Ethereum’s (ETH) rate is readied to encounter the effect of not simply its whales marketing however unloading by all its capitalists.

The following influence on rate might bring the second-generation cryptocurrency to multi-week lows.

Ethereum Investors Appear Doubtful

Ethereum’s rate lately shed an essential assistance degree owing to the more comprehensive market signs and the climbing pessimism amongst ETH owners. The most significant indicator of this can be kept in mind in the habits of the whales.

Whales have a tendency to have one of the most influence on a property, considered that they have the biggest pocketbook. When it comes to ETH, nonetheless, the whales do not show up extremely enthusiastic of revenues. The addresses holding in between 100,000 and 1 million ETH have actually marketed near to 700 million ETH in the last 2 weeks.

The marketing of this $2.32 billion well worth of supply has actually reduced their overall holdings to 20.26 million ETH. Given that whales are understood also throughout bearish market, their abrupt marketing does elevate problem.

Find Out More: Just How to Buy Ethereum ETFs?

Second of all, the sales amongst retail capitalists have additionally relatively rose.

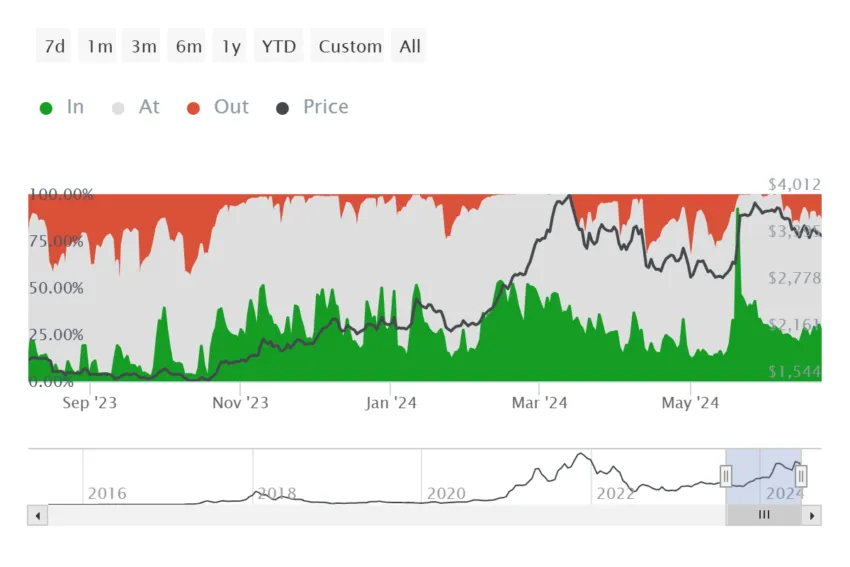

Upon observing the energetic addresses by earnings, it can be seen that regarding 25% of the individuals remain in earnings. The reason they are performing purchases on the network is more than likely to publication revenues.

When this sign is under 25%, the possibilities of marketing by ETH hodlers are instead reduced. Nonetheless, because the sign is over the limit, capitalists might try to safeguard whatever gains they can prior to the rate drops even more.

Hence, ETH might encounter the burden of these capitalists’ marketing.

ETH Rate Forecast: Plan For a Get Better

Ethereum’s rate is relocating within a dropping wedge, a technological pattern understood for indicating a favorable turnaround. This puts the possible target for the altcoin much over $4,000. Yet also in a favorable market, this is not mosting likely to take place.

Nonetheless, the favorable signs might respond to the previously mentioned bearish signs by offering ETH with a duration of debt consolidation. The sideways activity would certainly maintain the altcoin limited under $3,500 however additionally protect against a drawdown.

Find Out More: Ethereum (ETH) Rate Forecast 2024/2025/2030

Yet if Ethereum’s rate does fall short the favorable pattern, a drawdown might send it to $3,000 or reduced. This would certainly revoke any kind of capacity of a rally, expanding capitalists’ losses.

Please Note

According to the Count on Job standards, this rate evaluation write-up is for educational functions just and must not be taken into consideration economic or financial investment recommendations. BeInCrypto is dedicated to precise, honest coverage, however market problems go through alter without notification. Constantly perform your very own research study and speak with a specialist prior to making any kind of economic choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.