This is The Takeaway from today’s Early morning Quick, which you can subscribe to obtain in your inbox every early morning together with:

The weight of high assumptions is commonly a hefty problem to bring.

In life, if you are a leading entertainer at the workplace, it’s anticipated that you will certainly appear to be a leading entertainer each and every single day. Having a negative day? That’s not enabled, so go sling that crap elsewhere.

Sure, some university teacher that provided a motivating management speech at a TED Talk one decade back and is currently showing up in one-minute clips on your Instagram feed could recommend it’s okay to have negative days at the workplace, also if you are a champion.

Believe Me, it’s not– and do not allow that social clip enable you to believe or else.

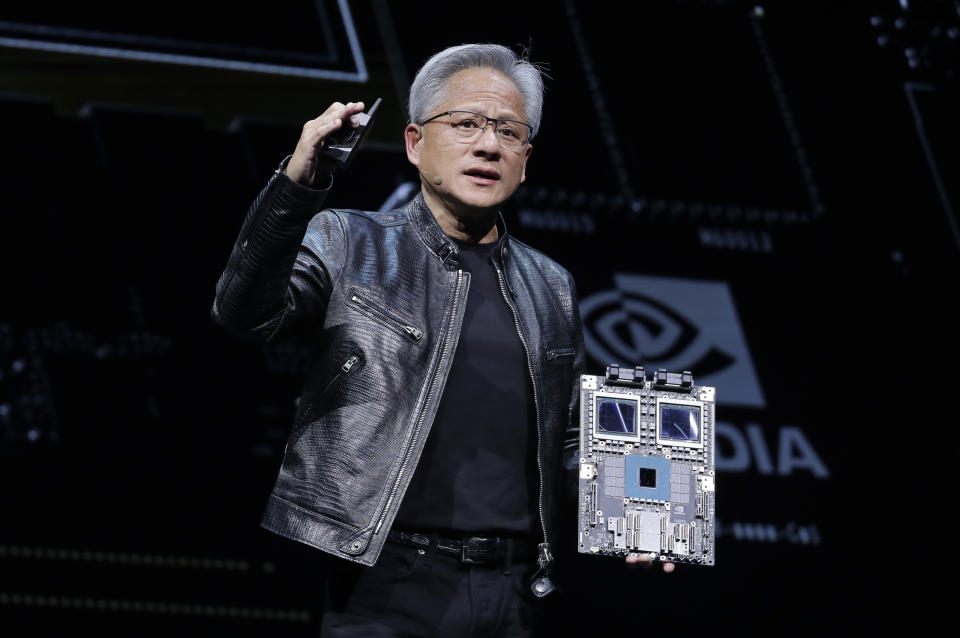

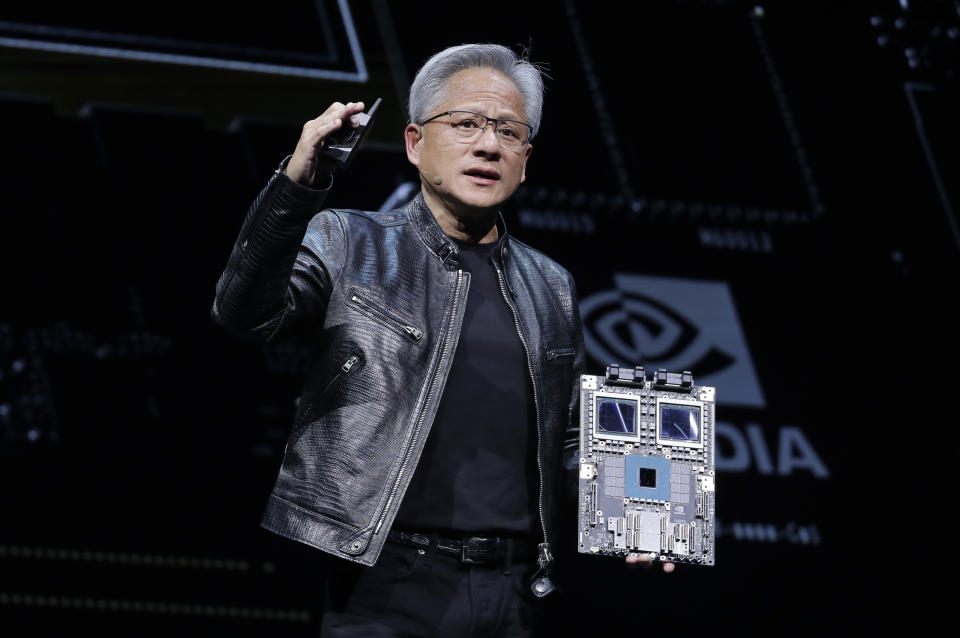

This exact same viewpoint can be put on the stock exchange’s essential supply: Nvidia (NVDA).

I understand you like that shift, Morning Brief viewers! Hear me out on this leading entertainer on the market.

Over the previous week, we were advised of exactly how filled with air assumptions are for Nvidia and exactly how the supply has actually gone into harmful waters that numerous investors that showed up late to the Nvidia video game have actually never ever browsed prior to.

On June 18, Nvidia’s market cap struck a shocking $3.34 trillion, overshadowing Microsoft (MSFT) to come to be the globe’s most useful business. Over the following 3 trading days, on apparently no essential information, the business dropped $430 billion in market cap.

For point of view, Coca-Cola’s (KO) market cap is $275 billion.

Some individuals I spoke with informed me individuals were taking revenues on Nvidia entering into the beginning of the 2nd fifty percent of the year. Others I spoke with for my “Opening Bid” podcast informed me there is some babble regarding brand-new rivals going into Nvidia’s grass, and possibly the business will not be as ridiculously leading over the following 5 years as numerous prepare for.

Every One Of that is reasonable, however it enhances the sight that the supply is vulnerable to sharp, out-of-the-blue unfavorable changes in view due to the fact that it’s up 3,000% in 5 years.

Yet if you pierce down even more, you can see simply exactly how extreme the assumptions on Nvidia have actually come to be.

-

Nvidia’s supply currently trades at regarding 21x (very steep) onward sales, up from 12x (likewise high) 2 months back, according to study from Creative Preparation primary market planner Charlie Bilello. This is a considerable costs over Microsoft at 12x and Apple (AAPL) at 8x, 2 technology titans that are carrying out effectively basically and are most likely to proceed shaking years in advance.

-

Nvidia’s supply lately traded regarding 100% over its 200-day relocating standard, BTIG principal market specialist Jonathan Krinsky mentioned. Given that 1990, the largest spread that any kind of United States business has actually ever before traded over its 200-day relocating standard while it was the biggest business on the planet was 80% by Cisco (CSCO) in March 2000, which noted its all-time high. “Simply put, Nvidia remains in an organization of its very own,” Krinsky stated.

It certain appears in this way.

Comparable assumptions were put on chipmaker Micron (MU) entering into revenues today. The supply obtained blown up as a result of “in-line” assistance that really did not fulfill insane assumptions for anything linked to AI need.

And I stress insane: On Monday, numerous sell-side experts boosted their price quotes and rate targets on Micron in advance of the record. As a person that utilized to handle a group of supply scientists, I can inform you that this activity heading right into a revenues record is not the standard.

It stank of experts purchasing right into the buzz excessive and expecting a gigantic one-day appear the supply.

” When you obtain a response like Micron’s, where the numbers need to suffice to prevent a sell-off, not to mention stimulate a rally, that’s a negative indicator– an inform that assumptions are so high that they can not be gone beyond,” Interactive Brokers primary planner Steve Sosnick informed me.

Others do not concur with my evaluation that Nvidia is valued for excellence, which is completely great. I do not have a syndicate on great concepts!

” But also for tool- to longer-term financiers, the tale still holds when we check out exactly how way out their capability is scheduled and prices is firming,” Tematica Study founder and primary financial investment policeman Chris Versace stated.

Something we can all settle on: Nvidia is a top-performing worker on the market, and it will certainly obtain no masquerade attempting to take a time off if it captures a chilly.

Mentioning costly technology supplies, shares of Amazon (AMZN) are up 55% in the previous year. Concerns remain regarding its society, nevertheless. WSJ press reporter Dana Mattioli discussed her eruptive brand-new publication “The Whatever Battle: Amazon’s Callous Mission to Have the Globe and Remake Corporate Power” in an episode of the “Opening Bid” podcast. Eavesdrop below.

This ingrained web content is not readily available in your area.

Opening Up Quote Episode Listing

Go Here for the current stock exchange information and comprehensive evaluation, consisting of occasions that relocate supplies

Check out the current economic and service information from Yahoo Financing

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.