Spending can be found in numerous tastes, so there isn’t a right or incorrect technique: You need to do what’s ideal for you. That uses also to reward investing. For some, reward investing indicates making the most of instant earnings, also if it needs compromising some development and long-lasting advantage; for others, it’s the contrary.

Medical care juggernaut Johnson & & Johnson (NYSE: JNJ) is a solemn name in the reward area, both for its brand name acknowledgment and for an exceptional dividend-raise touch that’s lasted 62 years and checking. Yet whether the supply needs to live in your profile relies on a selection of aspects.

Right Here’s exactly how to inform whether J&J is the ideal reward supply for you.

Quality methods you need to at the very least take into consideration possessing J&J

Reward investing has to do with assuming long-lasting, so the common measure in any type of technique is to concentrate on high-grade firms constructed to stand the examination of time. Johnson & & Johnson’s reward touch reveals that it’s done simply that.

The firm is an empire that runs 2 key organization devices: ingenious medication, the firm’s pharmaceutical arm; and medtech, which offers clinical tools, screening devices, and much more. According to monitoring, roughly 65% of J&J’s earnings originates from items with a top-two management placement worldwide. Simply put, Johnson & & Johnson items are a key option throughout the medical care sector.

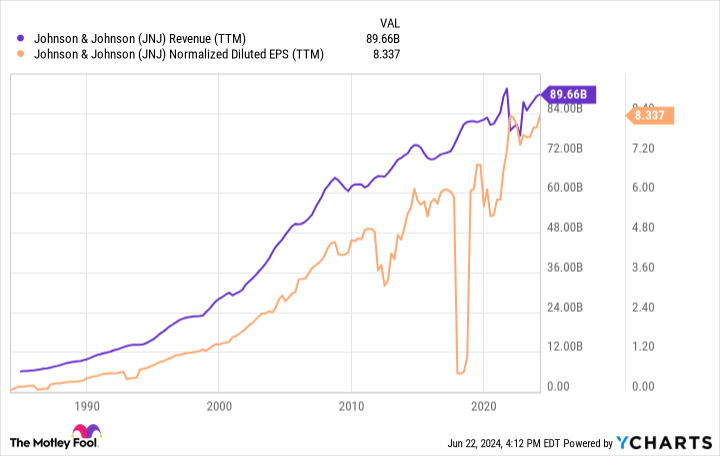

Integrate market management with a varied item profile, and you obtain an organization that does year in and year out:

Consistent revenues sustain a regular reward safeguarded by a healthy and balanced 64%dividend payout ratio Simply put, capital would certainly require to diminish a high cliff for the firm to stop working to money its reward with revenues. Also if such a situation did take place, Johnson & & Johnson flaunts what might be the globe’s most relied on annual report. It lugs a perfect AAA credit rating from the significant credit report bureaus– more than also the credit report ranking of the united state federal government.

Absolutely nothing in life is ensured, however Johnson & & Johnson’s security in the medical care market is perhaps as close as you’ll be available in investing.

Why Johnson & & Johnson might be ideal for you

If you’re a value-focused capitalist happy to get and hold blue chip firms, you can not do any type of much better than J&J. Nonetheless, the firm has actually ended up being so huge that development has actually slowed down; experts think profits will certainly expand by simply 5% to 6% every year over the long-term, which, incorporated with a strong 3.3% reward produce now, would certainly provide you a chance at 8% to 9% yearly complete returns. That will not make you abundant overnight, however it can build up when it substances for years, and Johnson & & Johnson may be one of the most sturdy organization in the world.

Appraisal is important when getting a supply with slower development, so this set is often best laid off if the cost isn’t right. Yet right now it’s trading near 52-week lows. Its forward price-to-earnings (P/E) proportion is simply 14, its most affordable in a number of years. If you wish to “get it and neglect it,” J&J is for you, and the supply is specifically appealing today.

Why Johnson & & Johnson could not be for you

There’s absolutely nothing incorrect with a stable yearly financial investment return of 8% to 9%. Besides, that’s a hair listed below the S&P 500‘s historic standard. That stated, if you’re young or have a hunger for even more threat you could try to find choices with even more upside, also if that indicates sustaining much more volatility.

J&J has actually routed the S&P 500’s complete returns by a large margin for the previous years. Recently, S&P 500 index funds, which have actually likewise traditionally verified secure relocations, have actually done much much better. Yet Johnson & & Johnson is an exceptional organization, and its attractive evaluation might establish you up for greater returns than you could have seen over the previous years.

Inevitably, those searching for one of the most reliable financial investments feasible will certainly incline Johnson & & Johnson, while those comfy with even more threat will most likely look somewhere else. It boils down to individual choice– component of what makes spending terrific for everybody.

Should you spend $1,000 in Johnson & & Johnson now?

Prior to you get supply in Johnson & & Johnson, consider this:

The Supply Expert expert group simply recognized what they think are the 10 best stocks for capitalists to get currently … and Johnson & & Johnson had not been among them. The 10 supplies that made it might create beast returns in the coming years.

Take Into Consideration when Nvidia made this listing on April 15, 2005 … if you spent $1,000 at the time of our referral, you would certainly have $775,568! *

Supply Expert supplies capitalists with an easy-to-follow plan for success, consisting of assistance on developing a profile, normal updates from experts, and 2 brand-new supply choices every month. The Supply Expert solution has greater than quadrupled the return of S&P 500 because 2002 *.

* Supply Expert returns since June 24, 2024

Justin Pope has no placement in any one of the supplies discussed. The suggests Johnson & & Johnson. The has a disclosure policy.

Is Johnson & Johnson the Best Dividend Stock for You? was initially released by The

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.