Tokenization is transforming the financial investment globe by attaching typical and electronic possession markets. As a component of this improvement, Flock Markets, a Berlin-based system, is readied to introduce gold-backed non-fungible symbols (NFTs).

This item provides a functional and unique application of blockchain modern technology.

Making Sure Conformity: Flock Markets’ Technique to Gold-Backed NFTs

Flock Markets is leading the fee in tokenizing real-world properties (RWAs) with their gold-backed NFTs. This campaign permits people to buy NFTs standing for possession of physical gold safely saved in a London-based Edge’s safe.

By allowing peer-to-peer trading of these NFTs on their decentralized non-prescription (dOTC) system, Flock Markets integrates the fluidness of decentralized money (DeFi) with the worth and liquidity of typical money (TradFi). This strategy boosts ease of access to gold financial investments. In addition, it makes sure conformity with know-your-customer (KYC) and anti-money laundering (AML) procedures.

Learn More: What Are Tokenized Real-World Properties (RWA)?

Additionally, Flock Markets intends to place its gold-backed NFTs to follow the upcoming Markets in Crypto-Assets (MiCA) policy in the European Union (EU). The present MiCA policy defines that it does not cover one-of-a-kind, non-fungible crypto-assets, that include electronic art and antiques. The policy additionally omits crypto-assets linked to one-of-a-kind, non-fungible solutions or physical properties, like item service warranties or realty.

Without a doubt, regulative conformity is extremely important in the tokenization ecological community, as highlighted by Alex Malkov, Founder of HAQQ Network. Malkov additionally worries the value of openness, routine audits, and clear interaction of safety actions to develop count on with financiers.

” To attend to cross-border regulative difficulties in possession tokenization, it is important to develop usual requirements and foster global participation. Carrying out blockchain-based identification confirmation systems can boost openness and safety by supplying unalterable documents of deals and identifications, helping with regulative conformity,” Malkov described to BeInCrypto.

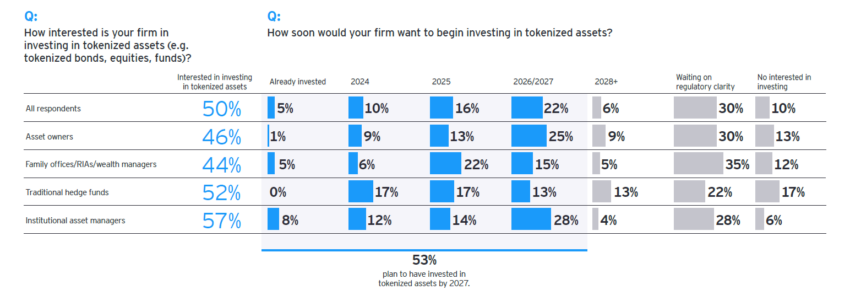

Flock Markets’ gold-backed NFTs are a substantial symptom of the more comprehensive real-world possession tokenization pattern. A current record from EY highlights that tokenization is acquiring grip amongst institutional financiers. Half of the participants in the record like purchasing tokenized properties.

Learn More: What is The Influence of Real Life Property (RWA) Tokenization?

” Throughout all capitalist kinds, 53% dream to purchase tokenized different funds, 46% in tokenized public funds, and 38% have an interest in purchasing tokenized realty financial investments. When inquired about the leading inspiration for rate of interest in tokenized properties, profile diversity was essential, complied with by accessibility to brand-new possession kinds and greater/increased liquidity,” EY experts composed in the record.

Please Note

In adherence to the Depend on Task standards, BeInCrypto is devoted to impartial, clear coverage. This newspaper article intends to offer exact, prompt info. Nonetheless, visitors are recommended to validate truths separately and speak with a specialist prior to making any kind of choices based upon this web content. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.