The tokenized United States treasuries market is experiencing extraordinary development.

High rate of interest and a rise popular for secure, high-yielding on-chain properties drive this accomplishment.

BlackRock’s BUIDL Takes the Lead in Tokenized Treasury Funds Sector

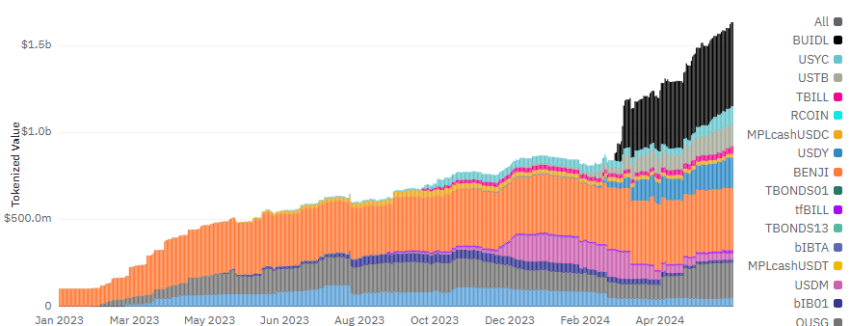

High rate of interest have actually reinforced need for protected, high-yielding T-bills on-chain. This has actually moved the worth of tokenized United States Treasury items by over 1,000% considering that very early 2023, getting to $1.64 billion by June 22.

Principal like BlackRock and Franklin Templeton are leading the fee. BlackRock’s tokenized United States Treasury fund BUIDL, valued at $481.42 million, lately surpassed Franklin Templeton’s BENJI $357.68 million fund to come to be the biggest. Crypto bush funds and market manufacturers take advantage of BUIDL as security for trading coins and symbols.

Learn More: What is Tokenization on Blockchain?

This development reveals a substantial change in the monetary market, where real-world possession (RWA) tokenization is coming to be significantly traditional. Significant banks like Goldman Sachs, JPMorgan, and Citi are proactively discovering and purchasing tokenization modern technologies.

Tokenization, which produces electronic symbols rep of real-world properties on a blockchain, provides countless advantages. These benefits consist of enhanced liquidity, faster deal times, and reduced costs.

The usage situations for tokenized treasuries are additionally broadening. According to RWA.xyz, tokenized treasuries are significantly used as security.

“[For instance,] Superstate’s USTB and BUIDL can be made use of as security on FalconX Network. [Meanwhile,] Ondo Financing’s USDY can be made use of on Drift Method,” it mentioned.

One more instance is Moody’s current “A-bf” bond ranking honor to Hillside Lighting International Limited, the provider of OpenEden’s tokenized United States T-bills, TBILL. This ranking raises TBILL symbols to the investment-grade group. OpenEden presently teams up with settlement business, DeFi procedures, crypto budgets, and various other Web3 applications to enable individuals to accessibility United States T-bill produces throughout various blockchains.

Business Giants Embrace the Future of Tokenization

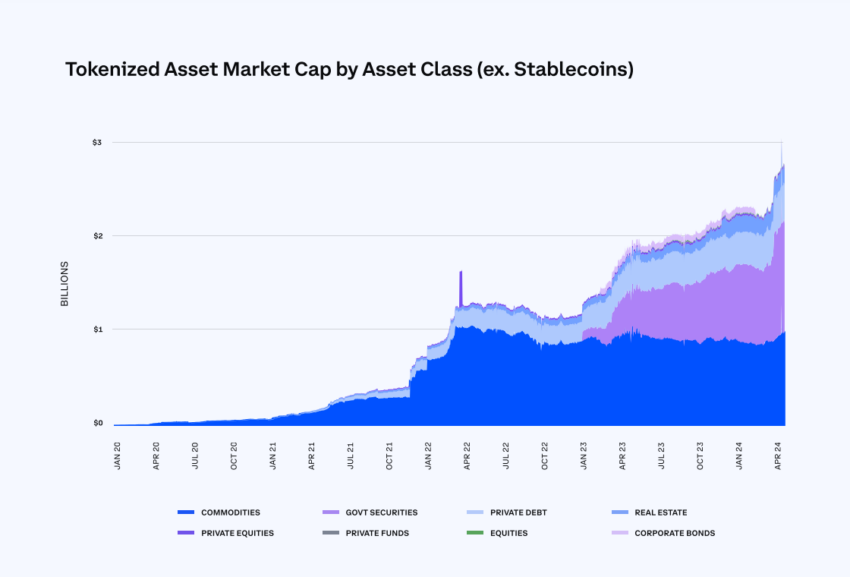

Regardless of the surge of real-world possession tokenization, information programs that stablecoins have actually driven the tokenization industry’s development. The complete worth of tokenized non-stablecoin properties has actually gone beyond $3 billion, increasing considering that very early 2023. This number just makes up openly trackable properties, with quotes from the Hong Kong Monetary Authority (HKMA) suggesting an extra $3.9 billion in tokenized bonds.

Learn More: What is The Effect of Real Life Property (RWA) Tokenization?

In addition, the development of stablecoins and various other electronic symbols reinvents settlement systems, making deals extra effective and economical. These elements additionally bring in significant banks, boosting the total market allure.

Leading business significantly identify the advantages of stablecoins and various other electronic symbols for faster and more affordable deals. A current record from Coinbase revealed that 86% of leading business recognize the benefits of possession tokenization for their business. In addition, 35% of them intend tokenization jobs, consisting of stablecoins.

Assets, particularly gold, additionally stay considerable in the tokenized properties market. This possession represent almost all the $1 billion in tokenized assets.

Undoubtedly, tokenization assures to reinvent the monetary industry, supplying much faster, extra effective, and protected solutions. As even more conventional monetary titans discover blockchain modern technology, tokenization continues to be a vital affordable benefit, driving development and development.

Please Note

In adherence to the Count on Task standards, BeInCrypto is dedicated to honest, clear coverage. This newspaper article intends to give exact, prompt details. Nevertheless, viewers are suggested to validate realities individually and talk to a specialist prior to making any type of choices based upon this material. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.