The worth of TIA, the indigenous token of Celestia, a modular blockchain network, has actually been up to a cost degree last observed in November 2023.

Since this writing, the altcoin exchanges hands at $6.82, having actually lost practically 30% of its worth in the previous thirty days.

Celestia Investors Look In Other Places

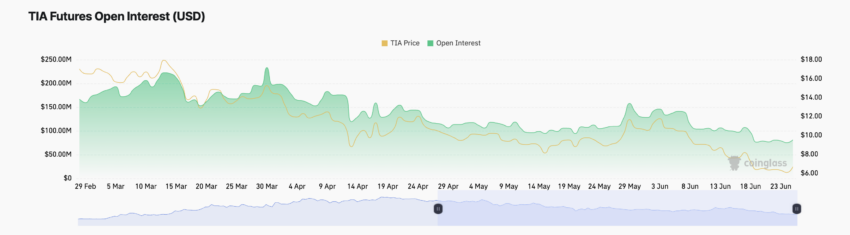

The autumn in Celestia’s worth has actually caused a matching decrease in task in its futures market. At $81.20 million since this writing, the coin’s futures open rate of interest has actually lowered by 37% given that the start of the month.

On a year-to-date (YTD) basis, the altcoin’s futures open rate of interest has actually dived by 44%. At its existing degree, TIA’s futures open rate of interest goes to its cheapest given that November 11, 2023.

A possession’s futures open rate of interest is the complete variety of impressive futures agreements that have actually not been resolved or shut.

When it drops, investors are shutting their settings without opening up brand-new ones. This is frequently a bearish signal that means minimized market task and validates the opportunity of a more cost decrease.

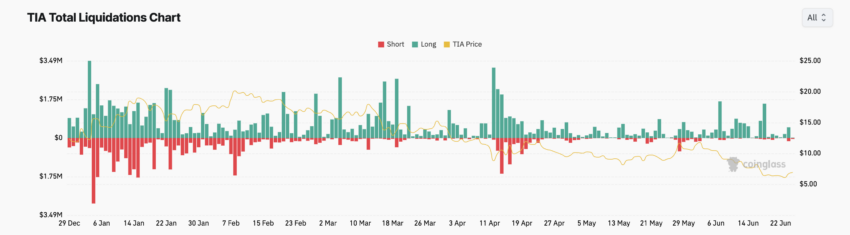

The coin’s double-digit decrease given that June started has actually resulted in a collection of lengthy liquidations. This is since the majority of its by-products investors remain to require lengthy settings regardless of TIA’s cost decrease.

Find Out More: Leading 10 Aspiring Crypto Coins for 2024

Nonetheless, their settings are powerfully shut as the coin’s cost touches brand-new lows. Professions are sold off when an investor’s setting is powerfully shut because of inadequate funds to preserve it.

Lengthy liquidations take place when a possession’s worth goes down suddenly, requiring investors with employment opportunities for a cost rally to leave.

TIA Rate Forecast: Autumn Under $6 Imminent?

TIA’s adverse Elder-Ray Index validates the bearish belief that presently routes the altcoin. At press time, this indication’s worth is -0.55. For context, it has actually returned just adverse worths given that June 6.

This indication determines the partnership in between the toughness of customers and vendors in the marketplace. When its worth is adverse, bear power controls the marketplace.

Additionally, the configuration of TIA’s Allegorical Quit and Opposite (SAR) indication provides support to the setting over. The dots that compose the indication are over its cost.

This indication figures out the instructions of a possession’s cost and determines possible turnaround factors. When its dots remainder over a possession’s cost, the marketplace is claimed to be in decrease.

Market individuals analyze this as a signal that the cost will certainly proceed dropping, and they need to hold brief settings or get in brand-new ones.

If TIA’s cost advances its sag, its worth might drop under $6 to trade at $5.77.

Nonetheless, if the bulls launch a rebound, the above forecast will certainly be revoked, and the coin’s cost will certainly climb up towards $7.18.

Please Note

In accordance with the Trust fund Task standards, this cost evaluation write-up is for informative functions just and need to not be thought about economic or financial investment recommendations. BeInCrypto is dedicated to precise, objective coverage, however market problems undergo transform without notification. Constantly perform your very own study and seek advice from a specialist prior to making any type of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.