There’s something of a fad around tradition software application companies and their rising assessments: Firms established in dinosaur times get on a tear, shown today with SAP‘s shares covering $200 for the very first time.

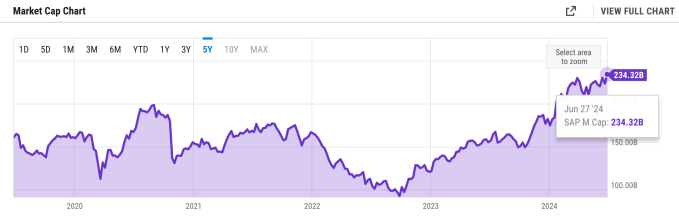

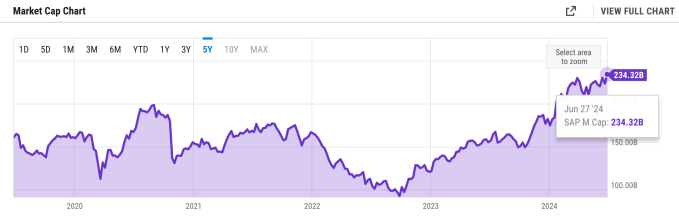

Established In 1972, SAP’s evaluation presently rests at an all-time high of $234 billion. The Germany-based business software application supplier was valued at $92 billion 2 years back, and $156 billion twelve month back, suggesting its market cap has actually expanded greater than 50% in the previous year alone.

Market assessments should not be merged with business health and wellness, yet it’s a helpful sign of just how a firm is doing– whether that’s via real economic efficiency or significant relocate’s making to move with the moments.

Old SAP

CEO Christian Klein has actually managed SAP’s turn-around because 2020, concentrating on helping customers transition to the cloud while striking valuable collaborations with hyperscalers such as Google and Nvidia in the process.

SAP’s fast surge can partially be credited to this shift from a traditional certificate design, with its Q1 2024 record revealing year-on-year cloud income development of 24%, a number it stated it anticipates to climb further in the next 12 months because of its “cloud stockpile” earnings in the pipe. Infusing “business AI” throughout its cloud collection is additionally figuring in in this trajectory.

Records arised in 2015 that its on-premises clients had become disgruntled with just how SAP was placing itsnew technology into its cloud products only Yet as opposed to pandering, SAP’s increasing down on its press to bring them to the cloud, offering its on-prem customers price cuts to make the transition— an AI carrot on a cloud stick, if you will.

Financial investment monitoring business Ave Maria Globe Equity Fund recently highlighted SAP as one of its leading 3 entertainers in Q1 2024, keeping in mind SAP’s shift “from a continuous certificate design to a SaaS design” will certainly develop a bigger overall addressable market (TAM) and higher margins.

And it’s such initiatives that are driving the lot of money of SAP and comparable tradition software application business, according to Gartner principal forecaster John-David Lovelock.

” There are a couple of tailwinds helping development– choices for darken on-premises systems, upgrades and growth demands,” Lovelock informed TechCrunch. “Yet the main result is just electronic service makeover initiatives that began in 2021 are recurring.”

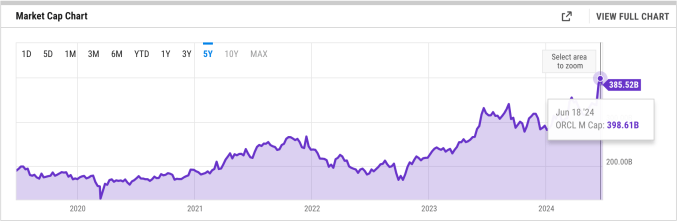

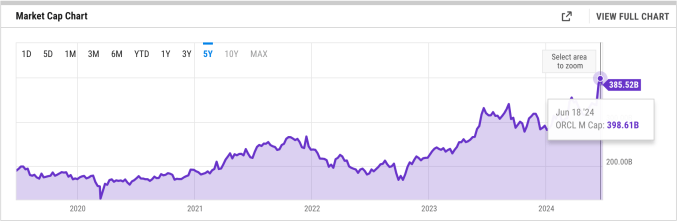

Hist-Oracle

And what concerning Oracle, the united state data source and cloud framework business established in 1977? Oracle is valued at greater than $385 billion since today, 20% up on in 2015, though this number went to nearly $400 billion a number of weeks back– by far its highest possible ever before evaluation.

The factors for this are approximately similar to that of SAP: “AI-fueled cloud growth,” the outcome of a long transition away from an on-premises design.

Especially, Oracle’s fiscal 2024 Q3 earnings saw the business pass an essential turning point, with its overall cloud income– that’s SaaS (software-as-a-service) plus IaaS (infrastructure-as-a-service)– exceeding its overall certificate assistance income for the very first time.

” We have actually gone across over,” Oracle Chief Executive Officer Safra Catz said on the earnings call.

At its Q4 earnings, Oracle reported small income development of 3%– yet this number enhanced to 20% for cloud-specific income. And extra is to find, states Catz, forecasting double-digit cloud income development in the coming fiscal year. This has actually been helped by collaborations with the similarity Microsoft, Google, and generative AI beloved OpenAI, which are looking for all the cloud framework they can obtain– OpenAI strategies to make use of Oracle’s cloud to educate ChatGPT.

” In Q3 and Q4, Oracle authorized the biggest sales agreements in our background– driven by huge need for training AI big language versions in the Oracle Cloud,” Catz stated.

Just Like SAP, Oracle additionally recently inked a deal with Nvidia to assist federal governments and business run “AI manufacturing facilities” in your area utilizing Oracle’s dispersed computer framework.

It’s not all a glowing expectation, though: Among Oracle’s front runner clients, TikTok, is facing a ban in the U.S., with Oracle warning this week that this can impact its profits in the future.

Large Blue eyes return

IBM, the business established in 1911 as Computing-Tabulating-Recording Company, got to an 11-year high in March of $180 billion, simply 6% off an all-time document.

The business’s evaluation has actually dropped around 14% ever since to under $160 billion, yet it stays 30% up on in 2015.

IBM was when an equipment business, with data processors and Computers the lineup, yet “Big Blue” segued right into a software and services company, which currentlymakes up most of its revenue IBM drew out its tradition framework solutions service as a stand-alone entity called Kyndryl in 2021.

IBM started its cloud trip in 2007 with Blue Cloud, proceeding via the years with the launch of IBM Cloud and via turning pointmegabucks acquisitions such as Red Hat In tandem, IBM has actually additionally pressed AI front and facility, beginning with IBM Watson and extra lately a slew of AI services to sustain AI need in the business– this consisted of the launch of Watsonx, which aids business educate, fine-tune, and release AI versions.

” Customer need for AI is increasing, and our publication of service for Watsonx and generative AI approximately increased from the 3rd to the 4th quarter,” IBM chairman and chief executive officer Arvind Krishna stated at its Q4 2023 earnings in January.

IBM’s current financials have actually been something of a variety, with its Q1 2024 numbers revealing a tiny income trek that missed out on expert quotes and incomes that defeat quotes. On the various other hand, its consulting income dropped somewhat.

Nevertheless, 2 months on, experts are favorable concerning IBM’s course, with Goldman Sachs today offering IBM a “get” score off the rear of its AI financial investments and proceeded concentrate on framework software application.

” Our company believe that IBM remains in the center innings of rotating its profile to a collection of up-to-date application and framework software application and a wider selection of solutions, far from a legacy-focused profile,” Goldman Sachs’ expert James Schneider said.

It’s prematurely to claim just how this belief will certainly mature, yet IBM’s AI investments are paying dividends as for Wall surface Road is worried.

Legacy-building

SAP, Oracle, and IBM aren’t the only tradition software application business appreciating productive times. Intuit, a 41-year-old economic software application business, hit the woozy elevations of $187 billion last month, simply a portion listed below its Pandemic-era high of $196 billion. Similar to others, Intuit has been investing heavily in AI as component of its press to stay pertinent, and this is the first thing it discusses at its incomes phone calls.

And Adobe, established in 1982, is also doing pretty well, with its evaluation up 8% year-on-year to $236 billion– Adobe reported document Q1 and Q2 revenues with AI and cloud touted as pivotal to this growth.

Microsoft is the globe’s most useful business, a $3.3 trillion juggernaut whose shares have actually risen 33% in the previous year. A decade in the hot seat, Satya Nadella has actually changed Microsoft right into a cloud-first, AI-first gigantic business, having lost out on the smartphone gold rush because of previous mistakes.

Microsoft transforms 50 following year, and remaining pertinent after many commercial, technical, political, and supervisory changes isn’t simple. Yet Microsoft hasn’t simply stayed pertinent– its profits, earnings, and just about every other metric remain to rise, due to its investments in the cloud and, extra lately, generative AI.

While these business are most definitely taking advantage of accepting brand-new patterns, there are various other variables at play also– particularly, financiers do not have lots of areas to park their cash to make bank on brand-new modern technology.

Ray Wang, creator and major expert at Constellation Research, thinks the reduction of competitors in particular markets has actually aided drive financiers towards the big deals.

” There’s marginal competitors as we remain in oligopolies and duopolies,” Wang informed TechCrunch. “We utilized to have numerous software application business, yet years of mergings and procurements have actually trimmed the alternatives to a couple of business in every location, classification, market dimension, and market.”

Wang additionally indicated the stagnant IPO market, along with the influence of the personal equity ball, as reasons that tradition modern technology business are succeeding.

” COVID eliminated the IPO market– we do not have the start-ups of the past that can expand to end up being the following Oracle, SAP, or Salesforce. The pipeline has actually misbehaved regardless of the variety of software application business being begun– they have actually not reached range,” Wang stated. “[And] a lot of the acquisitions by the PE firms have actually damaged the spirt of entrepreneurship and [have] transformed these business right into economic robotics.”

There are lots of methods to cut and dice all this, yet reputable software application companies are eventually much better placed to grow when a game-changing modern technology such as AI comes, owing to the reality they have a market existence and steady consumer base.

Their corresponding cloud changes are additionally a huge component of the story, incorporating nicely with the surge of AI, which is heavily dependent on the cloud.

They additionally have substantial sources at their disposal, with calculated procurements playing a huge part in their press to remain pertinent: IBM is reinforcing its crossbreed cloud passions with its current $6.4 billion bid for HashiCorp, while SAP revealed plans to pay $1.5 billion for AI-infused electronic fostering system WalkMe.

AI may be having a very little effect on business’ profits today, yet it’s an essential as for Wall surface Road is worried: Alphabet, Amazon, and Microsoft have all hit document highs of late, and AI is a huge part of it. Apple’s shares additionally struck an all-time high off the rear of its recent AI announcements, although “Apple Knowledge” isn’t readily available yet.

The AI trend may be raising all watercrafts presently, yet Gartner’s well known “hype cycle” prophesizes that passion in brand-new modern technology subsides as all the very early experiments and applications fall short to supply on their pledge– this is what it calls a “trough of disillusionment.” This can be coming, according to Lovelock, suggesting a number of those billion-dollar generative AI start-ups can have something to stress over.

” It’s simple to obtain shed in brand-new and arising software application markets,” Lovelock stated. “It is additionally difficult to contend for focus when brand-new AI business are flaunting multi-billion bucks of income within a couple of years of launch. Nevertheless, standard software application markets have a mixed yearly income over $1 trillion in 2024– tradition software application sales are expanding highly, and AI’s solid development has actually obfuscated this reality for lots of.”

Organizations that have actually been around for years are much better placed to prosper because of their existing grip. We may be in an AI bubble, yet when traditional fostering really removes, the SAPs, Oracles, and IBMs of the globe will certainly be much better placed to get on it.

This short article initially showed up on TechCrunch at

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.