It is no more information that the last month has actually been noted by a decrease in task in the basic cryptocurrency market. At $2.37 trillion since this writing, the worldwide cryptocurrency market capitalization has actually stopped by 15% in the previous 1 month.

In the middle of this decrease, Toncoin (BUNCH), the cryptocurrency connected to the preferred messaging application Telegram, has actually risen by 20%. Its whales have actually additionally boosted their buildup.

Toncoin Whales Open Their Bags

An on-chain evaluation of Toncoin’s whale task exposed an uptick in the last month. The matter of load whales that hold in between 1000 and 1,000,000 coins has actually boosted by 15% in the last 1 month.

Presently, this associate of load whales contains 1,200 addresses, noting its highest degree ever before.

When big owners collect a property throughout a rally, it usually signifies solid self-confidence in the property’s future capacity.

Likewise, whale purchasing task can sustain a property’s continual uptrend. Their acquisitions can develop extra higher stress on the rate, strengthening the favorable energy.

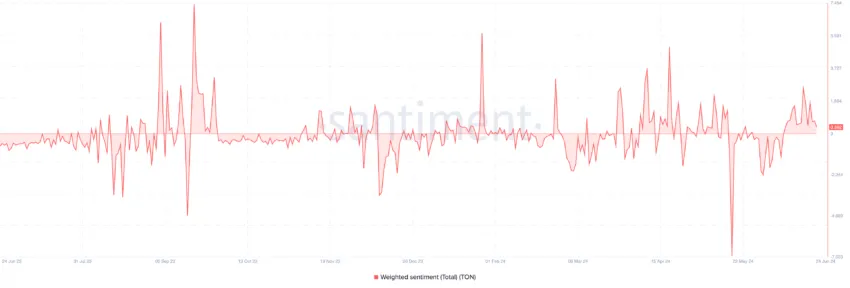

The coin’s heavy belief declares at press time, verifying the favorable prejudice towards load. Over absolutely no, its existing worth is 0.36.

Find Out More: What Are Telegram Crawler Coins?

This statistics tracks the general favorable or unfavorable prejudice in a property’s points out on social networks. When its worth declares, it indicates that the majority of the property’s points out on social networks share confident feelings.

Heap Rate Forecast: The Bulls Have a Course to Triumph

At press time, load professions at $7.57. An evaluation of its rate efficiency on a day-to-day graph reveals that it just recently went across over the 20-day Exponential Relocating Ordinary (EMA).

A property’s 20-day EMA gauges its typical rate over the previous 20 trading days. When a property rallies over it, it is a favorable signal verifying the rise in acquiring stress.

Additionally, analyses from load’s Directional Activity Index (DMI) reveal that the favorable directional index (blue) just recently went across over the unfavorable index (red).

A property’s DMI is utilized to examine the toughness and instructions of its market pattern. When its favorable index crosses over the unfavorable index, it signifies a possible purchasing chance. It suggests that the higher motion in the property’s rate is more powerful than the down motion.

If this pattern proceeds, load’s worth might reach $7.70.

Nonetheless, if the current rally in the coin’s rate results in an uptick in profit-taking task, this estimate will certainly be revoked, and load’s rate will certainly be up to $7.48.

Please Note

In accordance with the Depend on Task standards, this rate evaluation post is for informative functions just and must not be taken into consideration economic or financial investment guidance. BeInCrypto is dedicated to precise, honest coverage, however market problems go through transform without notification. Constantly perform your very own study and talk to an expert prior to making any kind of economic choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.