Surge’s (XRP) rate has actually gradually decreased because it shut at a year-to-date high of $0.72 on March 11. The token’s rate has actually dropped by 7% in the last month.

This current decrease has actually resulted in the development of a coming down triangular that the seventh-largest cryptocurrency by market capitalization currently looks for to burst out of.

Surge Makes its Approach Resistance

At press time, XRP went to $0.48. It traded near the top line of its coming down triangular, which has actually created resistance because Might 22.

A coming down triangular is a bearish pattern created when a possession’s rate makes a collection of reduced highs while keeping a reasonably level assistance degree.

When a possession’s rate efforts to go across over the top trendline of this triangular, which creates a resistance degree, it represents a possible favorable outbreak. If the outbreak is gone along with by boosted trading quantity, it verifies a feasible pattern turnaround from bearish to favorable.

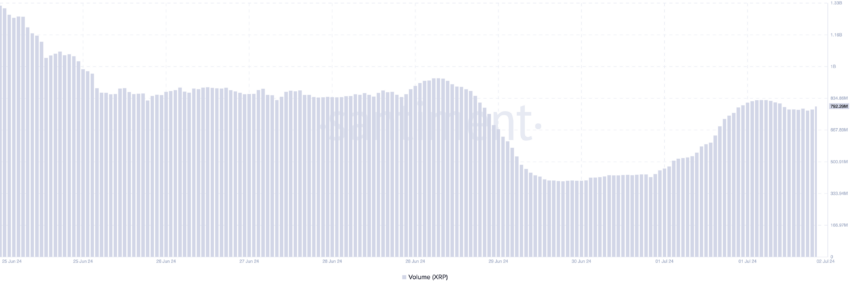

XRP has actually seen a rise in day-to-day trading quantity in the previous couple of days. In the previous 24-hour, the altcoin’s trading quantity has actually amounted to $775 million, increasing by over 30%.

Learn More: Just How To Purchase XRP and Every Little Thing You Required To Know

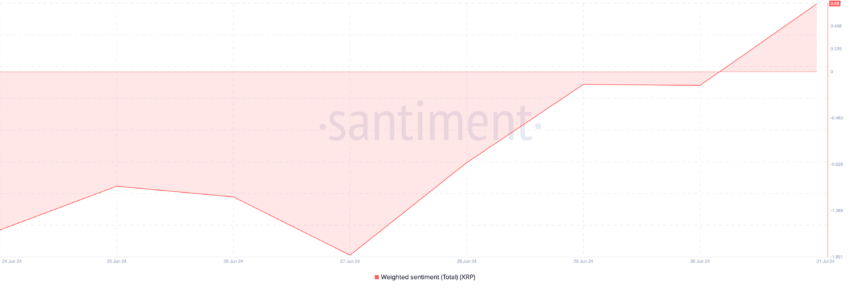

Likewise, its heavy belief has actually turned to favorable for the very first time because June 21. This statistics tracks the general state of mind of the marketplace concerning a possession. It takes into consideration the belief routing the possession and the quantity of social media sites conversations.

When it turns from adverse to favorable, it recommends a change in market belief from bearish to favorable. At press time, XRP’s heavy belief is 0.68.

XRP Cost Forecast: Purchasers and Vendors Remain In a Tussle

As XRP starts to rally, analyses from its Relocating typical convergence/divergence (MACD) sign expose that a favorable crossover of the MACD line (blue) and the signal line (orange) happened on June 30.

This sign determines a possession’s rate fads and determines possible buy or market signals. When the MACD line converges the signal line in an uptrend, it is favorable. Investors commonly analyze it as a buy signal, as the possession’s shorter-term standard is increasing much faster than its longer-term standard.

If XRP’s heavy belief continues to be favorable and need for the altcoin remains to climb up, its rate might rally to $0.49.

Nonetheless, if it stops working to damage above resistance and drops back within the triangular, the above forecast is revoked and will certainly trade at $0.47.

Please Note

According to the Depend on Task standards, this rate evaluation write-up is for educational functions just and need to not be thought about economic or financial investment recommendations. BeInCrypto is devoted to precise, impartial coverage, however market problems go through alter without notification. Constantly perform your very own research study and speak with an expert prior to making any type of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.