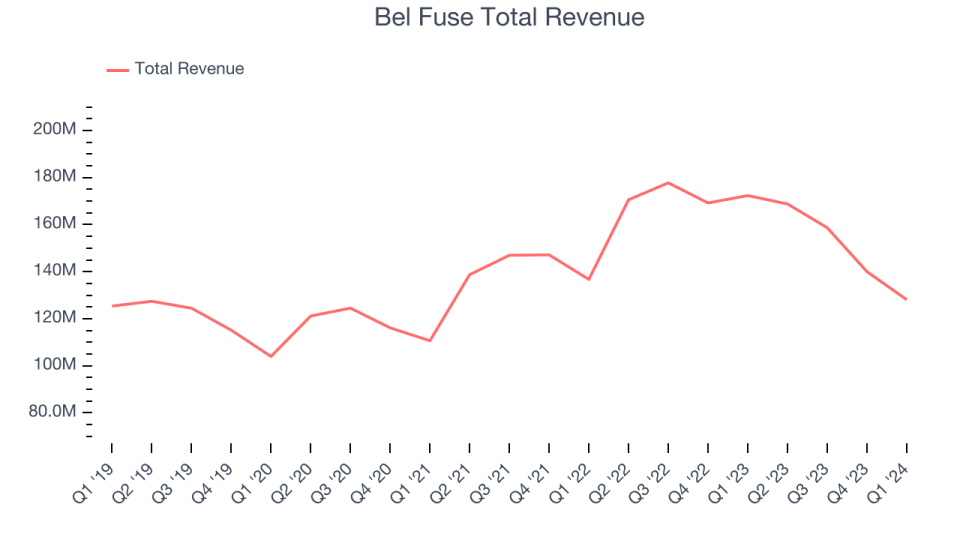

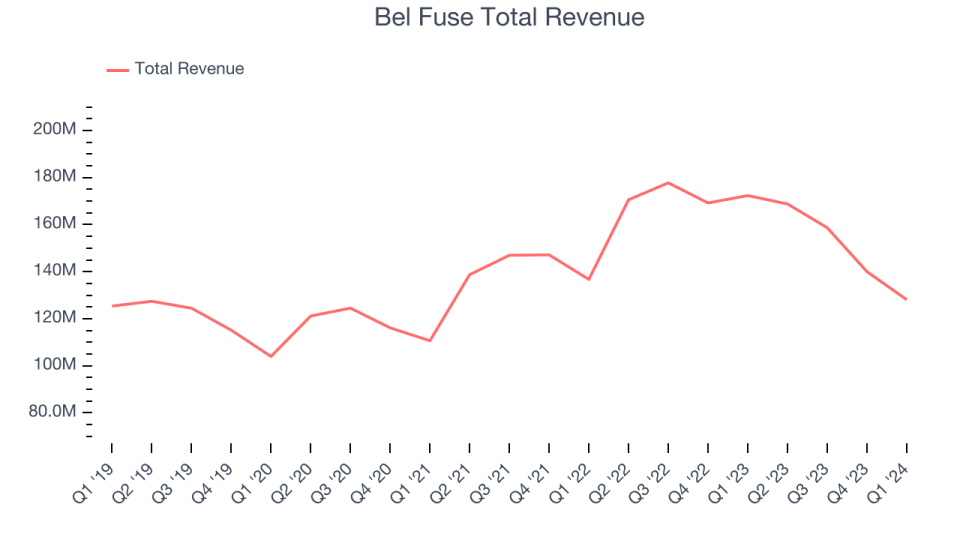

Finest Q1: Bel Fuse (NASDAQ: BELFA)

Started by 26-year-old Elliot Bernstein throughout the electronic devices boom after WW2, Bel Fuse (NASDAQGS: BELF.A) offers digital systems and tools to the telecoms, networking, transport, and commercial markets.

Bel Fuse reported profits of $128.1 million, down 25.7% year on year, disappointing experts’ assumptions by 0.4%. It was a blended quarter for the firm, with a slim miss out on of experts’ sales quotes. On the various other hand, EPS was available in ahead of assumptions.

Bel Fuse had the slowest income development amongst its peers. The supply is up 17.7% given that the outcomes and presently trades at $84.11.

Is currently the moment to purchase Bel Fuse? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Advanced Power (NASDAQ: AEIS)

Introducing modern technologies for superhigh frequency power shipment, Advanced Power (NASDAQGS: AEIS) offers power materials, thermal monitoring systems, and dimension and control tools for different producing procedures.

Advanced Power reported profits of $327.5 million, down 23% year on year, disappointing experts’ assumptions by 6.9%. It was a weak quarter for the firm, with a miss out on of experts’ profits quotes.

Advanced Power had the weakest efficiency versus expert quotes in the team. The supply is up 11.5% given that the outcomes and presently trades at $106.95.

Read our full analysis of Advanced Energy’s results here.

Belden (NYSE: BDC)

With its enamel-coated copper cable utilized in WWI for the Allied pressures, Belden (NYSE: BDC) layouts, makes, and markets digital elements to different markets.

Belden reported profits of $535.7 million, down 16.5% year on year, going beyond experts’ assumptions by 4.3%. It was a solid quarter for the firm, with an outstanding beat of experts’ Venture income quotes and a strong beat of experts’ profits quotes.

The supply is up 13.5% given that the outcomes and presently trades at $92.3.

Read our full, actionable report on Belden here, it’s free.

Knowles (NYSE: KN)

Holding a swath of licenses, Knowles (NYSSE: KN) provides acoustics elements for different markets.

Knowles reported profits of $196.4 million, up 36.1% year on year, according to experts’ assumptions. It was an okay quarter for the firm, with a slim beat of experts’ income quotes.

Knowles provided the fastest income development amongst its peers. The supply is up 7.7% given that the outcomes and presently trades at $17.

Read our full, actionable report on Knowles here, it’s free.

Sign Up With Paid Supply Capitalist Study

Aid us make StockStory a lot more practical to capitalists like on your own. Join our paid customer study session and get a $50 Amazon present card for your point of views. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.