As Chainlink (WEB LINK) totters around the $13 to $14 area, investors will certainly look for surprise understandings right into the possible rate motion. As anticipated, current occasions have actually compelled market individuals to take on a much more careful method.

Nonetheless, the increase in the last 24 hr, which created web link’s rate to boost by 7.72%, might alter the more comprehensive understanding. With a possible rate boost on the cards, right here’s what on-chain information outlines the feasible influence.

Chainlink Investors Required to Beware

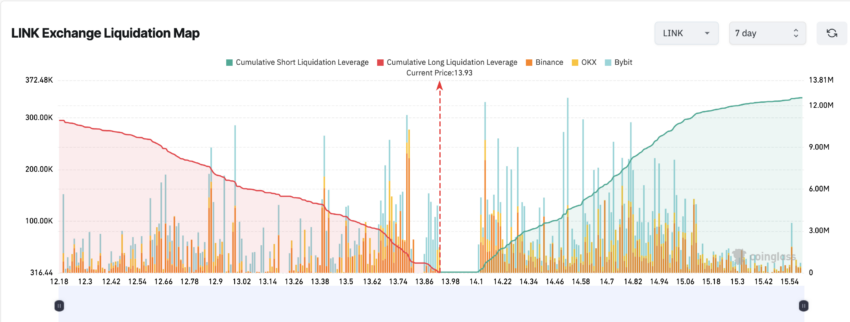

BeInCrypto examines Chainlink’s Liquidation Map to comprehend the most likely impact of a more uptrend on web link investors.

- Liquidation Map: This map analyzes previous rate fads to recognize possible degrees with liquidation dangers.

At press time, web link professions at $13.94, a 6.93% boost in 24 hr. With climbing quantity, the cryptocurrency’s worth might head towards $15.

According to Coinglass, if Chainlink’s rate strikes $15.62, the Cumulative Short Liquidation Take Advantage Of is $12.56 million. In non-technical terms, investors that have actually put bank on a web link’s rate decline with not enough margin equilibrium will certainly shed cash ought to the forecast occurred.

Learn More: What Is Chainlink (WEB LINK)?

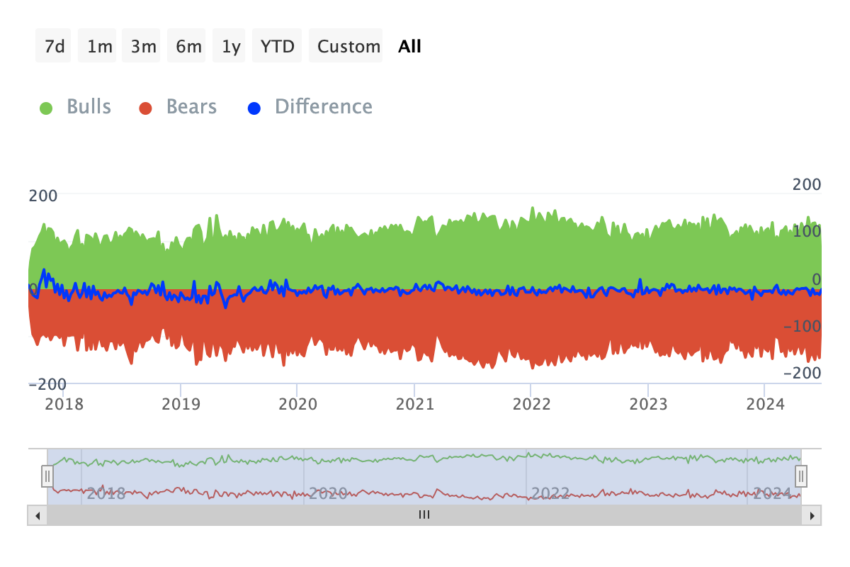

On the other hand, placements valued at $10.99 million will certainly be sold off if web link goes down to $12.18. Nonetheless, information from IntoTheBlock discloses that a dive to the $12 area looks not likely, as obvious from the Bulls and Bears sign.

- Bulls and Bears sign: This sign gauges the variety of addresses that purchased or offered greater than 1% of the complete trading quantity. Those that purchased greater than 1% are called bulls, while those marketing are identified as bears.

Moreover, there were even more bears than bulls in the last 7 days. This is one factor web link slid to $12.91 on June 24.

However since this writing, bulls have actually taken control of. Must they suffer this energy, web link might withstand descending stress and profession greater.

Web Link Rate Forecast: Greater Worths Likely

From a technological viewpoint, we observed that web link developed a double-bottom pattern. The double-bottom pattern commonly shows a turnaround and, in most cases, the begin of a possible uptrend.

It occurs when the rate touches an assistance degree two times, suggesting a time out in the possession’s drop. On the everyday graph, web link developed a comparable pattern in between November 2023 and January 10 this year.

In Between January 26 and February 13, web link’s rate rallied from $13.82 to $20.50. Based upon this historic efficiency, the cryptocurrency’s worth might begin an uptrend, taking it to $14.73 within the following couple of days. If verified, the rate of web link can climb to $17.73 in some weeks.

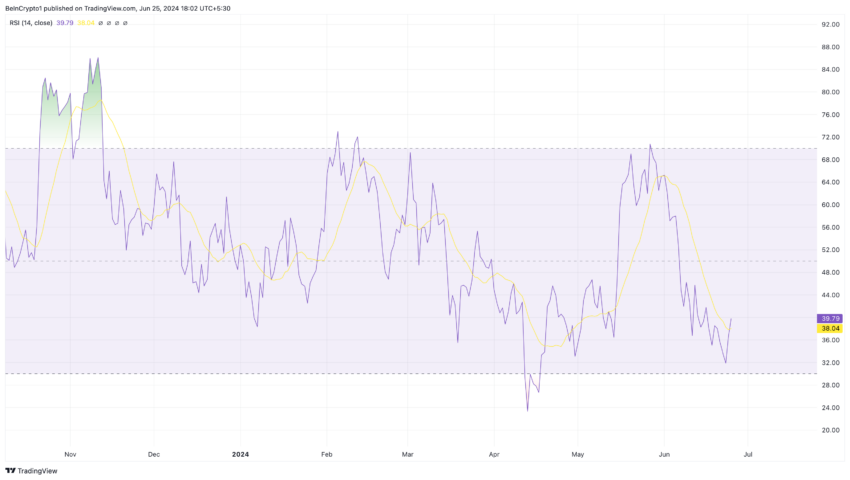

On The Other Hand, the Family Member Toughness Index (RSI) which gauges energy, is recuperating from its oversold problem.

When the RSI analysis is 30 or below, it indicates that a property is oversold. Analyses at 70 or over show overbought problems. Since this writing, the RSI goes to 39.63, recommending that the possible increase to $15 has actually not yet been verified.

Learn More: Chainlink (WEB LINK) Rate Forecast 2024/2025/2030

Nonetheless, if the analysis goes across the 50.00 neutral area, web link can get to the rate stated over or trade greater. However the forecast will certainly be revoked if the energy catches bearish pressures.

Bitcoin (BTC) is an additional variable that can prevent the uptrend. A couple of days back, the coin encountered marketing stress, which attracted the broader market down.

Since this writing, Arkham Knowledge reveals that the German federal government is relocating an additional round of BTC to exchanges. Must these sell-offs proceed, rates of altcoins, consisting of web link, might quit enhancing, and the following step for the token might be listed below $12.80.

Please Note

According to the Count on Job standards, this rate evaluation short article is for informative objectives just and need to not be taken into consideration monetary or financial investment guidance. BeInCrypto is devoted to exact, impartial coverage, yet market problems go through alter without notification. Constantly perform your very own research study and seek advice from a specialist prior to making any type of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.