Incomes results frequently suggest what instructions a business will certainly absorb the months in advance. With Q1 currently behind us, allow’s take a look at Transcat (NASDAQ: TRNS) and its peers.

Supply chain and supply monitoring are styles that expanded in emphasis after COVID damaged the international motion of basic materials and parts. Repair and maintenance suppliers that flaunt trusted option and promptly supply items to consumers can gain from this style. While shopping hasn’t interfered with commercial circulation as high as customer retail, it is still a genuine hazard, compeling financial investment in omnichannel abilities to offer consumers almost everywhere. In addition, repair and maintenance suppliers go to the impulse of financial cycles that affect the capital investment and building and construction tasks that can juice need.

The 7 repair and maintenance suppliers supplies we track reported an ok Q1; generally, profits remained in line with expert agreement price quotes. Appraisal multiples for lots of development supplies have actually not yet gone back to their very early 2021 highs, however the marketplace was hopeful at the end of 2023 as a result of cooling down rising cost of living. The begin of 2024 has actually been a various tale as combined signals have actually brought about market volatility, and repair and maintenance suppliers supplies have actually had a harsh stretch, with share costs down 8.1% generally because the previous incomes outcomes.

Ideal Q1: Transcat (NASDAQ: TRNS)

Offering the pharmaceutical, commercial production, power, and chemical procedure markets, Transcat (NASDAQ: TRNS) offers dimension tools and materials.

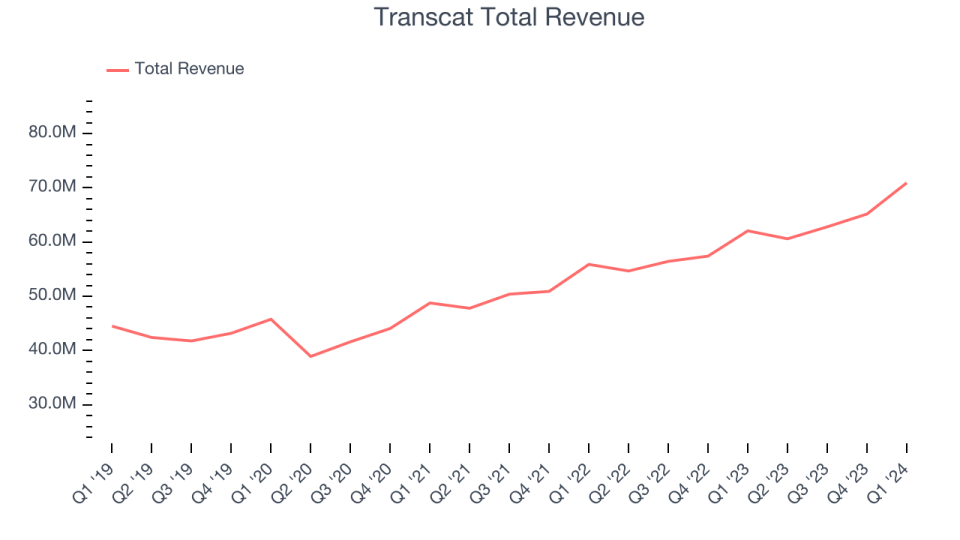

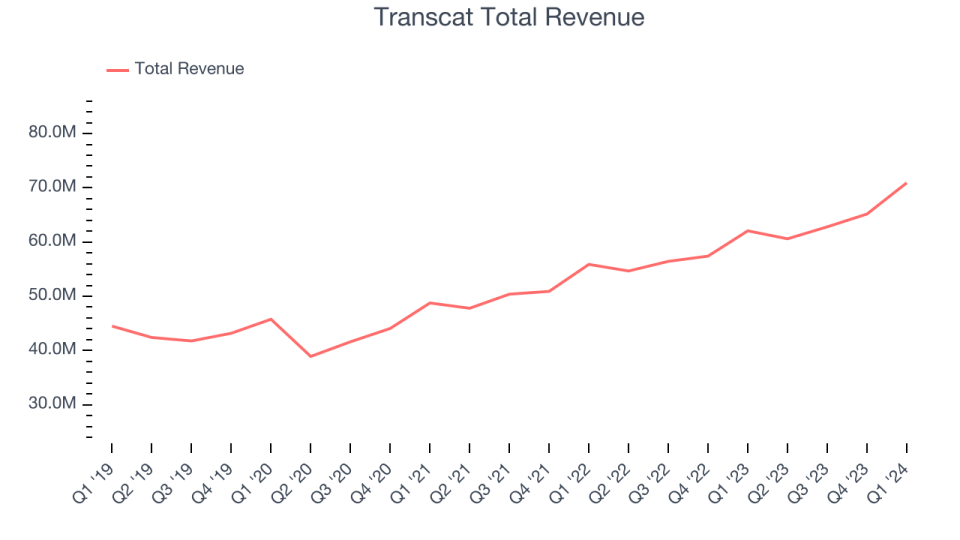

Transcat reported profits of $70.91 million, up 14.3% year on year, covering experts’ assumptions by 3.4%. It was an amazing quarter for the firm, with profits and EPS surpassing experts’ assumptions.

” We are exceptionally pleased with our 4th quarter and complete year financial 2024 outcomes as double-digit natural Solution profits development and raised efficiency drove Solution gross margin development while Circulation gross margins rose as a result of development in Leasings,” commented Lee D. Rudow, Head Of State and chief executive officer.

Transcat racked up the greatest expert approximates beat of the entire team. The supply is down 0.8% because the outcomes and presently trades at $122.82.

Is currently the moment to purchase Transcat? Access our full analysis of the earnings results here, it’s free.

W.W. Grainger (NYSE: GWW)

Started as a vendor of electric motors, W.W. Grainger (NYSE: GWW) offers upkeep, repair work, and operating (MRO) materials and solutions to companies and establishments.

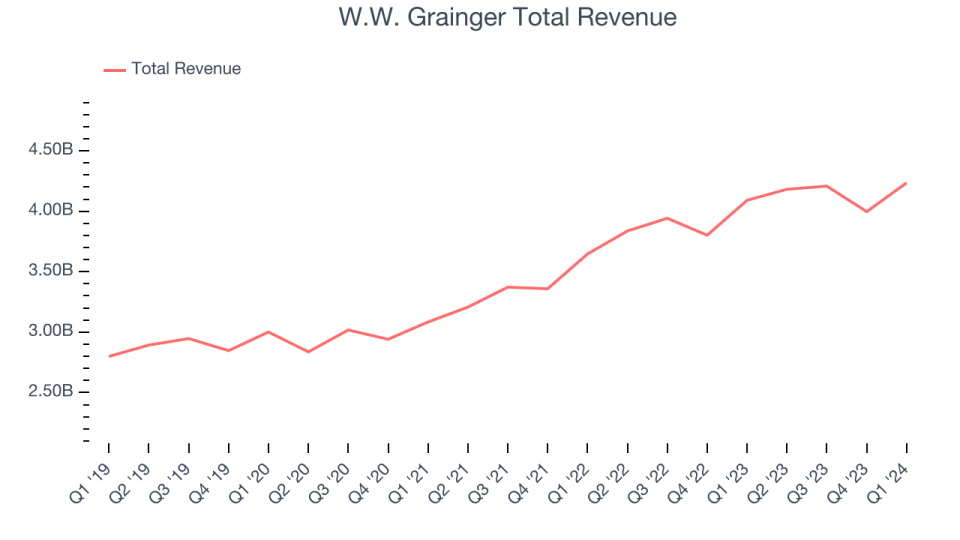

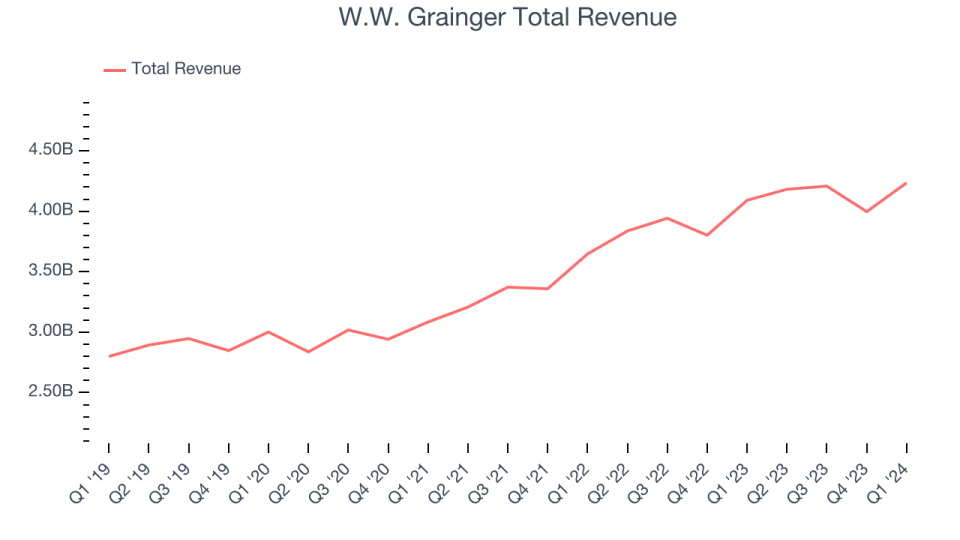

W.W. Grainger reported profits of $4.24 billion, up 3.5% year on year, disappointing experts’ assumptions by 0.5%. It was a blended quarter for the firm, with a good beat of experts’ natural profits price quotes however a miss out on of experts’ incomes price quotes.

The supply is down 4.5% because the outcomes and presently trades at $915.51.

Is currently the moment to purchase W.W. Grainger? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: MSC Industrial (NYSE: MSM)

Established in New York City’s Little Italy, MSC Industrial Direct (NYSE: MSM) offers commercial materials and tools, providing huge and trusted option for consumers such as service providers

MSC Industrial reported profits of $979.4 million, down 7.1% year on year, according to experts’ assumptions. It was an okay quarter for the firm, with a slim beat of experts’ incomes price quotes.

MSC Industrial had the slowest profits development in the team. The supply is up 0.4% because the outcomes and presently trades at $78.51.

Read our full analysis of MSC Industrial’s results here.

WESCO (NYSE: WCC)

Based in Pittsburgh, WESCO (NYSE: WCC) offers electric, commercial, and interactions items and boosts them with solutions such as supply chain monitoring.

WESCO reported profits of $5.35 billion, down 3.1% year on year, according to experts’ assumptions. It was a slower quarter for the firm, with a miss out on of experts’ incomes price quotes.

The supply is up 3.1% because the outcomes and presently trades at $159.24.

Read our full, actionable report on WESCO here, it’s free.

DXP (NASDAQ: DXPE)

Started as Southern Engine and Pump Business, DXP Enterprises (NASDAQ: DXPE) is a commercial representative that markets pumps, electric motors, steel milling and threading devices, and safety and security tools like safety glasses, to name a few product or services.

DXP reported profits of $412.6 million, down 2.7% year on year, according to experts’ assumptions. It was a good quarter for the firm, with a slim beat of experts’ sales price quotes.

The supply is down 19.4% because the outcomes and presently trades at $44.91.

Read our full, actionable report on DXP here, it’s free.

Sign Up With Paid Supply Capitalist Research Study

Assist us make StockStory a lot more useful to capitalists like on your own. Join our paid customer research study session and obtain a $50 Amazon present card for your viewpoints. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.