Mortgage debt has actually swollen by 80% over the previous twenty years, causing an unmatched degree of family financial obligation amongst Americans.

That’s according to a new study from financial obligation debt collection agency The Kaplan Team that checks out financial obligation throughout lots of kinds of financings and united state states. While home loan financial obligation make up 74% of all family financial obligation, trainee and vehicle financings each comprise 11%, and charge card make up 7%.

” One of the most striking searching for is the considerable boost in overall family financial obligation, which has actually expanded by 81.5% over the previous twenty years,” Dean Kaplan, Chief Executive Officer of Kaplan Team, informed HousingWire. “This substantial increase emphasizes the rising economic stress on American family members.”

There’s obvious regarding why home loan financial obligation is raising. The quickly increasing expense of homes, specifically given that the start of the COVID-19 pandemic, has actually caused greater degrees of home loan financial obligation than ever. Kaplan’s numbers reveal a clear velocity in the quantity of home loan financial obligation given that 2020.

The homeowners of the District of Columbia have the greatest ordinary degree of superior home loan financial obligation at $79,730 per occupant.

” Information suggest that DC has dramatically greater degrees of trainee lending financial obligation contrasted to the standard, which might be because of high education and learning prices and a lot of homeowners with college levels,” Kaplan reported “Furthermore, charge card financial obligation in DC is likewise greater than the standard, which might be affected by the high expense of living and potentially reduced ordinary earnings.”

Completing the states where homeowners have one of the most mortgage financial obligation are Colorado ($ 70,790), California ($ 67,840), Washington ($ 64,750), and Hawaii ($ 63,620).

The states with the least quantity of home loan financial obligation have a tendency to be much more country states in the South and Southeast that have much more economical real estate. West Virginia has the least quantity of home loan financial obligation at just $19,610 per occupant. That’s specifically fascinating due to the fact that according to Residential Property Shark, West Virginia has the greatest homeownership price in the nation at regarding 75%.

Completing the states with the most affordable degrees home loan financial obligation each are Mississippi ($ 20,750), Arkansas ($ 24,000), Oklahoma ($ 24,730), and Kentucky ($ 25,275).

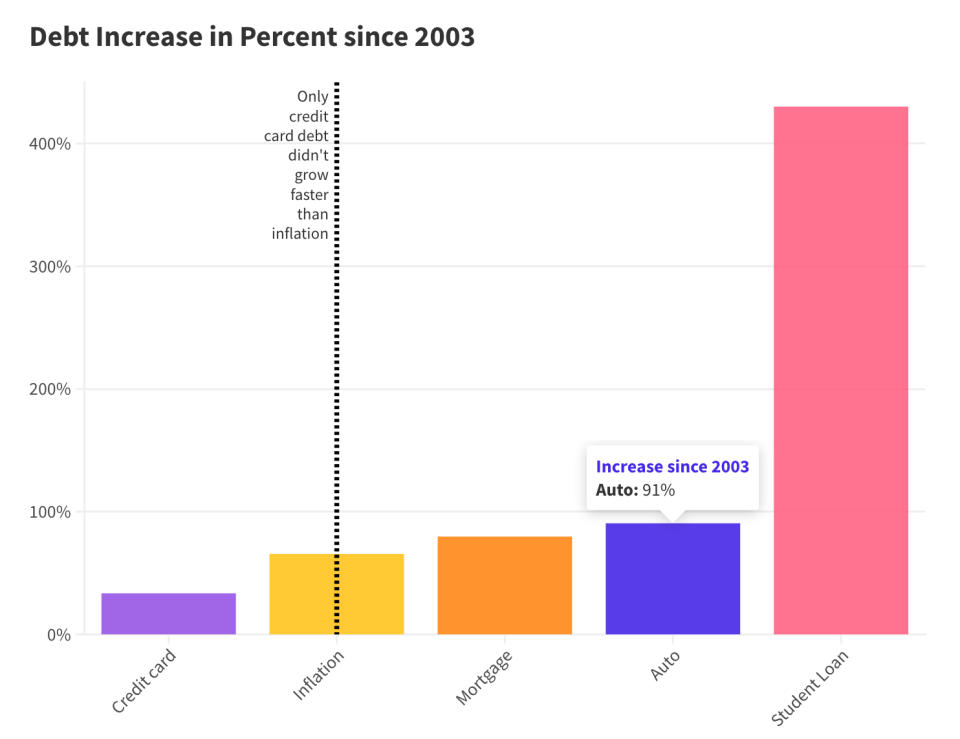

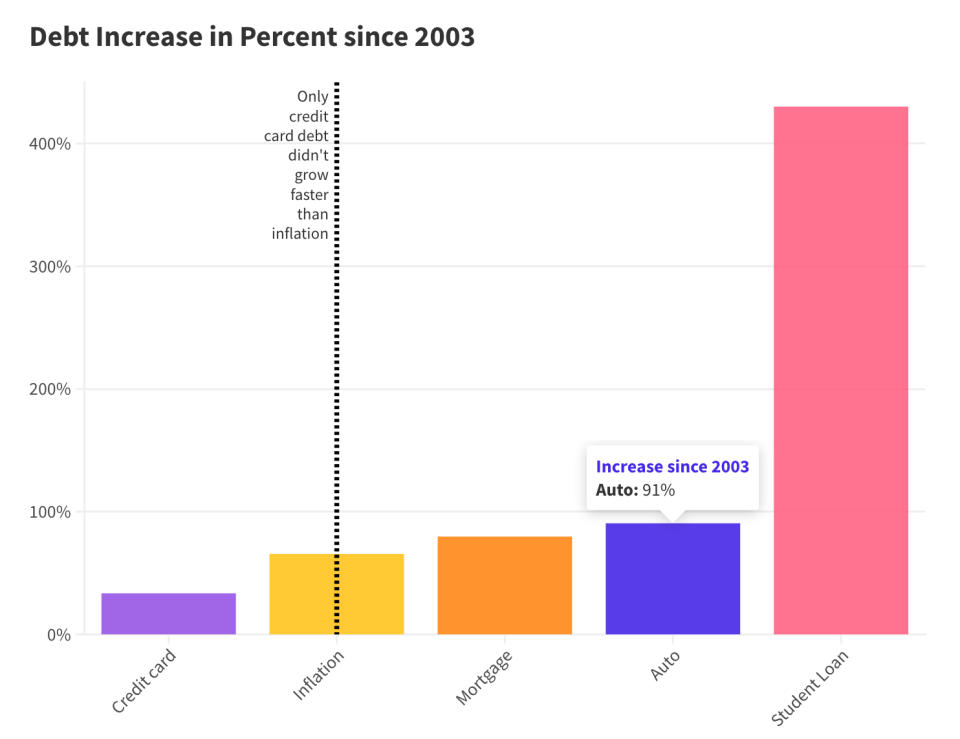

While home loan financial obligation composes the mass of the 4 kinds of financial obligation taken a look at by the trainee, it’s not the fastest-growing section. That ignominious difference comes from trainee lending financial obligation, which over the previous twenty years has actually increased by a monstrous 430%.

Automobile financings are likewise exceeding home loan financial obligation, having actually increased by 91% given that 2003.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.