XRP is unquestionably home to more whale addresses than numerous would certainly anticipate, with supply information also revealing an intriguing focus amongst these whale budgets. An XRP supporter called Chad Steingraber just recently highlighted this sensation on social media sites. According to the supply circulation, XRP gets on track to create a supply problem in the future, particularly with the SEC claim versus Surge currently ending.

Rise In XRP Whales Increase Shortage Problems

XRP was produced with a complete flowing supply of 100 billion XRP symbols. Nevertheless, in spite of this significant quantity of symbols that can in theory be offered, XRP has actually taken care of to be limited. This intriguing difference was just recently highlighted by Steingraber, that kept in mind that the general public supply today is much much less than individuals recognize.

Component of XRP’s shortage results from Surge’s control over most of the supply via an escrow system that launches just a little section monthly. Especially, this escrow system is understood to have around 40 billion XRP symbols which are presently shut out from the general public supply. This regulated supply design has actually produced an unnaturally restricted flowing supply. As need substantially surpasses this restricted supply being launched, it’s placing extreme acquiring stress on the restricted XRP offered on exchanges.

Besides the 39 billion approximately XRP symbols in escrow, XRP’s accessibility for retail investors has actually been endangered by whale buildup in current months. Out of the 55.6 billion XRP presently in flow, the leading 10 XRP addresses regulate concerning 11.2 billion XRP. Moreover, the leading 50 addresses regulate 26.9 billion XRP, virtually fifty percent of the present supply.

The #XRP public supply today is much much less than individuals recognize. You will certainly never ever see 100Billion on the competitive market.

It will certainly evaporate right into a little limited quantity.

Retail trading figures out the cost. pic.twitter.com/m8BBirjJd3

— Chad Steingraber (@ChadSteingraber) June 22, 2024

For contrast, the top 103 Bitcoin addresses have much less than 16% of the overall flowing supply of Bitcoin. This inconsistency is much more blazing if the optimum supply of both cryptocurrencies is contrasted. This supply-and-demand inequality is the ideal dish for XRP whales to remain to control the flowing supply.

What Does This Mean For XRP?

The focus of XRP in the hands of less owners can increase costs substantially if the whales choose not to offer. While raised shortage could appear worrying for brand-new retail investors shopping XRP, it additionally signifies solid self-confidence in XRP’s future cost activity. As Steingraber kept in mind, retail trading figures out the cost, suggesting a boost popular from retail investors will at some pointtranslate to an increase in price

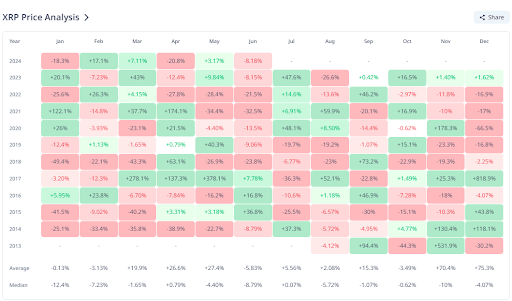

At the time of creating, XRP is trading at $0.4759, down by 6.28% in the previous 7 days. Remarkably, this decrease appears to have actually settled in the previous 24-hour. The bulls are showing activity near $0.4620, establishing the phase for an intriguing cost activity in July. According to cost background data from CryptoRank, XRP’s cost activity in July has actually declared for the previous 4 years.

In July 2023, XRP observed a 47.6% cost boost after visiting 8.15% in June 2023. Present cost activity reveals XRP gets on a comparable 8.18% decrease in June 2024. If background were to duplicate itself, a comparable rise would certainly see XRP finishing July around $0.70.

Included photo produced with Dall.E, graph from Tradingview.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.