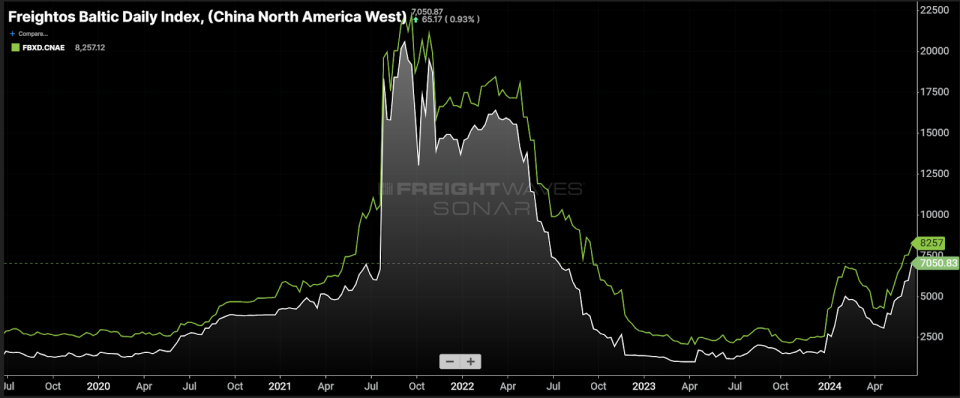

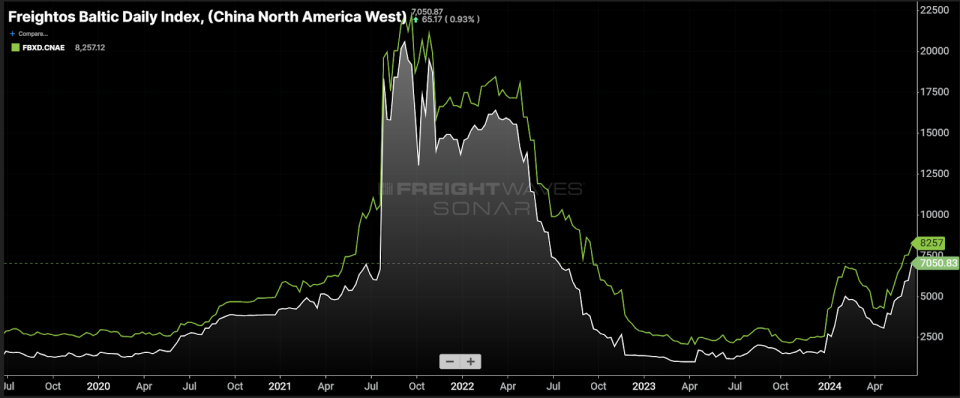

Graph of the Week: Freightos Baltic Daily Index– China to The United States And Canada West and East CoastlineSONAR: FBXD.CNAW, FBXD.CNAE

Place prices for delivering forty-foot comparable containers over the sea from China to The United States and Canada struck their highest degree given that the summer season of 2022 and are still climbing up. Supply chain interruption has gone back to the maritime sector, however just how does it contrast to the pandemic period and is it lasting?

Trustworthy sourcing drives performance in any type of firm’s supply chain. If products and their succeeding transport are continually offered, after that companies can place much less initiative right into projecting and handling supplies. These were the key issues throughout the pandemic.

The pandemic-era supply chain fiasco was triggered by a collection of aspects:

-

Surging need for products well past assumptions.

-

Minimal manufacturing accessibility as a result of quarantining.

-

Not enough transport ability.

-

Minimal port framework.

-

Panic purchasing by business as a result of the above.

Concerns 1, 2 and 4 are absent in the present atmosphere, however 3 and 5 are. The boost in order preparation effects all downstream transport and logistics.

Need is not truly the concern

Product need has actually been reasonably steady over the previous couple of years, though it has actually been much better than several economic experts anticipated. Orders for durables dropped somewhat year over year in Might.

The Inbound Sea TEUs Quantity Index (IOTI), which determines reservations of twenty-foot comparable containers from China to the united state, is up 15% year over year however down 13% from 2023 optimal degrees struck last August when prices were about a quarter what they are currently. Need has actually been boosting continuously given that Might, however not at an especially disconcerting price contrasted to in 2014.

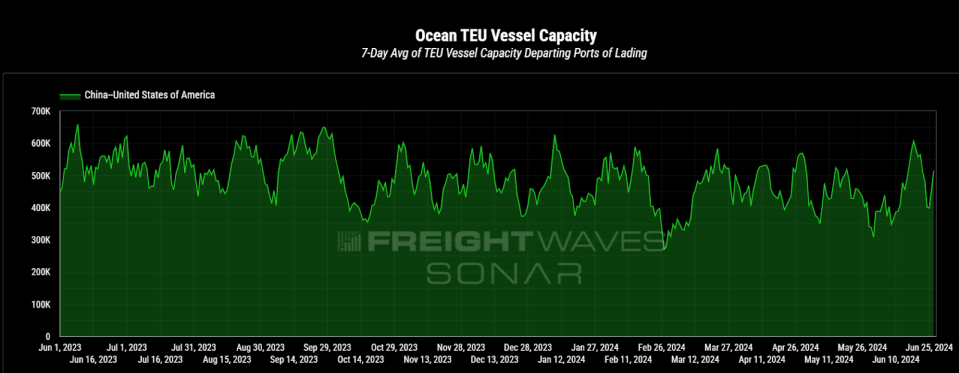

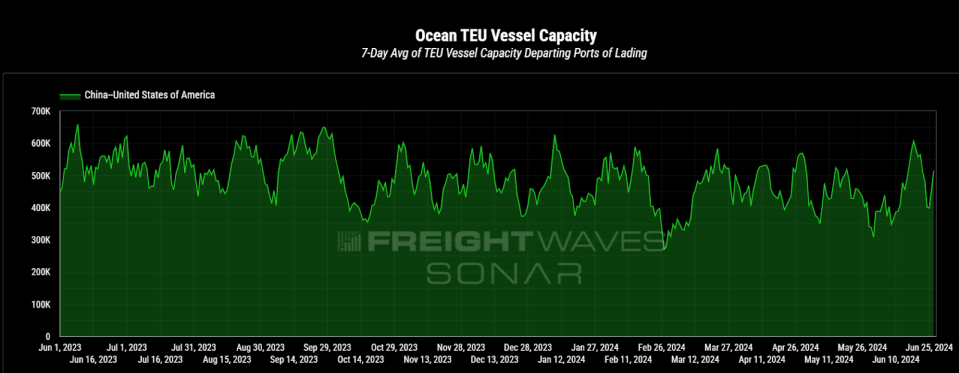

Capability difficulties

The Israel-Hamas battle that started in October in 2014 has actually undercuted among the key delivery paths worldwide. Houthi rebels based in Yemen remain to attack ships in the Red Sea, requiring several providers to expand their journey by approximately 10-12 days. This prolonged journey gets rid of almost 2 weeks of ability and solution from each vessel that typically takes a trip with the Red Sea.

While this does not straight effect a lot of the transport ability on products heading from Asia to the united state, it does indirectly draw from the general swimming pool of offered ships. This diversion affects greater than 25% of the worldwide ability, according to Flexport.

There have actually been cases of some degree of ability monitoring, which is hard to claim definitively, however typical vessel ability for ships relocating from China to the united state is down around 8% y/y in June. This down pattern has actually been reasonably constant given that last September. Seasonality and the Red Sea diversion might discuss some however most likely not all of it.

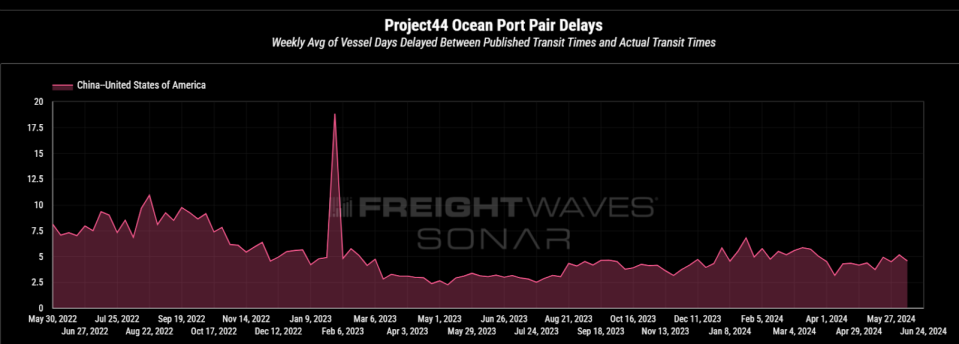

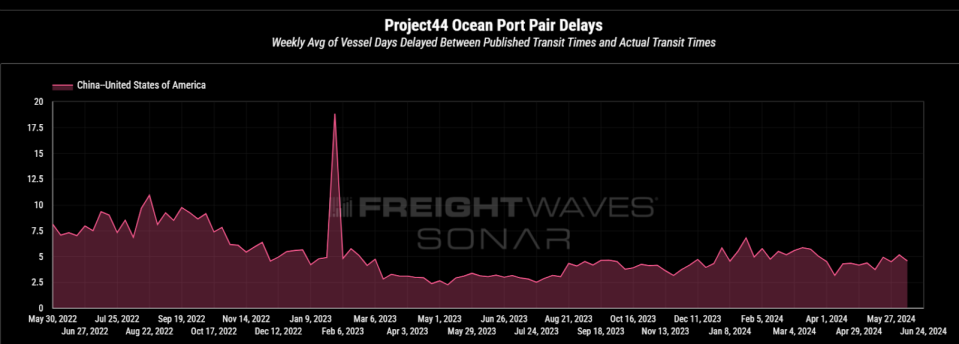

Solution damage might be even more of the trouble as carriers might have anticipated transportations to maintain sustainably after the pandemic. The typical port set hold-up has actually expanded from 3 to 5 days over the previous year while released transportations have actually been reasonably level from China to the United State

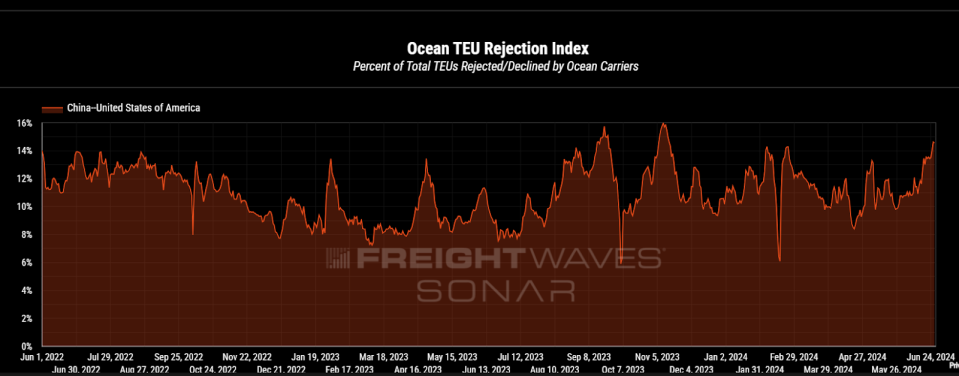

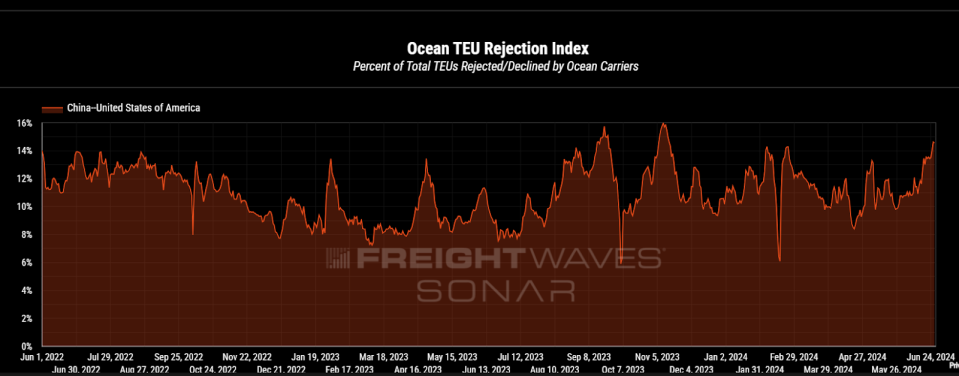

Denial prices have actually been balancing greater given that last November also, relocating from regarding 8% with a lot of 2023 to over 10% a lot of this year. The present worth of 14.5% is the acme given that the beginning of the Red Sea problems.

Climbing up the optimal

Peak period for maritime imports has actually typically remained in July and August. Lots of marvel if the present need development is the outcome of a rise in orders being drew onward to make sure on-time distribution and accessibility.

If real, after that the following 2 months’ IOTI will certainly be level. Otherwise real, after that there will certainly be much more stress on prices and ability. The united state transport market will certainly likewise really feel these results as the expanding discrepancy of products includes in worldwide container lacks.

This might be a benefit for residential intermodal and some degree of increase to the still overcapacity-laden trucking sector. While this does not look like the turmoil of the pandemic period, it does resemble supply chains will certainly be a lot more tested than they were in 2014.

Regarding the Graph of the Week

The FreightWaves Graph of the Week is a graph option from SONAR that offers an intriguing information indicate define the state of the products markets. A graph is selected from hundreds of prospective graphes on SONAR to aid individuals envision the products market in actual time. Weekly a Market Specialist will certainly upload a graph, in addition to discourse, reside on the front web page. Afterwards, the Graph of the Week will certainly be archived on FreightWaves.com for future referral.

finder accumulations information from thousands of resources, offering the information in graphes and maps and giving discourse on what products market professionals need to know regarding the sector in actual time.

The FreightWaves information scientific research and item groups are launching brand-new datasets every week and boosting the customer experience.

To ask for a finder demonstration, click here

The blog post Maritime shipping still on troubled waters showed up initially on FreightWaves.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.