Denim garments firm Levi’s (NYSE: LEVI) will certainly be reporting revenues tomorrow mid-day. Right here’s what to seek.

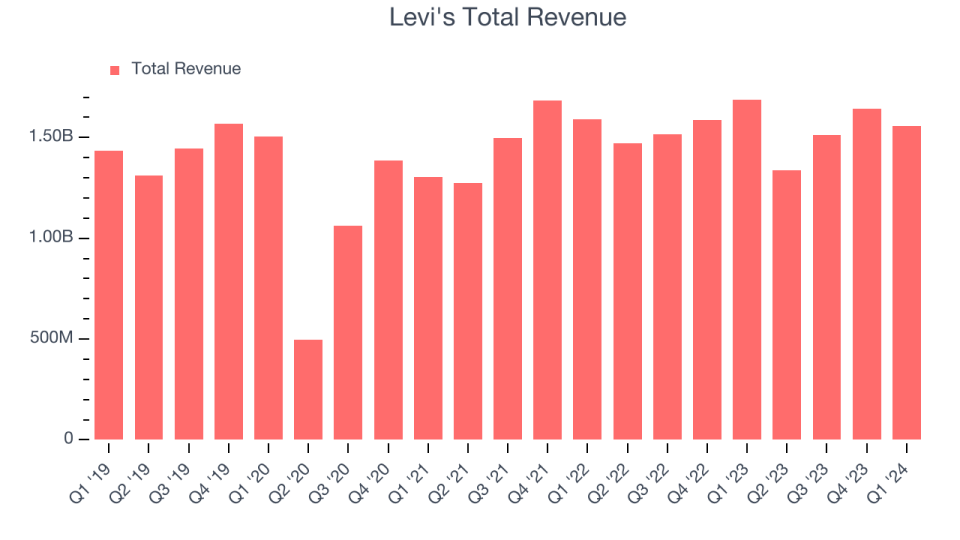

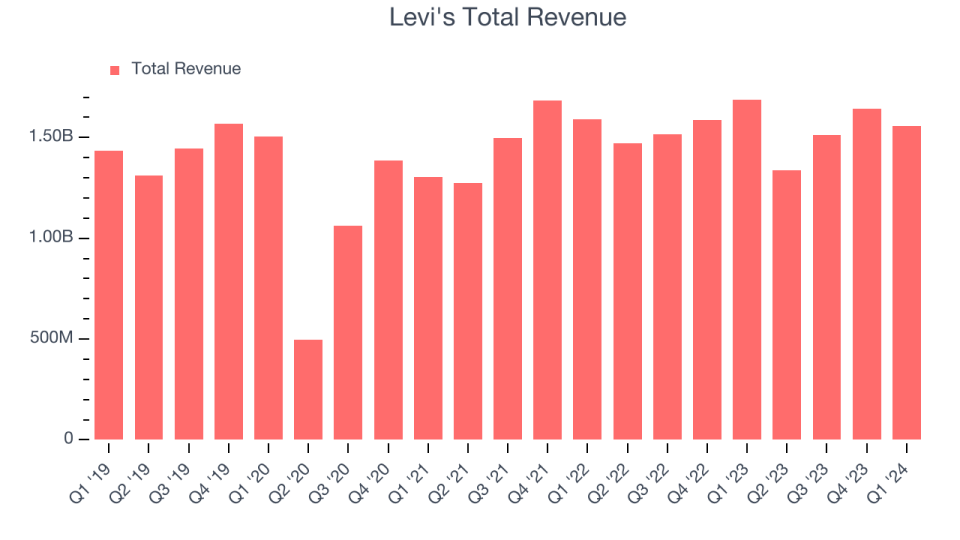

Levi’s fulfilled experts’ profits assumptions last quarter, reporting profits of $1.56 billion, down 7.8% year on year. It was a combined quarter for the firm, with an excellent beat of experts’ revenues price quotes yet a miss out on of experts’ operating margin price quotes.

Is Levi’s a buy or market entering into revenues? Read our full analysis here, it’s free.

This quarter, experts are anticipating Levi’s profits to expand 8.6% year on year to $1.45 billion, a turnaround from the 9.1% reduction it taped in the very same quarter in 2014. Changed revenues are anticipated to find in at $0.11 per share.

Most of experts covering the firm have actually reconfirmed their price quotes over the last 1 month, recommending they expect business to persevere heading right into revenues. Levi’s has actually missed out on Wall surface Road’s profits approximates 4 times over the last 2 years.

With Levi’s being the initial amongst its peers to report revenues this period, we do not have anywhere else to want to obtain a mean just how this quarter will certainly decipher for customer optional supplies.

When a firm has even more money than it understands what to do with, redeeming its very own shares can make a great deal of feeling– as long as the rate is right. Thankfully, we have actually located one, a low-cost supply that is spurting totally free capital AND redeeming shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.