Costco Wholesale‘s ( NASDAQ: EXPENSE) supply had a specifically excellent initial fifty percent of 2024, climbing almost 29%. That’s about two times the gain of the S&P 500 index over that time structure. Prior to you’re drawn in by the supply’s evident energy, you may intend to go back and have a look at business you are getting– and specifically just how much you are spending for it.

Costco has one more solid quarter

Costco’s does not finish in December, so its revenues obtain reported a little off the common tempo that lots of business comply with. Hence, in late Might, it uploaded monetary third-quarter 2024 monetary outcomes. The numbers were respectable, which isn’t whatsoever shocking provided the long-lasting success the club shop retailer has actually attained.

Sales increased 9.1% year over year. Under line, take-home pay per share was $3.78, up from $2.93 in the prior-year duration. To be reasonable, the 3rd quarter of monetary 2023 consisted of a $0.50-per-share single cost, so the rise had not been fairly as huge as it initially appears. However revenues still increased well, also taking the cost right into account.

Likewise of note, provided the market in which Costco runs, weresame-store sales The leading line consists of both existing areas and brand-new shops, while same-store sales just consider the efficiency of areas open for a minimum of a year. The firm’s same-store sales increased 6.6% in the quarter, which suggests its older areas remain to run at a high degree. Shopping earnings raised a massive 20.7%, however this is simply a tiny piece of Costco’s company.

What are you spending for Costco shares?

Considering Costco’s monetary third-quarter monetary outcomes, you can see why financiers would certainly be positive regarding the supply thus far in 2024. And yet, you should not overlook the price being spent for a business. To reword Benjamin Graham, the male that educated Warren Buffett everything about worth investing, paying way too much for an excellent firm can transform it right into a negative financial investment.

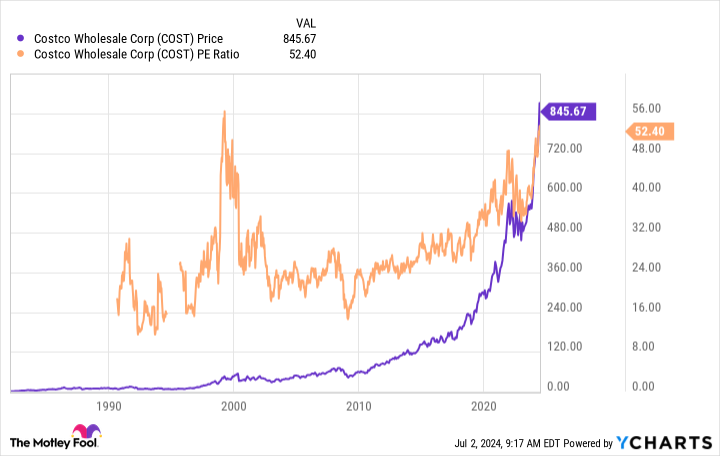

On the evaluation front, Costco is beginning to look a little bit extended. Each of the conventional evaluation metrics– price-to-sales, price-to-earnings (P/E), price-to-book worth, and price-to-cash circulation– are well over their five-year standards. To point out simply one instance, Costco’s present P/E proportion is an eye-watering 52 contrasted to a five-year standard of about 40. However 40 is currently a quite raised number taking into consideration that the ordinary P/E for the S&P 500 is closer to 23 now. SPDR S&P Retail ETF, which tracks the more comprehensive retail market, has an ordinary P/E of just around 14.

Think Of that for one secondly: Costco’s P/E proportion of 52 is more than 3 times the P/E of the ordinary retail supply. This recommends that financiers are valuing in a great deal of excellent information at Costco. Any type of shortage about assumptions, also a small one, might lead financiers to discard the shares. And if there’s a bearish market, it is most likely that Costco will certainly be especially tough hit provided its remarkable rally.

That’s where the chart over is available in. Costco’s share cost and P/E are both near all-time highs. While it is feasible that the supply maintains rallying in the 2nd fifty percent of the year, financiers with also the tiniest worry regarding evaluation possibly will not intend to possess it.

A terrific firm at as well dear a rate

Costco is an extremely well-run firm, and all of Wall surface Road understands it. That’s an issue for any kind of brand-new placements in the supply, provided the substantial costs the shares have actually been paid for. Many financiers will possibly intend to maintain Costco on their want list for the following huge pullback in the shares when, with any kind of good luck, the evaluation will not look so extended.

Should you spend $1,000 in Costco Wholesale now?

Prior to you get supply in Costco Wholesale, consider this:

The Supply Expert expert group simply determined what they think are the 10 best stocks for financiers to get currently … and Costco Wholesale had not been among them. The 10 supplies that made it might generate beast returns in the coming years.

Think About when Nvidia made this listing on April 15, 2005 … if you spent $1,000 at the time of our referral, you would certainly have $786,046! *

Supply Expert gives financiers with an easy-to-follow plan for success, consisting of advice on developing a profile, normal updates from experts, and 2 brand-new supply choices every month. The Supply Expert solution has greater than quadrupled the return of S&P 500 given that 2002 *.

* Supply Expert returns since July 2, 2024

Reuben Gregg Brewer has no placement in any one of the supplies discussed. The has placements in and advises Costco Wholesale. The has a disclosure policy.

Costco Stock Trounced the S&P 500 in the First Half of 2024, but Can It Keep the Momentum Up for the Next 6 Months? was initially released by The

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.