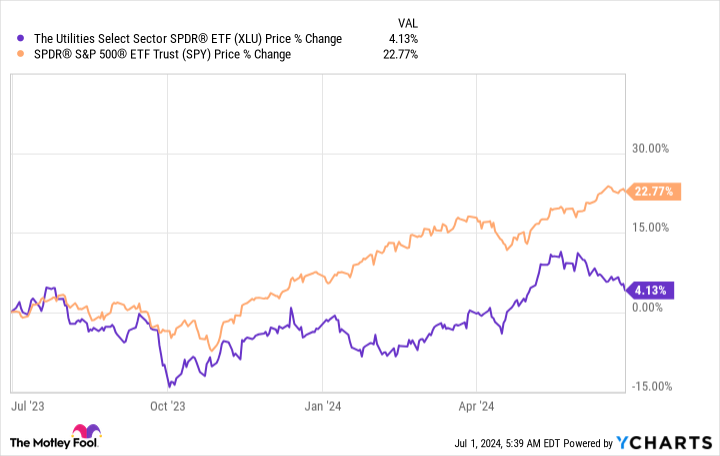

The energy field has significantly underperformed the S&P 500 index over the previous year, routing the more comprehensive market by over 15 portion factors. Greater rates of interest are a huge component of the tale considering that energies normally make hefty use financial obligation to money their organizations. However the field is home to a great deal of reputable reward supplies.

You may intend to take a more detailed check out NextEra Power ( NYSE: NEE), Brookfield Renewable ( NYSE: BEP) ( NYSE: BEPC), and Preeminence Power ( NYSE: D) in July while Wall surface Road is still in an ugly state of mind and returns in the field are still soaring.

NextEra Power is a reward development device

NextEra Power has actually boosted its reward yearly for 3 years and checking. That’s a quite engaging touch, yet it isn’t the most effective available. As a matter of fact, there are a handful of energies that have actually accomplishedDividend King status Where NextEra Power sticks out is reward development, with the routing annualized reward rise over the previous years at a substantial 10% or two. That number is 10% over the routing 3- and five-year durations, also. And monitoring is forecasting 10% reward development with at the very least 2026, so the touch of substantial reward development isn’t over yet.

10% reward development benefits any kind of firm, and it’s actually helpful for autility Exactly how does NextEra accomplish this? It has a sluggish and progressively expanding controlled energy service in addition to which it has actually constructed among the biggest eco-friendly power organizations on the planet. The last service is the development engine, and offered the worldwide change towards cleaner power resources, the path for development promises to be long.

The issue with NextEra Power is that financiers understand simply exactly how well run the firm is and have actually valued it appropriately. The return is below par for an energy at 2.9%. However if you are a reward development financier, this is possibly the energy supply you’ll intend to have.

Brookfield Renewable is laser-focused on tidy power

If you like the idea of buying tidy power yet are trying to find even more return than NextEra Power needs to provide, you need to think about Brookfield Renewable. This isn’t practically an energy, yet it has tidy power properties worldwide and deserves your focus offered its substantial 5% or 5.7% return. Why exist 2 returns? Since there are 2 share choices, one structured as a collaboration and one as a standard company.

Both Brookfield Renewable Allies and Brookfield Renewable Firm stand for the exact same entity. The only distinction remains in the need amongst financiers for each and every share kind. The collaboration is a little bit a lot more made complex because it includes a K-1 type that needs to be handled come tax obligation time. However it is not a master minimal collaboration, so it can still be possessed in a tax-advantaged pension.

If you are attempting to optimize your easy revenue stream, Brookfield Renewable Allies is a solid choice. If you do not intend to trouble with the K-1, a 5% return is still quite appealing. In any case, you still obtain an internationally varied profile of tidy power properties.

However, a lot more significantly, you reach spend along with Brookfield Property Administration ( NYSE: BAM), which looks after Brookfield Renewable. Brookfield Property Administration has years of experience and is a well-respected framework financier. You can do a lot even worse than partnering with this firm by including high-yield Brookfield Renewable to your profile.

Preeminence Power recuperates

The last choice on this checklist is a turn-around tale in the type of Preeminence Power. As simply an easy controlled energy, it has actually experienced a significant service overhaul over the previous years or two. One of the most current evaluation has actually led to big non-core properties being offered (consisting of 3 controlled gas energies) to make sure that the firm can pay for financial obligation, reduced its payment proportion, and concentrate on its fairly well-positioned controlled electrical energy procedures.

The reward return is presently around 5.4% today, yet the reward isn’t mosting likely to expand up until the payment proportion remains in line with the market standard, which will possibly take a couple of years. Nevertheless, offered the return, financiers are being paid well to wait. Afterwards factor, the reward ought to expand according to revenues, which the firm thinks can increase in between 5% and 7% a year. Especially, Preeminence runs in among the fastest-growing information facility markets on the planet, which need to assist to stimulate need for power in its area.

There’s still time, yet do not wait also lengthy

Energy supplies are greatly out of support today as Wall surface Road fret about the long-lasting result of greater rates of interest. While rates of interest are a headwind, the field will certainly adapt to the adjustment gradually, much like it has throughout previous price adjustment cycles. If you can stand actioning in when others are frightened, acquiring currently while the information misbehaves can bring about solid returns over the long-term. And 3 great areas to begin in the energy area are NextEra Power, Brookfield Renewable, and Preeminence Power.

Should you spend $1,000 in Brookfield Renewable now?

Prior to you get supply in Brookfield Renewable, consider this:

The Supply Consultant expert group simply recognized what they think are the 10 best stocks for financiers to get currently … and Brookfield Renewable had not been among them. The 10 supplies that made it can create beast returns in the coming years.

Think About when Nvidia made this checklist on April 15, 2005 … if you spent $1,000 at the time of our referral, you would certainly have $751,670! *

Supply Consultant gives financiers with an easy-to-follow plan for success, consisting of advice on developing a profile, routine updates from experts, and 2 brand-new supply choices every month. The Supply Consultant solution has greater than quadrupled the return of S&P 500 considering that 2002 *.

* Supply Consultant returns since July 2, 2024

Reuben Gregg Brewer has placements in Preeminence Power. The has placements in and suggests Brookfield Property Administration, Brookfield Renewable, and NextEra Power. The suggests Brookfield Renewable Allies and Preeminence Power. The has a disclosure policy.

3 Utility Stocks With Attractive Yields to Buy Hand Over Fist in July was initially released by The

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.