Profits results frequently suggest what instructions a business will certainly absorb the months in advance. With Q1 currently behind us, allow’s look at Carter’s (NYSE: CRI) and its peers.

Within garments and devices, not just do designs alter much more regularly today than years previous as trends take a trip with social media sites and the net however customers are likewise changing the means they acquire their products, preferring omnichannel and ecommerce experiences. Some garments, devices, and deluxe products firms have actually made collective initiatives to adjust while those that are slower to relocate might fall back.

The 17 garments, devices and deluxe products supplies we track reported a blended Q1; usually, profits defeat expert agreement price quotes by 0.5%. while following quarter’s profits support was 2.2% listed below agreement. Rising cost of living proceeded in the direction of the Fed’s 2% objective at the end of 2023, resulting in solid securities market efficiency. The begin of 2024 has actually been a bumpier trip, as the marketplace switches over in between positive outlook and pessimism around price cuts as a result of blended rising cost of living information, and garments, devices and deluxe products supplies have actually held about consistent among all this, with share costs up 3.2% usually considering that the previous revenues outcomes.

Carter’s (NYSE: CRI)

Reported to offer greater than 10 items for each kid birthed in the USA, Carter’s (NYSE: CRI) is an American developer and marketing professional of youngsters’s garments.

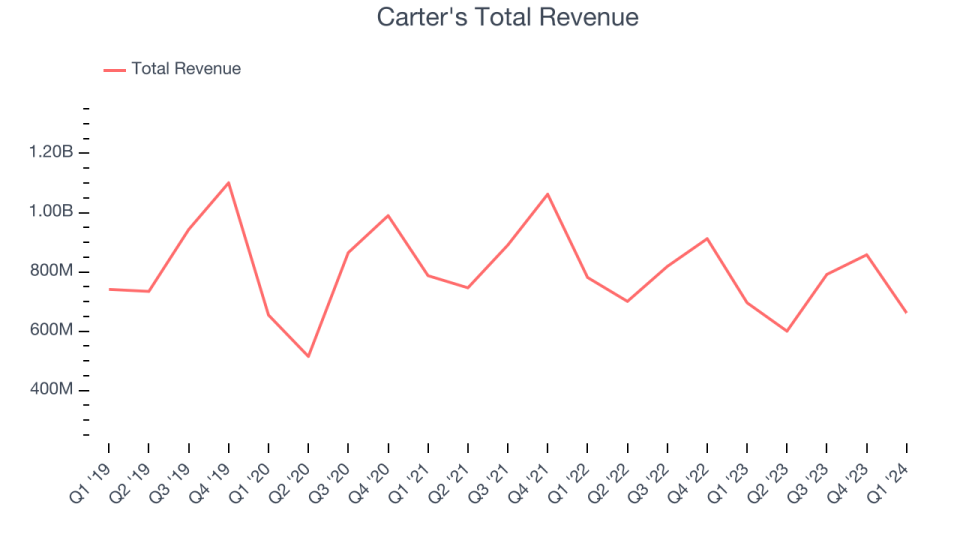

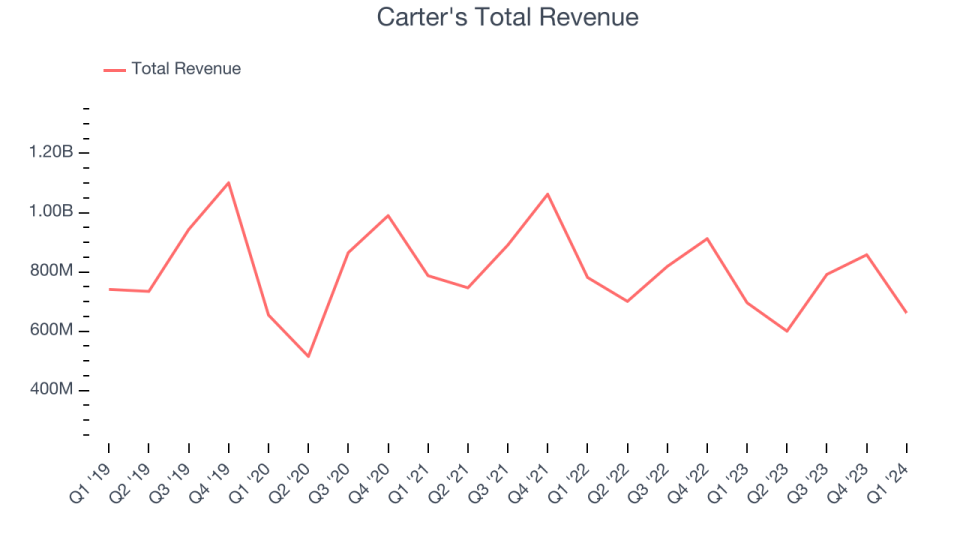

Carter’s reported profits of $661.5 million, down 4.9% year on year, covering experts’ assumptions by 3.3%. It was an alright quarter for the firm, with a remarkable beat of experts’ revenues price quotes however underwhelming revenues support for the following quarter.

” We surpassed our sales and revenues purposes in the very first quarter,” claimed Michael D. Casey, Chairman and President.

The supply is down 8.9% considering that the outcomes and presently trades at $65.17.

Is currently the moment to acquire Carter’s? Access our full analysis of the earnings results here, it’s free.

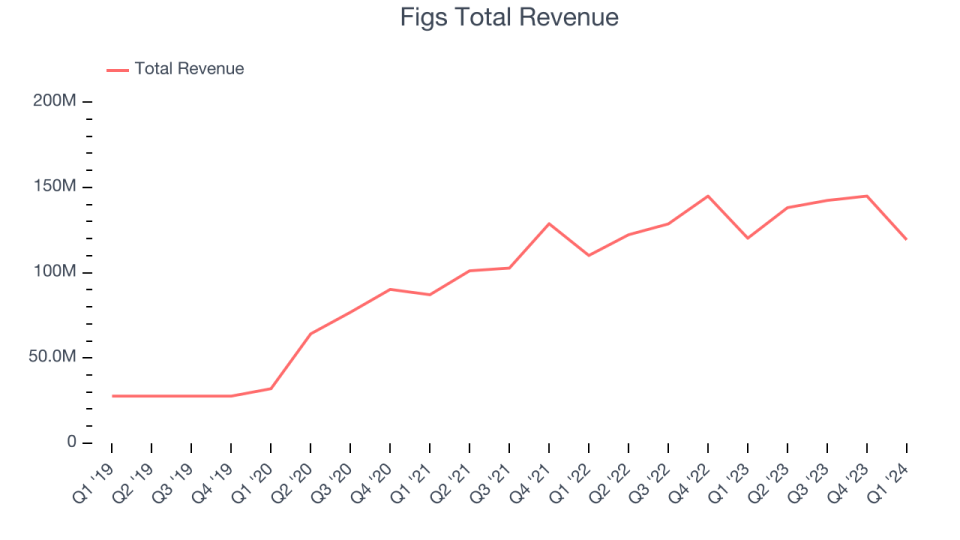

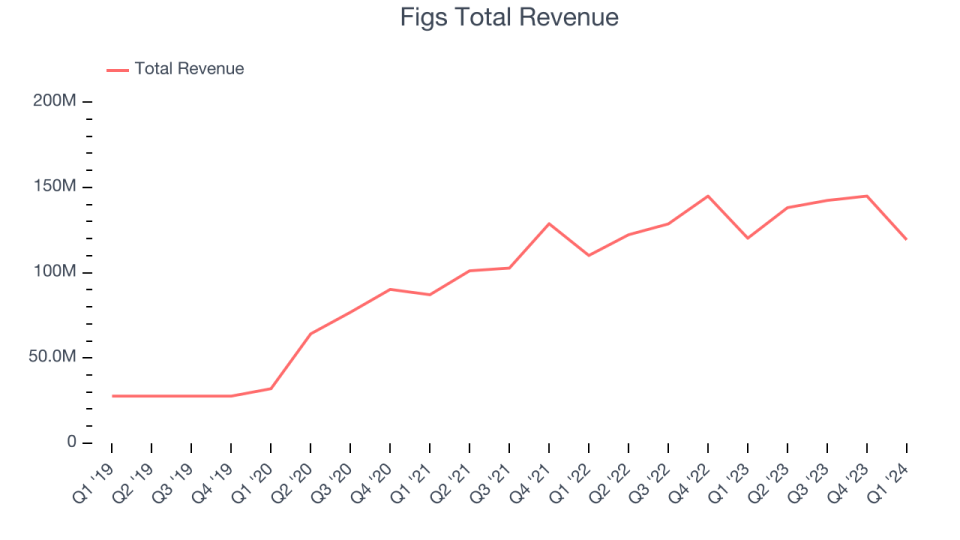

Finest Q1: Figs (NYSE: FIGS)

Climbing to popularity by means of TikTok and established in 2013 by Heather Hasson and Trina Spear, Figs (NYSE: FIGS) is a medical care garments firm recognized for its trendy strategy to clinical clothing and attires.

Figs reported profits of $119.3 million, down 0.8% year on year, surpassing experts’ assumptions by 1.6%. It was an extremely solid quarter for the firm, with a remarkable beat of experts’ revenues price quotes and a remarkable beat of experts’ operating margin price quotes.

The supply is down 21.8% considering that the outcomes and presently trades at $4.4.

Is currently the moment to acquire Figs? Access our full analysis of the earnings results here, it’s free.

ThredUp (NASDAQ: TDUP)

Established to transform thrifting, ThredUp (NASDAQ: TDUP) is a leading on-line style resale market that uses a large option of gently-used clothes and devices.

ThredUp reported profits of $79.59 million, up 4.8% year on year, disappointing experts’ assumptions by 0.9%. It was a weak quarter for the firm, with a miss out on of experts’ operating margin and revenues price quotes.

ThredUp managed the fastest profits development however had the weakest full-year support upgrade in the team. The supply is down 9.1% considering that the outcomes and presently trades at $1.7.

Read our full analysis of ThredUp’s results here.

Under Armour (NYSE: UAA)

Established In 1996 by a previous College of Maryland football gamer, Under Armour (NYSE: UAA) is a garments brand name focusing on sports apparel developed to enhance sports efficiency.

Under Armour reported profits of $1.33 billion, down 4.7% year on year, in accordance with experts’ assumptions. It was a weak quarter for the firm, with underwhelming revenues support for the complete year and a miss out on of experts’ operating margin price quotes.

The supply is up 1.9% considering that the outcomes and presently trades at $6.92.

Read our full, actionable report on Under Armour here, it’s free.

Stitch Take Care Of (NASDAQ: SFIX)

Among the initial registration box firms, Stitch Repair (NASDAQ: SFIX) is an on the internet individual designing and style solution that curates tailored clothes choices for consumers.

Stitch Repair reported profits of $322.7 million, down 15.8% year on year, exceeding experts’ assumptions by 5.4%. It was an extremely solid quarter for the firm, with a remarkable beat of experts’ revenues price quotes and full-year profits support surpassing experts’ assumptions.

Stitch Repair attained the most significant expert approximates beat and greatest full-year support raising amongst its peers. The supply is up 44% considering that the outcomes and presently trades at $3.83.

Read our full, actionable report on Stitch Fix here, it’s free.

Sign Up With Paid Supply Financier Research Study

Aid us make StockStory much more valuable to financiers like on your own. Join our paid individual study session and get a $50 Amazon present card for your point of views. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.