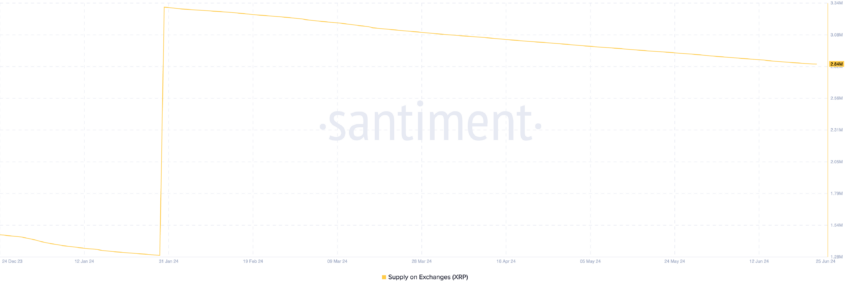

The variety of Surge (XRP) symbols held throughout cryptocurrency exchanges completes 2.84 million XRP, which is valued at $1.34 million at present market value.

This stands for the most affordable quantity of XRP symbols hung on exchanges given that the start of the year.

Surge Records Low Sell-offs

At press time, the token’s supply on exchanges was 2.84 million XRP, the most affordable degree given that January 1. When a property’s supply on exchanges decreases, its overall quantity hung on cryptocurrency exchanges lowers.

This might result from financiers holding their symbols in an equipment pocketbook, betting on decentralized money systems (DeFi), or typically avoiding marketing their holdings in assumption of a future rate rally.

Nevertheless, XRP’s current rate activity has actually disappointed any type of capacity for a considerable rebound in the close to term. Since this writing, XRP professions at $0.47. In the last month, the altcoin’s worth has actually plunged by 12%.

Learn More: Every little thing You Required To Find Out About Surge vs SEC

For context, the altcoin reviewed its year-to-date low of $0.46 on June 24, noting its 2nd time this month alone.

The regular decrease in XRP’s worth is partially attributable to just how much losses its owners have actually sustained lately. As an example, its day-to-day proportion of deal quantity in earnings to loss (analyzed utilizing a 30-day relocating standard) is 0.88 at press time.

This suggests that for each XRP deal finishing in a loss, just 0.88 purchases return an earnings.

XRP Rate Forecast: The Bears Remain In Control

Analyses from XRP’s rate efficiency on an everyday graph reveal the decrease in the need for the altcoin. As an example, its Chaikin Cash Circulation (CMF), which gauges cash circulation right into and out of its market, is presently 0.06.

An unfavorable CMF worth suggests market weak point. It is a bearish signal that recommends liquidity departure from the marketplace. Investors typically translate it as a signal of an additional decrease in a property’s worth.

XRP’s Relocating Typical Merging Aberration (MACD) arrangement validates the bearish view. Since this writing, the token’s MACD line (blue) relaxes under the signal (orange) and absolutely no lines.

The indication recognizes adjustments in a property’s toughness, rate instructions, and energy. When the MACD line drops under the signal line, it is a bearish signal, which recommends that marketing stress is extra considerable than purchasing task.

If the need for XRP remains to plunge, its rate will certainly be up to $0.42.

Learn More: Surge (XRP) Rate Forecast 2024/2025/2030

Nevertheless, if view changes from bearish to favorable, the token’s rate will certainly climb to $0.49.

Please Note

According to the Depend on Job standards, this rate evaluation short article is for informative functions just and must not be taken into consideration economic or financial investment recommendations. BeInCrypto is devoted to exact, honest coverage, however market problems undergo alter without notification. Constantly perform your very own study and talk to an expert prior to making any type of economic choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.