Allow’s go into the loved one efficiency of Waste Administration (NYSE: WM) and its peers as we decipher the now-completed Q1 waste monitoring profits period.

Waste monitoring business can have licenses allowing them to take care of unsafe products. In addition, lots of solutions are done via agreements and statutorily mandated, non-discretionary, or repeating, resulting in even more foreseeable earnings streams. Nevertheless, policy can be a headwind, making existing solutions out-of-date or forcing business to spend priceless resources to abide by brand-new, a lot more environmentally-friendly regulations. Last but not least, waste monitoring business go to the impulse of financial cycles. Rates of interest, for instance, can substantially affect commercial manufacturing or business tasks that develop waste and by-products.

The 5 waste monitoring supplies we track reported a blended Q1; typically, incomes remained in line with expert agreement price quotes. Rising cost of living proceeded in the direction of the Fed’s 2% objective at the end of 2023, resulting in solid stock exchange efficiency. The begin of 2024 has actually been a bumpier trip, as the marketplace switches over in between positive outlook and pessimism around price cuts as a result of blended rising cost of living information, however waste monitoring supplies have actually revealed durability, with share costs up 7% typically given that the previous profits outcomes.

Waste Administration (NYSE: WM)

Established In 1968, Waste Administration (NYSE: WM) focuses on waste collection, disposal, reusing, and ecological solutions throughout The United States and Canada.

Waste Administration reported incomes of $5.16 billion, up 5.5% year on year, disappointing experts’ assumptions by 1.2%. It was a good quarter for the business, with a strong beat of experts’ profits price quotes.

” We’re pleased with the solid functional and monetary efficiency the WM group provided in the initial quarter,” claimed Jim Fish, WM’s Head of state and Ceo.

The supply is down 0.5% given that the outcomes and presently trades at $209.47.

Is currently the moment to get Waste Administration? Access our full analysis of the earnings results here, it’s free.

Finest Q1: Clean Harbors (NYSE: CLH)

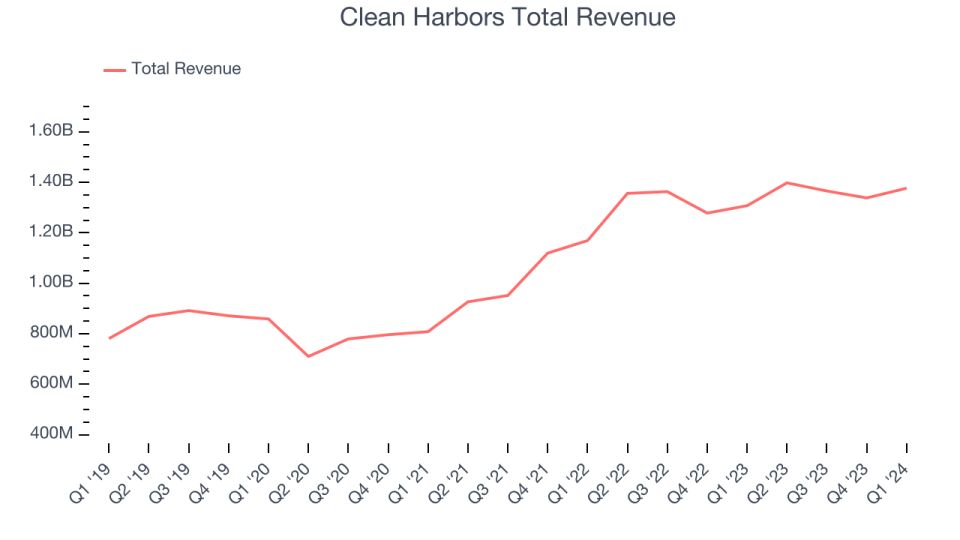

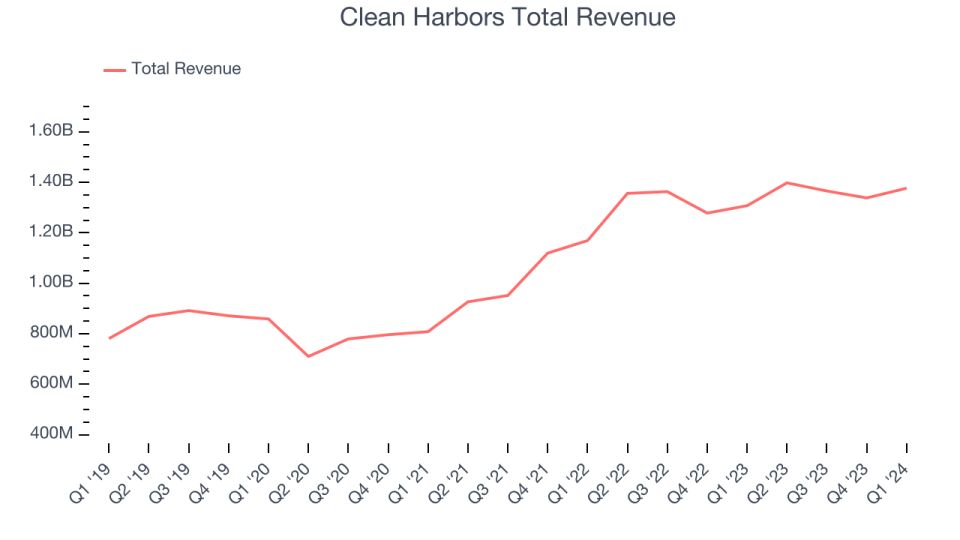

Having actually contributed in the cleaning of lots of historic oil spills, Clean Harbors (NYSE: CLH) gives ecological solutions like unsafe and non-hazardous garbage disposal.

Clean Harbors reported incomes of $1.38 billion, up 5.3% year on year, outmatching experts’ assumptions by 3%. It was a remarkable quarter for the business, with a strong beat of experts’ natural earnings price quotes.

Tidy Harbors racked up the largest expert approximates defeat amongst its peers. The supply is up 15.8% given that the outcomes and presently trades at $219.55.

Is currently the moment to get Clean Harbors? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Stericycle (NASDAQ: SRCL)

Having actually finished 500 procurements given that its beginning, Stericycle (NASDAQ: SRCL) gives garbage disposal and delicate details damage solutions.

Stericycle reported incomes of $664.9 million, down 2.8% year on year, disappointing experts’ assumptions by 1.7%. It was a weak quarter for the business, with a miss out on of experts’ natural earnings price quotes.

Stericycle had the weakest efficiency versus expert price quotes and slowest earnings development in the team. The supply is up 16.2% given that the outcomes and presently trades at $57.95.

Read our full analysis of Stericycle’s results here.

Casella Waste Equipment (NASDAQ: CWST)

Begun with a solitary trash vehicle back in 1975, Casella Waste (NASDAQ: CWST) is a waste solutions business that gives waste collection, disposal, and recycling.

Casella Waste Equipments reported incomes of $341 million, up 29.9% year on year, according to experts’ assumptions. It was an okay quarter for the business, with earnings directly going beyond Wall surface Road’s price quotes.

Casella Waste Equipments racked up the fastest earnings development amongst its peers. The supply is up 2.9% given that the outcomes and presently trades at $96.86.

Read our full, actionable report on Casella Waste Systems here, it’s free.

Republic Solutions (NYSE: RSG)

Making use of a totally all-natural gas-power vehicle fleet, Republic Solutions (NYSE: RSG) gives waste collection and associated solutions throughout the USA and Canada.

Republic Solutions reported incomes of $3.86 billion, up 7.8% year on year, disappointing experts’ assumptions by 0.7%. It was a blended quarter for the business, with a miss out on of experts’ quantity price quotes.

The supply is up 0.8% given that the outcomes and presently trades at $193.16.

Read our full, actionable report on Republic Services here, it’s free.

Sign Up With Paid Supply Capitalist Research Study

Aid us make StockStory a lot more useful to financiers like on your own. Join our paid individual study session and obtain a $50 Amazon present card for your point of views. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.