What does a financial institution failing in 1874 relate to the racial riches space in America in 2024?

Ends Up, a great deal.

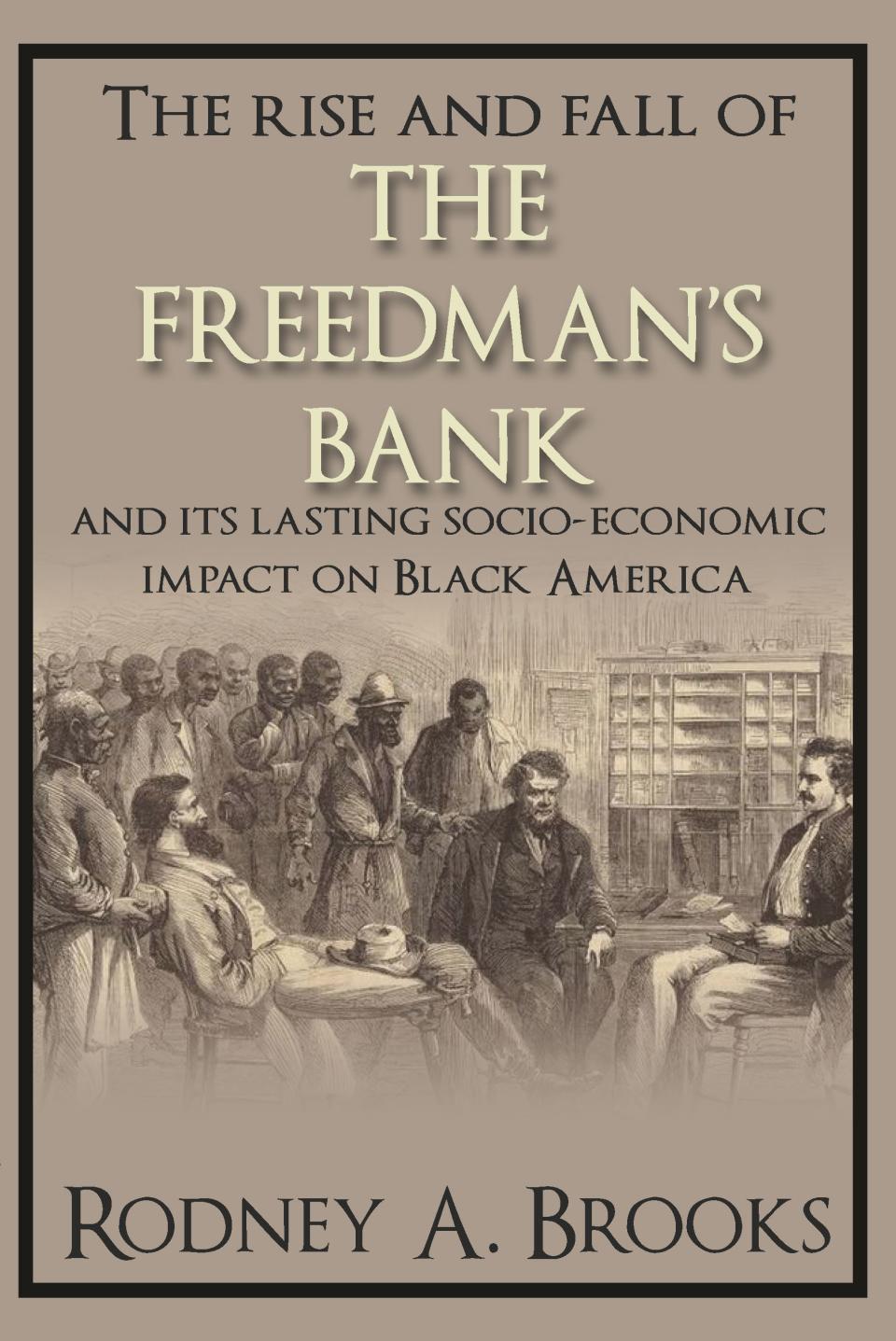

In his brand-new publication, “The Rise and Fall of The Freedman’s Savings Bank And its Lasting Socio-Economic Impact on Black America,” writer Rodney Brooks, previous replacement handling editor at United States Today, unloads the tale of the fast fluctuate of the financial institution developed in 1865 by Congress to offer previous servants an area to transfer their incomes from their solution in the Union Military. It quickly expanded to millions in down payments, as Black Americans made tiny down payments of $5 to $50.

With a mix of mismanagement and a monetary panic that struck the nation in 1873, the financial institution was compelled to close its doors with droves of depositors shedding every one of their life financial savings. Which is exactly where lots of Black Americans’ suspect of banks, which has actually given for generations, started, Brooks creates.

” A lot of individuals that made down payments were converted– due to the fact that every one of the promos including photos of Union Generals and Head Of State Lincoln– that they were risk-free and safeguarded by the United States federal government,” Brooks claimed.

Not so.

” It was the very first effort of Black Americans attempting to conserve and spend, and it was consulted with a calamity,” Brooks informed Yahoo Financing.

Brooks traces that financial institution’s implosion to the racial riches space in the United States today. There’s a seven-figure space in between the typical riches of white family members contrasted to Black family members, according to research by the Urban Institute, a detached brain trust. The typical riches of white family members in 2022 got to a document high of over $1.3 million, contrasted to concerning $211,000 for Black family members.

Right Here’s what Brooks needed to claim concerning the financial institution’s failing, the economic concerns encountering Black Americans today, and the nation’s relentless riches space, modified for size and quality:

Kerry Hannon: Rodney, can you offer us a photo of what The Freedman’s Financial institution was and why the death?

The Freedman’s Financial institution was developed and authorized right into legislation by Head of state Lincoln after the Civil Battle. The standard idea behind it was that previous servants had no other way to conserve their cash due to the fact that white financial institutions did decline them as clients. Some were making earnings for the very first time, and there was no place to go. The significant incentive behind it was that the black soldiers that dealt with in the Civil Battle, that obtained finalizing benefits for signing up with the Military, and they were obtaining earnings. So it was developed as a means for Black Civil Battle professionals and previous servants to conserve cash, however additionally it was a means to offer a monetary education and learning. I imply, that’s one method you learn more about cash is to visit a financial institution, enjoy your cash expand, and learn more about passion.

Their down payments were not safeguarded by the United States federal government. What took place?

The financial institution was intended to be managed by Congress, which really did not do so. Congress disregarded it, however it was controlled by a board of 50 white business people.

At first, the purpose was to have one financial institution branch in Washington, D.C., not a branch system, which is extremely pricey. Yet the financial institution monitoring chose to go where the Black soldiers were, so they can benefit from those down payments. And prior to you understood it, the financial institution had 37 branches. There had not been also an across the country system amongst white financial institutions during that time.

You compose that the failing of the financial institution was “an awesome of Black desires.” Just how so?

W.E.B. Du Bois claimed an added ten years of enslavement would certainly not have the exact same effect. These were individuals that were conserving cash, conserving their dimes. Several of them had actually never ever made money prior to. Farmers were placing in cash to purchase seeds, and individuals were conserving cash to purchase homes. And when the financial institution fell short, every one of those desires passed away due to the fact that the majority of the depositors shed their cash. The financial institution shed around $3 million in down payments which would certainly have had to do with $80 million today.

Black Americans have a lengthy background of suspect of American banks– this is the tradition of the Freedman’s Financial institution and among the origin of the suspect of Blacks in the financial system.

Just How is Black America still really feeling the impacts of the financial institution failing now?

There are still Black Americans that will not place their cash in financial institutions. And Black individuals still have trouble obtaining lendings. Tiny Black organizations particularly encounter this concern.

Allowed’s discuss the racial riches space, particularly the space in retired life financial savings.

It’s truly frightening due to the fact that Black Americans have little to absolutely nothing in regards to retired life financial savings, that makes a hefty reliance on Social Protection. And due to that Black Americans, particularly Black ladies, take Social Protection early which indicates you’re going to obtain a portion of what you must if you wait up until your complete old age.

Allow’s take a look at a couple of remedies. What are some points that could aid transform the program?

A Lot Of them would certainly entail some solid activity by the federal government. The high assistance amongst white Americans for repairs has actually dissipated. Repairs were paid to the Japanese that were placed unlawfully in prisoner-of-war camp in America. Repairs are something that can tighten the riches space.

Child bonds appear to be extra sensible politically. Generally the federal government deposits cash for youngsters at birth to provide a jumpstart after they finish from secondary school. The moms and dads include cash to it each year up until the youngsters get to university age. That is just one of the most effective remedies that would certainly reduce the racial riches space in fifty percent.

What’s your recommendations for Black Americans now that are attempting to conserve and take control of their economic futures?

The most significant point I would certainly claim is that suspect with all banks needs to go. Black Americans, particularly young Black Americans, need to be extra comfy with conserving and spending. Financial education and learning by itself is not mosting likely to fix the racial riches space. Yet it needs to belong of it.

Among my preferred tales is a Black organization female I spoke to that claimed her mommy made her compose the look for the costs when she was a teen. And consequently, she understood that there was no cash left after the costs were paid. It was a monetary lesson she discovered. When she was a grown-up, she employed a monetary organizer to aid her. So I’m speaking about moms and dads showing their children, and sometimes, currently children showing their moms and dads.

Kerry Hannon is an Elderly Reporter at Yahoo Financing. She is an occupation and retired life planner, and the writer of 14 publications, consisting of “In Control at 50+: How to Succeed in The New World of Work” and “Never Too Old To Obtain Rich.” Follow her on X @kerryhannon.

Click On This Link for the current individual financing information to aid you with spending, settling financial debt, getting a home, retired life, and extra

Review the current economic and organization information from Yahoo Financing

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.