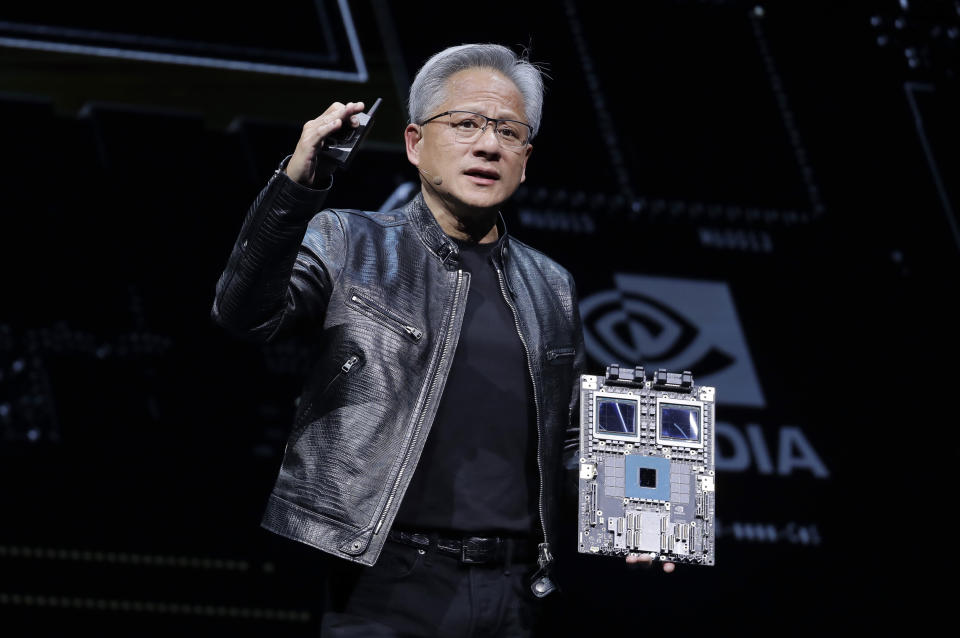

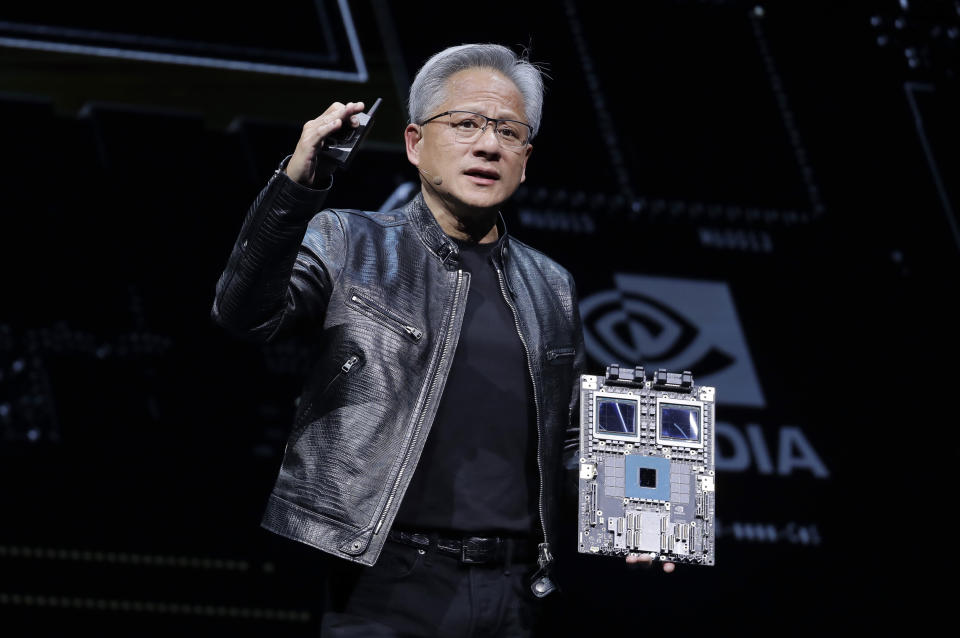

Nvidia supply (NVDA) stood out greater than 3% on Tuesday early morning, turning around a three-day slide that removed about $430 billion of the AI chip titan’s market cap.

Shares decreased virtually 13% because Thursday as financiers revolved out of the supply, which struck a record-high close specifically one week back when it quickly exceeded Microsoft (MSFT) as one of the most useful firm worldwide.

The chip heavyweight repaid that title as the three-day sell-off started.

” I believe it’s method overblown. I do not believe individuals must fidget concerning what’s occurring with Nvidia,” Kenny Polcari, handling companion at Kace Funding Advisors, informed Yahoo Money on Tuesday.

” I would certainly utilize this weak point as a chance,” he included, keeping in mind the timing of the decrease.

” We go to completion of the quarter, so it’s a quarter-marking duration. You have actually obtained a great deal of large possessions that are attempting to reshuffle and rebalance,” he stated.

Polcari included he would not be amazed if the supply moved “an additional 5% or 8%.”

On Tuesday, Nvidia’s market cap climbed up back to float around the $3 trillion market cap, though it was still listed below the assessments of Microsoft or Apple (AAPL).

Nvidia has actually played a crucial function in buoying the S&P 500 (^ GSPC) and the Nasdaq (^ IXIC) to duplicated document highs in 2024.

The Santa Clara, Calif.-based firm finished a 10-for-1 supply split on June 10.

Ines Ferre is an elderly service press reporter for Yahoo Money. Follow her on X at @ines_ferre.

Go Here for the most up to date securities market information and extensive evaluation, consisting of occasions that relocate supplies

Check out the most up to date monetary and service information from Yahoo Money

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.