The German federal government is remaining to proactively sell off sections of its significant Bitcoin (BTC) holdings, moving considerable amounts to different cryptocurrency exchanges and purses, according to information from Arkham Knowledge. This wave of transfers consists of the current activity of $24 million well worth of Bitcoin, emphasizing a wider technique that might be affecting Bitcoin’s existing market characteristics.

German Gov’ t Proceeds With Bitcoin Liquidation Method

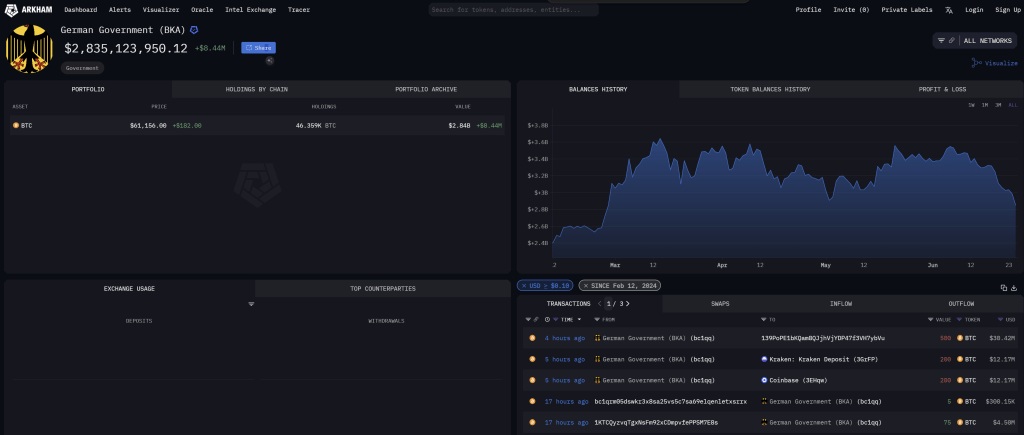

On June 25, the Federal Wrongdoer Cops Workplace (BKA), running a government-labeled cryptocurrency budget, relocated 900 BTC throughout 3 different purchases. 2 of these purchases, each including 200 BTC, were sent out to noticeable exchanges Coinbase and Sea serpent. Furthermore, a bigger transfer of 500 BTC was guided to an address identified as “139Po”, a purse whose tasks and possession stay uncertain, in spite of previous communications with the German federal government’s budget.

” UPDATE: German Federal government offering extra $24M BTC. In the previous 2 hours the German Federal government has actually relocated 400 BTC to exchange down payments at Sea serpent and Coinbase. They have actually additionally relocated 500 BTC to resolve 139Po. We have yet to see where these funds are relocated,” Arkham Intel reported by means of X.

These purchases become part of a bigger pattern of Bitcoin sales by the federal government, which had actually formerly moved $130 million BTC on June 19 and $65 million BTC on June 20. The purchases from June 19 and 20 saw some funds returning from Sea serpent and smaller sized quantities from purses related to Robinhood, Bitstamp, and Coinbase. Originally, the budget collected almost 50,000 BTC, took from the driver of the pirated flick internet site Movie2k.

” This remains in enhancement to $130M BTC sent out to exchanges on 19th June and $65M BTC sent out on 20th June, although they got $20.1 M back from Sea serpent and $5.5 M from purses connected to Robinhood, Bitstamp and Coinbase. Presently, the German Federal government holds 46,359 BTC, worth $2.8 B at existing rates,” Arkham included.

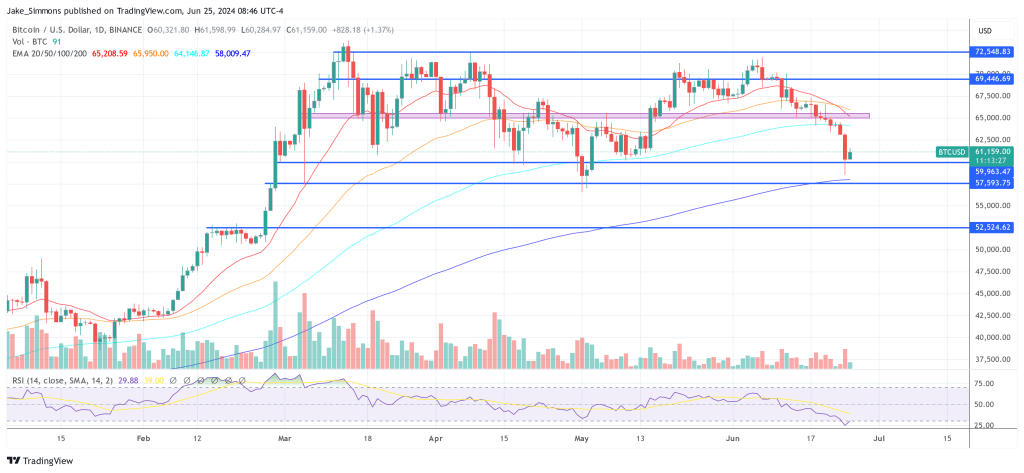

The continuous sell-off shows up to have actually added to current rate stress on Bitcoin, which has actually seen a decrease of 11.7% over the previous month and over 6.2% once a week, presently trading simply over $61,000. Experts recommend that the German federal government’s activities on central exchanges (CEXs) are a significant variable behind BTC’s weak efficiency.

Looking ahead, the marketplace slump may be additional exacerbated in July as the obsolete crypto exchange Mt. Gox prepares to begin settling its financial institutions. With greater than 140,00 BTC worth $9.4 billion to roughly 127,000 financial institutions, the marketplace might encounter extra marketing stress, possibly driving rates down better. Nevertheless, as recommended by Galaxy Digital’s head of research study, Alex Thorn, the marketing stress may be overstated significantly by the market.

At press time, BTC traded at $61,159.

Included picture developed with DALL · E, graph from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.