On-chain information reveals the Bitcoin mining hashrate has actually decreased to the most affordable given that very early March.

7-Day Standard Bitcoin Mining Hashrate Has Actually Remained To Drop Lately

The “mining hashrate” describes an indication that keeps an eye on the complete computer power the miners have actually presently linked to the Bitcoin blockchain. This metric’s worth might be thought about a proxy for the belief amongst the miners.

When the indication’s worth rises, the existing miners increase their mining ranches, and brand-new ones get in the area. Such a pattern recommends the blockchain is looking eye-catching to these chain validators.

On the various other hand, the statistics signing up a decrease indicates some miners have actually determined to bring their devices offline, possibly since they are no more locating the cryptocurrency lucrative.

Currently, below is a graph that reveals the 7-day ordinary Bitcoin mining hashrate over the previous year:

The 7-day ordinary worth of the statistics appears to have actually been decreasing in current days|Resource: Blockchain.com

As presented in the above chart, the 7-day ordinary Bitcoin mining hashrate established a brand-new all-time high (ATH) last month, however the statistics has actually given that been experiencing a drawdown. This decrease will likely be the bearish energy the cryptocurrency’s rate has actually been observing.

Miners make the majority of their income with the BTC block benefits they get as payment for fixing blocks. These benefits are repaired in worth and basically repaired in regularity. Because of this, the only variable pertaining to them is the place rate of BTC.

When the rate of the possession goes down, so does the worth of the benefits these miners are obtaining, which normally results in a decline in income. Bitcoin has actually taken a large hit just recently, so it makes good sense that some miners have actually gone undersea.

Adhering to one of the most current leg down in the mining hashrate, its worth has actually dived to its most affordable given that very early March. If BTC continues at its existing lows or decreases even more, the indication will likely expand its autumn.

Due to the miners’ distress, they have actually additionally been marketing their stored-up benefits just recently, as an expert mentioned in a CryptoQuant Quicktake post.

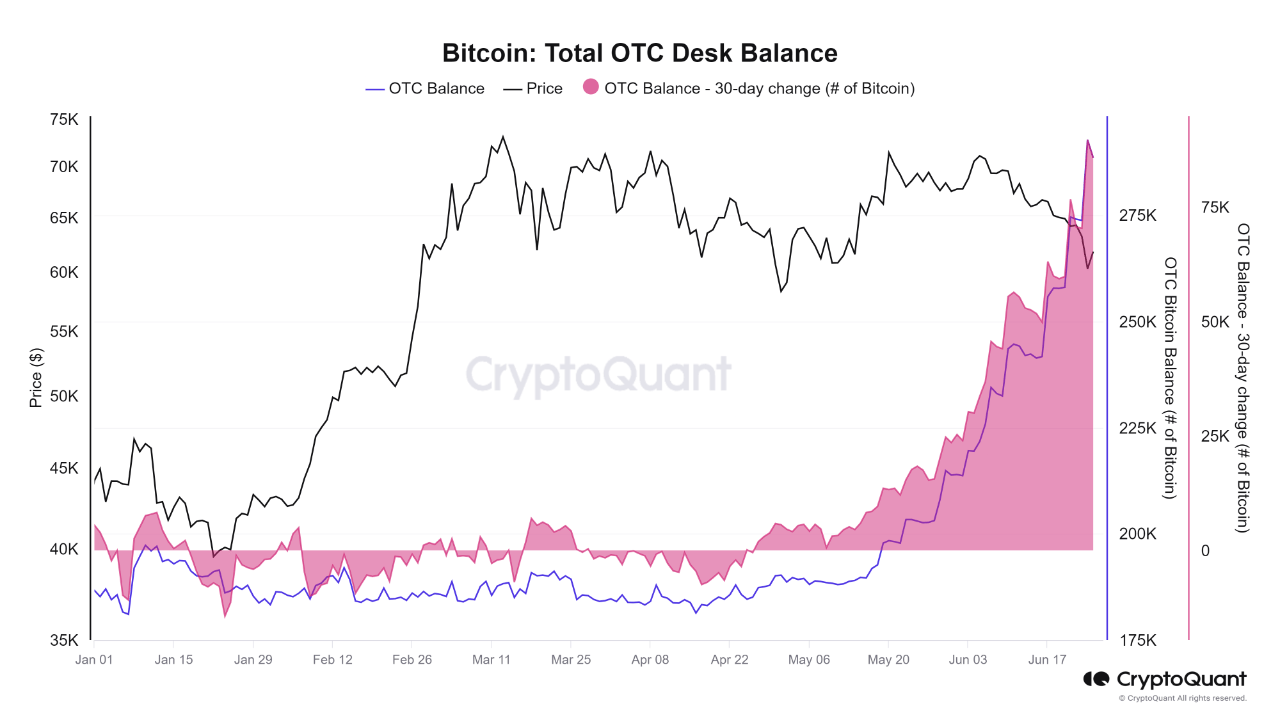

The information for the BTC equilibrium being in the pocketbooks linked to the OTC workdesks|Resource: CryptoQuant

The over graph reveals the pattern in the Bitcoin equilibrium for the non-prescription (OTC) workdesks. It would certainly show up that this statistics has actually observed a remarkable rise just recently. According to the quant, the marketing actions from the BTC miners have actually been an element behind this development.

BTC Cost

Bitcoin is trading near the reduced end of its current loan consolidation array as its rate is around $61,700.

Appears like the rate of the possession has actually been embeded a drop just recently|Resource: BTCUSD on TradingView

Included photo from Dall-E, CryptoQuant.com, graph from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.