Revenues results typically show what instructions a business will certainly absorb the months in advance. With Q1 currently behind us, allow’s take a look at Varonis (NASDAQ: VRNS) and its peers.

Cybersecurity remains to be just one of the fastest-growing sectors within software program permanently factor. Nearly every business is gradually discovering itself coming to be an innovation business and encountering climbing cybersecurity dangers. Companies are increasing fostering of cloud-based software program, relocating information and applications right into the cloud to conserve expenses while boosting efficiency. This movement has actually opened them to a wide variety of brand-new dangers, like workers accessing information using their smart device while on an open network, or logging right into an online user interface from a laptop computer in a brand-new place.

The 9 cybersecurity supplies we track reported a slower Q1; usually, earnings defeat expert agreement quotes by 1.4%. while following quarter’s income advice was 0.5% listed below agreement. Supplies, specifically development supplies where capital additionally in the future are more vital to the tale, had a great end of 2023. Yet the start of 2024 has actually seen extra unstable supply efficiency because of blended rising cost of living information, however cybersecurity supplies have actually revealed strength, with share rates up 5.1% usually considering that the previous incomes outcomes.

Varonis (NASDAQ: VRNS)

Established by a duo of previous Israeli Protection Forces cyber war designers, Varonis (NASDAQ: VRNS) supplies software-as-service that assists consumers safeguard information from cyber dangers and get exposure right into just how business information is being made use of.

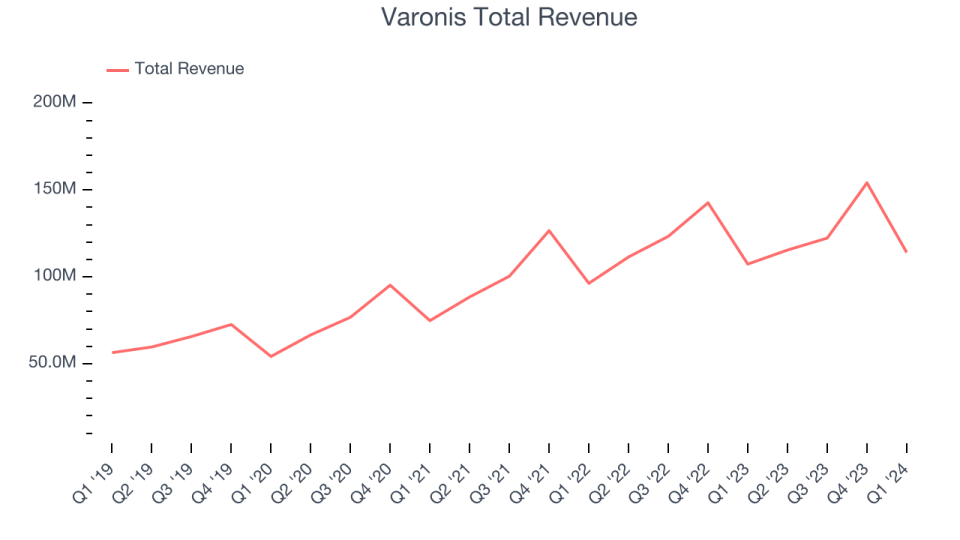

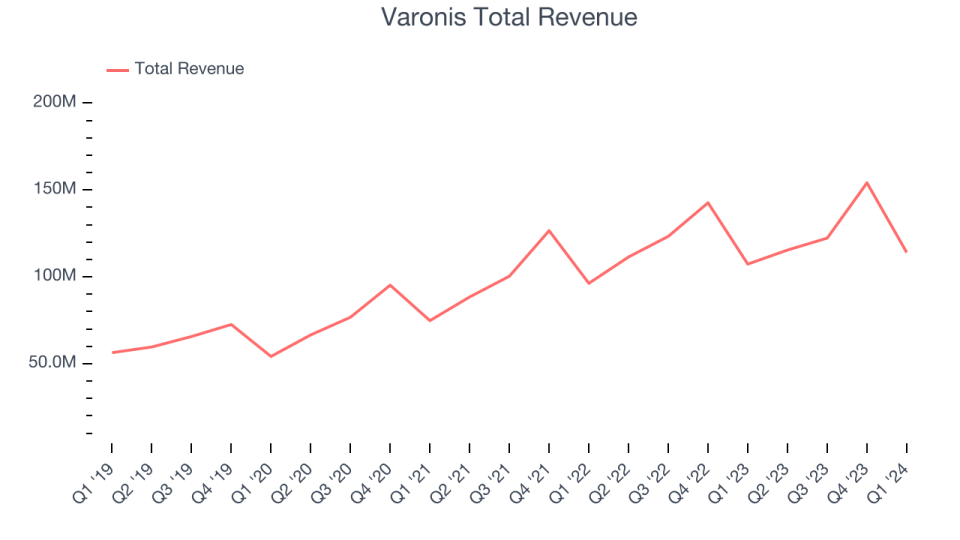

Varonis reported earnings of $114 million, up 6.2% year on year, according to experts’ assumptions. It was a blended quarter for the business, with a strong beat of experts’ invoicings quotes however a decrease in its gross margin.

Yaki Faitelson, Varonis chief executive officer, claimed, “Our initial quarter results mirror the proceeded solid fostering of our SaaS system, driven by the automated end results that consumers obtain and our lately presented MDDR offering, which our company believe is a video game changer for our business.”

Varonis provided the slowest income development of the entire team. The supply is up 8.7% considering that the outcomes and presently trades at $48.54.

Is currently the moment to purchase Varonis? Access our full analysis of the earnings results here, it’s free.

Finest Q1: Zscaler (NASDAQ: ZS)

After effectively marketing all 4 of his previous cybersecurity business, Jay Chaudhry’s 5th endeavor, Zscaler (NASDAQ: ZS) supplies software-as-a-service that assists business firmly attach to applications and networks in the cloud.

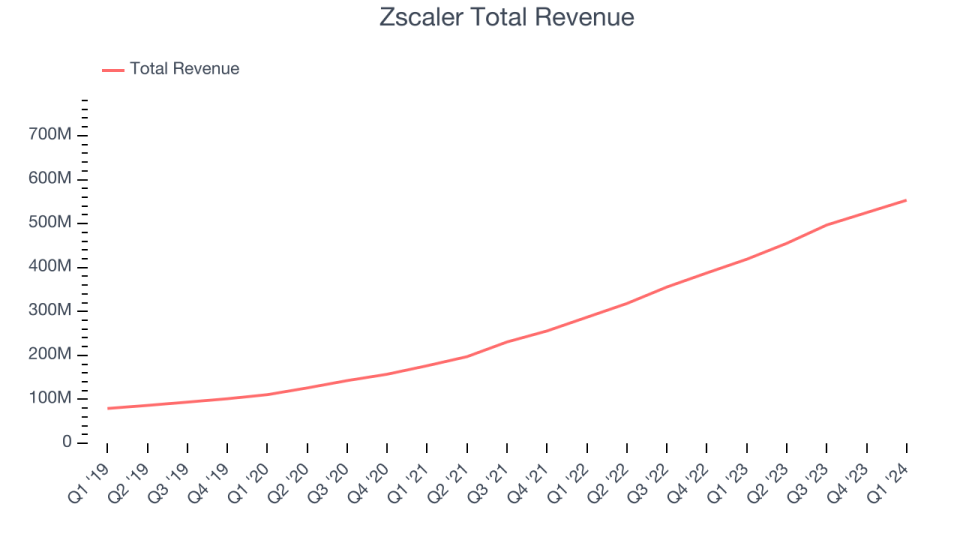

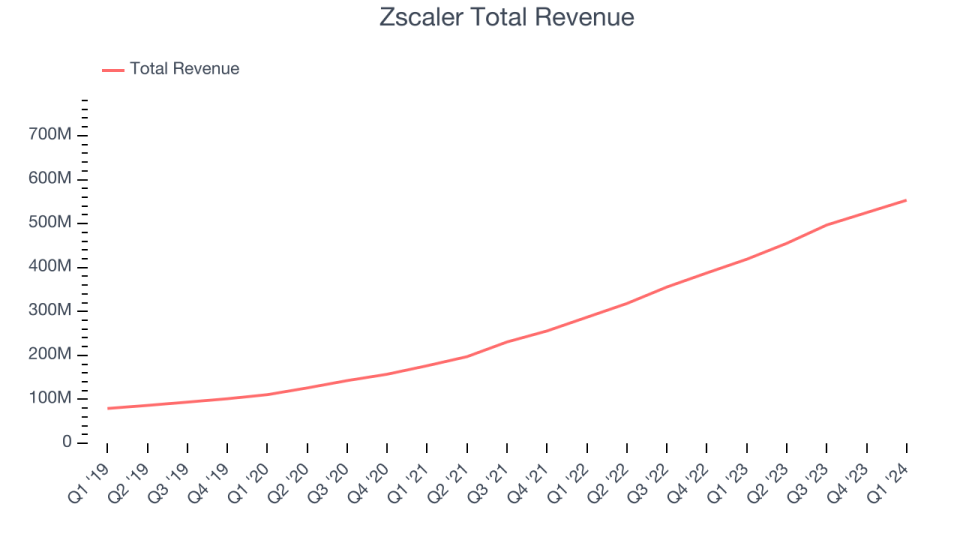

Zscaler reported earnings of $553.2 million, up 32.1% year on year, outshining experts’ assumptions by 3.2%. It was a really solid quarter for the business, with an outstanding beat of experts’ invoicings quotes and a strong beat of experts’ ARR (yearly repeating income) quotes.

Zscaler racked up the largest expert approximates defeat amongst its peers. The supply is up 26.6% considering that the outcomes and presently trades at $196.83.

Is currently the moment to purchase Zscaler? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Rapid7 (NASDAQ: RPD)

Established In 2000 with the concept that network safety and security comes prior to endpoint safety and security, Rapid7 (NASDAQ: RPD) gives software program as a solution that assists business comprehend where they are subjected to cyber safety and security dangers, rapidly discover violations and react to them.

Rapid7 reported earnings of $205.1 million, up 12% year on year, according to experts’ assumptions. It was a weak quarter for the business, with underwhelming income advice for the following quarter and decreasing consumer development.

Rapid7 had the weakest full-year advice upgrade in the team. The business shed 64 consumers and wound up with an overall of 11,462. The supply is down 6.4% considering that the outcomes and presently trades at $42.9.

Read our full analysis of Rapid7’s results here.

SentinelOne (NYSE: S)

With origins in the Israeli cyber knowledge area, SentinelOne (NYSE: S) gives software program to aid companies effectively discover, avoid, and check out cyber assaults.

SentinelOne reported earnings of $186.4 million, up 39.7% year on year, going beyond experts’ assumptions by 2.9%. It was a weak quarter for the business, with a miss out on of experts’ invoicings quotes and underwhelming income advice for the following quarter.

SentinelOne provided the fastest income development amongst its peers. The business included 60 business consumers paying greater than $100,000 each year to get to an overall of 1,193. The supply is up 5.6% considering that the outcomes and presently trades at $20.52.

Read our full, actionable report on SentinelOne here, it’s free.

CrowdStrike (NASDAQ: CRWD)

Established by George Kurtz, the previous CTO of the anti-viruses business McAfee, CrowdStrike (NASDAQ: CRWD) gives cybersecurity software program that shields business from violations and assists them discover and react to cyber assaults.

CrowdStrike reported earnings of $921 million, up 33% year on year, going beyond experts’ assumptions by 1.8%. It was a blended quarter for the business, with a miss out on of experts’ invoicings quotes.

The supply is up 26% considering that the outcomes and presently trades at $385.15.

Read our full, actionable report on CrowdStrike here, it’s free.

Sign Up With Paid Supply Capitalist Study

Aid us make StockStory extra handy to financiers like on your own. Join our paid individual research study session and obtain a $50 Amazon present card for your viewpoints. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.