A prominent crypto expert has actually described just how the Bitcoin cost might be in jeopardy of more drawback based upon the existing circulation of BTC supply around the cost.

This Bitcoin Rate Array Holds A Crucial Supply Obstacle

In a current post on the X system, famous crypto expert Ali Martinez reviewed just how the cost of Bitcoin might endure even more decrease. The reasoning behind this bearish forecast focuses on the ordinary price basis of a number of BTC capitalists.

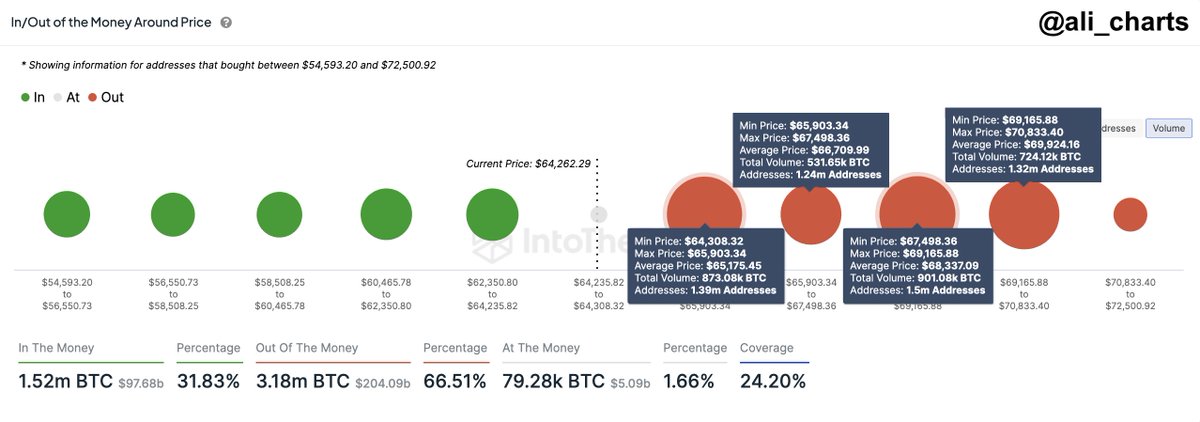

Information from IntoTheBlock reveals that around 5.45 million addresses acquired around 3.03 million BTC within the cost series of $64,300 and $70,800. As highlighted by Martinez, this has actually brought about the development of an important supply obstacle within this cost brace.

For context, a supply obstacle describes a rate variety where a huge quantity of cryptocurrency was gotten. From the dimension of the dots in the chart listed below, it shows up that Bitcoin presently has a considerable supply obstacle over it.

A chart revealing the circulation of BTC supply around numerous cost varieties|Resource: Ali_charts/X

This cost variety comes to be specifically appropriate when the Bitcoin cost drops listed below this degree, as BTC owners within the supply obstacle could begin offering in order to reduce their losses. This might bring about heightened marketing stress and possibly steeper cost modification for the premier cryptocurrency.

In addition, a large offloading and constant cost decrease might adversely affect the marketplace belief, setting off panic offering among various other capitalists. If the marketing stress is substantial, this might contribute to the descending stress on the cost of BTC.

Since this writing, the Bitcoin cost loafs $64,460, showing a simple 0.2% rise in the previous 24-hour.

Bitcoin Miners Are Capitulating

Common capitalists could not be the only course of individuals adding to the marketing stress encountering the Bitcoin cost currently. The most up to date on-chain discovery reveals that the Bitcoin miners have actually additionally been energetic out there in current weeks.

According to information from IntoTheBlock, Bitcoin miners have actually unloaded greater than 30,000 BTC (valued at around $2 billion because June). This stands for the fastest price of decrease in BTC miners’ books in over a year.

The blockchain analytics fixed this sell-off to the lowered earnings of the miners adhering to the current halving occasion. The 4th halving occasion, which took place in April 2024, saw the miner’s benefit loss from 6.25 BTC to 3.125 BTC.

The cost of Bitcoin tries to go across $65,000 on the everyday duration|Resource: BTCUSDT graph on TradingView

Included photo from iStock, graph from TradingView

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.