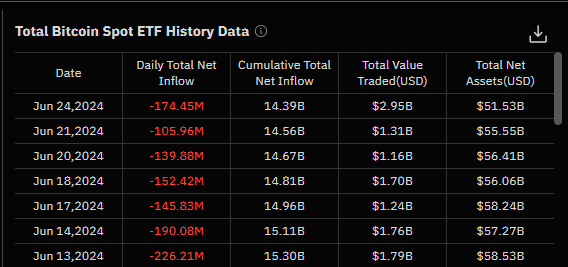

In the previous 7 trading days, area Bitcoin (BTC) exchange-traded funds (ETFs) have actually experienced substantial discharges totaling up to $1.13 billion.

This advancement has actually elevated issues amongst capitalists and investors regarding Bitcoin’s security and future trajectory.

Behind the Area Bitcoin ETF Discharges: Changes in Market Belief and Characteristics

According to SoSo Worth information, the area Bitcoin ETFs have actually videotaped discharges from June 13 up until June 24. Grayscale Bitcoin Trust Fund (GBTC) and Integrity Wise Beginning Bitcoin Fund (FBTC) are the greatest factors to these substantial discharges, with $90 million and $35 million discharges since June 24, specifically.

Learn More: What Is a Bitcoin ETF?

The crypto research study company 10x Study highlights that the existing ETF marketing contrasts dramatically with the favorable acquiring seen in February and March, which was driven by viewed institutional fostering of Bitcoin. In today’s market, the bearish view shows ETF marketing as establishments possibly leave the marketplace, dramatically influencing market self-confidence and trading habits.

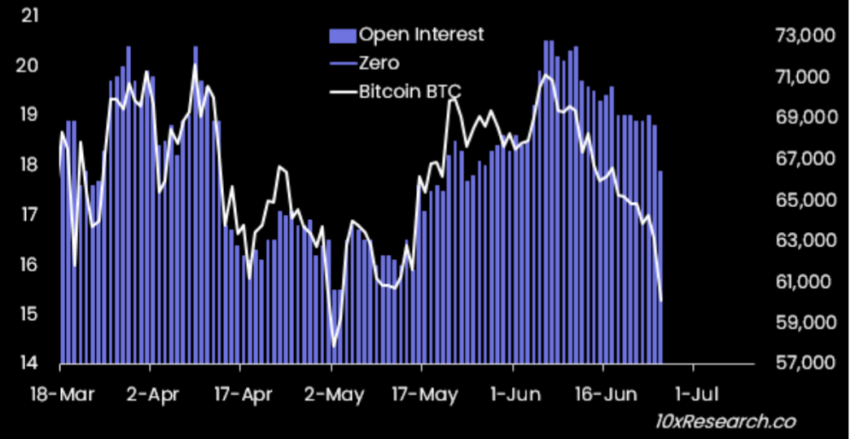

This change appears in the activities of numerous multi-strategy bush funds. Formerly long on Bitcoin ETFs and brief on Chicago Mercantile Exchange (CME) Bitcoin futures, these funds are currently relaxing their placements. This choice, driven by an annualized financing price listed below 10%, is mirrored in the decrease of open rate of interest in Bitcoin CME futures, matching the quantity of offered Bitcoin area ETFs.

In addition, speculative trading task in futures, driven by institutional acquiring via ETFs, has actually increased the financing price. Organizations embraced a delta-neutral method, acquiring ETFs and offering futures to secure returns.

Arbitrage funds, which comprise 30-40% of the $14.2 billion Bitcoin ETF inflows, have actually generally leveraged a delta-neutral method by acquiring area Bitcoin and marketing futures. The existing market problems have actually triggered a review of this method, mirroring a wider change in institutional actions and market view.

Bitcoin ETF Purchasers Flat as Market Deals With Cost Decrease

Moreover, 10x Study explained issues regarding over-bullish view pertaining to area Ethereum ETFs, specifically offered the weak Bitcoin ETF inflows. This worry is enhanced by the truth that the typical Bitcoin ETF purchaser is currently level, with a typical access cost of $60,000-$ 61,000.

The constant discharges from these ETFs accompany Bitcoin’s existing cost motion. On June 24, Bitcoin’s cost plunged from $64,076 to $59,495, noting an about 7% decline. According to 10x Study, a number of elements added to this sell-off, consisting of circulations from Mt. Gox, sales by the German federal government, Bitcoin miners, ETFs, and OG pocketbooks.

” Hypothetically, this amounts to $16-18 billion, comparable to the year-to-date Bitcoin ETF inflows,” Markus Thielen from 10x Study kept in mind.

10x Study has actually additionally determined several sell signals for Bitcoin. These signals consist of substantial volatility and cost array signs anticipating decreases. These elements recommend much deeper decreases might take place prior to a possible rebound from reduced degrees.

Nonetheless, 10x Study kept in mind that Bitcoin is presently deeply oversold. Furthermore, the Greed and Anxiety Index goes to among its least expensive degrees, typically suggesting market bases. This problem provides crypto influencers favorable views, motivating them to recommend acquiring the dip.

Learn More: Bitcoin (BTC) Cost Forecast 2024/2025/2030

In spite of the substantial discharges from area Bitcoin ETFs and the existing BTC cost scenario, a number of institutional capitalists still reveal their bullishness towards the cryptocurrency. Previously today, corporates like MicroStrategy and Japanese company Metaplanet revealed substantial Bitcoin acquisitions. In addition, area Bitcoin ETFs in Hong Kong have actually seen a rise in Bitcoin quantity, from 3,842 BTC on June 21 to $3,911 on June 24.

Please Note

In adherence to the Count on Task standards, BeInCrypto is devoted to objective, clear coverage. This newspaper article intends to offer precise, prompt info. Nonetheless, visitors are recommended to validate truths separately and seek advice from a specialist prior to making any kind of choices based upon this web content. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.