Completing Q1 profits, we consider the numbers and crucial takeaways for the media supplies, consisting of Detector Songs Team (NASDAQ: WMG) and its peers.

The introduction of the web altered exactly how programs, movies, songs, and total details circulation. Therefore, lots of media firms currently deal with nonreligious headwinds as focus changes online. Some have actually made collective initiatives to adjust by presenting electronic registrations, podcasts, and streaming systems. Time will certainly inform if their approaches do well and which firms will certainly become the long-lasting champions.

The 9 media supplies we track reported a weak Q1; generally, profits defeat expert agreement price quotes by 0.8%. Supplies– particularly those trading at greater multiples– had a solid end of 2023, however 2024 has actually seen durations of volatility. Combined signals concerning rising cost of living have actually brought about unpredictability around price cuts, and while several of the media supplies have actually made out rather much better than others, they jointly decreased, with share costs dropping 1.8% generally given that the previous profits outcomes.

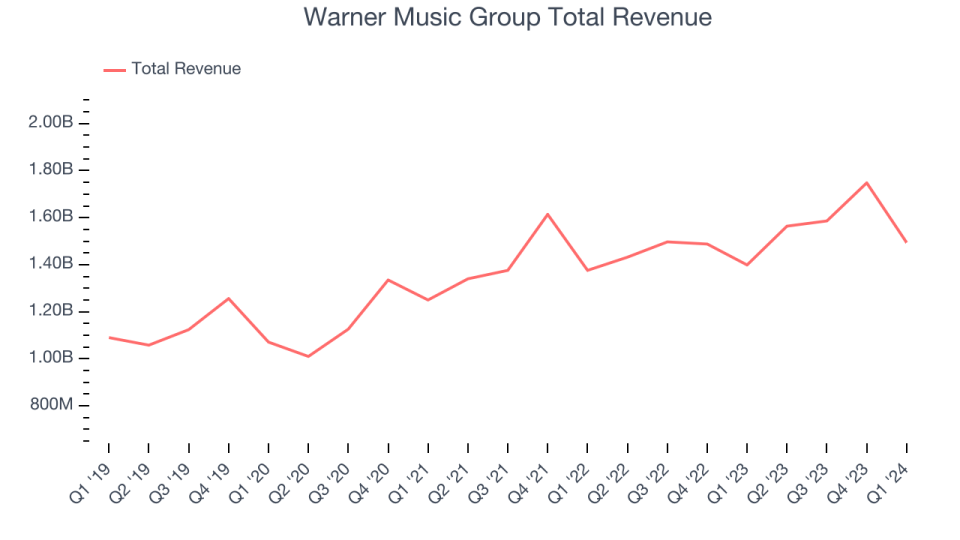

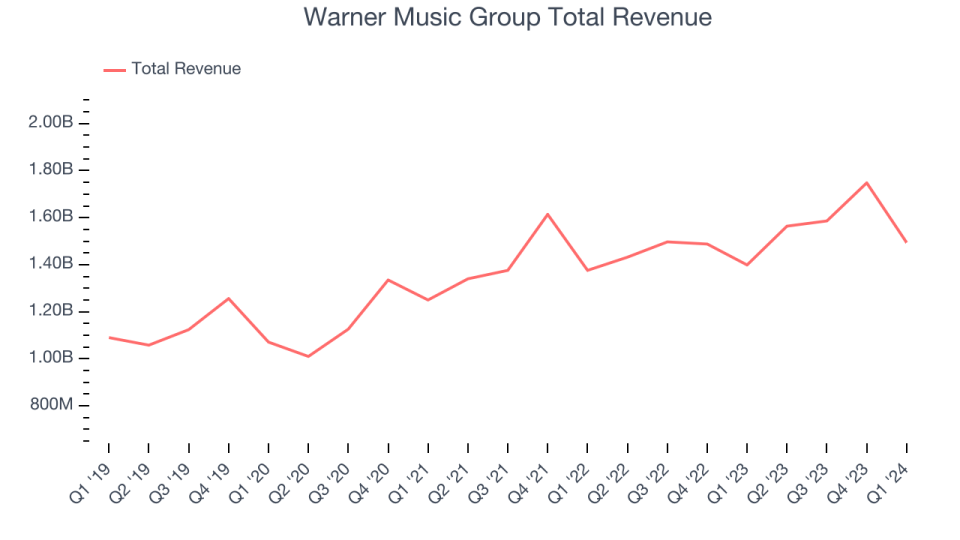

Detector Songs Team (NASDAQ: WMG)

Introducing the jobs of epic musicians like Frank Sinatra, Detector Songs Team (NASDAQ: WMG) is a songs firm taking care of a varied profile of musicians, recordings, and songs posting solutions worldwide.

Detector Songs Team reported profits of $1.49 billion, up 6.8% year on year, in accordance with experts’ assumptions. It was a weak quarter for the firm: Detector Songs Team directly defeated experts’ profits and EPS assumptions this quarter, driven by outperformance in its Songs Posting sector. On the various other hand, its operating margin missed out on and it melted cash-Wall Road was preparing for favorable cost-free capital.

The supply is down 14.2% given that the outcomes and presently trades at $30.61.

Read our full report on Warner Music Group here, it’s free

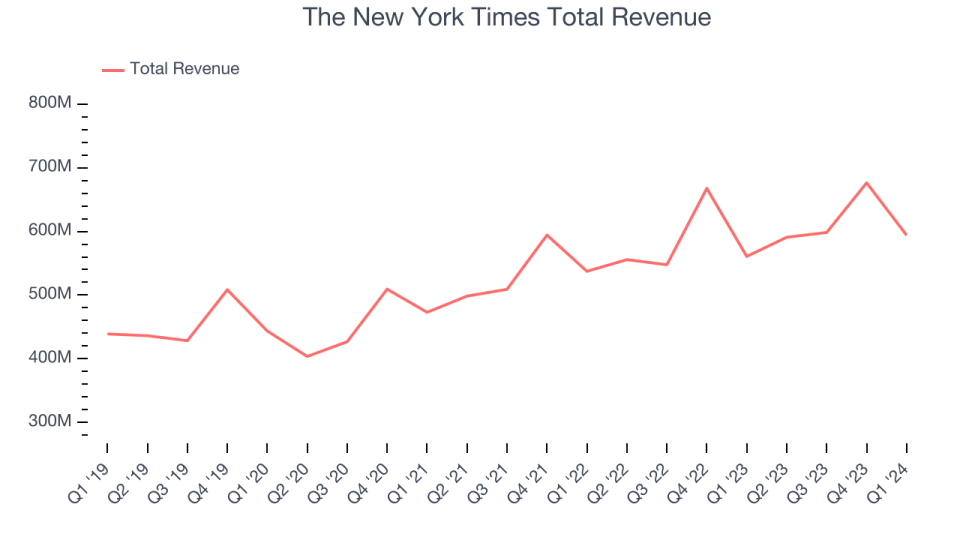

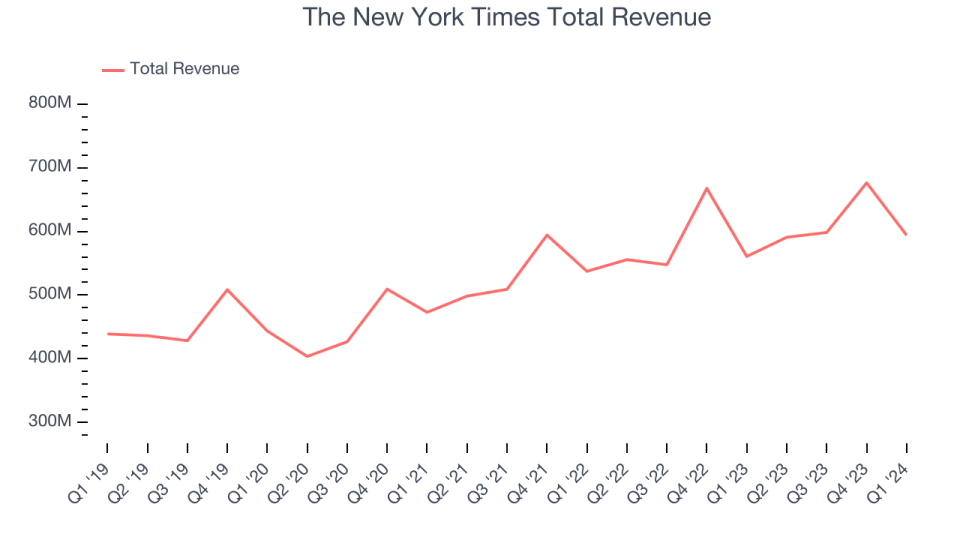

Finest Q1: The New York City Times (NYSE: NYT)

Established In 1851, The New York City Times (NYSE: NYT) is an American media company understood for its significant paper and extensive electronic journalism systems.

The New york city Times reported profits of $594 million, up 5.9% year on year, in accordance with experts’ assumptions. It was an extremely solid quarter for the firm, with a remarkable beat of experts’ profits price quotes.

The supply is up 11.2% given that the outcomes and presently trades at $51.44.

Is currently the moment to purchase The New york city Times? Access our full analysis of the earnings results here, it’s free.

Slowest Q1: Detector Bros. Exploration (NASDAQ: WBD)

Developed from the merging of WarnerMedia and Exploration, Detector Bros. Exploration (NASDAQ: WBD) is an international media and home entertainment firm, supplying tv networks, streaming solutions, and movie and tv manufacturing.

Detector Bros. Exploration reported profits of $9.96 billion, down 6.9% year on year, disappointing experts’ assumptions by 2.6%. It was a weak quarter for the firm, with a miss out on of experts’ profits price quotes.

Detector Bros. Exploration had the weakest efficiency versus expert price quotes in the team. The supply is down 8.5% given that the outcomes and presently trades at $7.12.

Read our full analysis of Warner Bros. Discovery’s results here.

Information Corp (NASDAQ: NWSA)

Developed in 2013 after a restructuring, Information Corp (NASDAQ: NWSA) is an international empire understood for its information posting, broadcasting, electronic media, and publication posting.

Information Corp reported profits of $2.42 billion, down 1% year on year, disappointing experts’ assumptions by 1%. It was a weak quarter for the firm, with a miss out on of experts’ profits price quotes.

The supply is up 14.5% given that the outcomes and presently trades at $27.63.

Read our full, actionable report on News Corp here, it’s free.

Venture (NYSE: EDR)

Proprietor of the UFC, WWE, and a customer lineup consisting of Christian Bundle, Venture (NYSE: EDR) is a varied international home entertainment, sporting activities, and material firm understood for its skill depiction and participation in the show business.

Venture reported profits of $1.85 billion, up 15.9% year on year, disappointing experts’ assumptions by 1.1%. It was a weak quarter for the firm, with a miss out on of experts’ profits price quotes.

The supply is up 1.2% given that the outcomes and presently trades at $26.81.

Read our full, actionable report on Endeavor here, it’s free.

Sign Up With Paid Supply Capitalist Research Study

Assist us make StockStory much more practical to financiers like on your own. Join our paid customer research study session and get a $50 Amazon present card for your point of views. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.