Bitcoin may be weak at place prices, gliding approximately 13% from $74,800 in the middle of extreme liquidation stress.

Also as costs withdraw from all-time highs and $66,000 confirms to be a mirage, experts are positive concerning what exists in advance. Many anticipate the coin to rise in the direction of the necessary mental line, $100,000, in the coming days or weeks.

A Financial Situation In The USA?

The spike would certainly be increased by Bitcoin riding on the “electronic gold” story that’s rapidly obtaining grip in the middle of expanding worries concerning the monetary health and wellness of financial institutions in the USA.

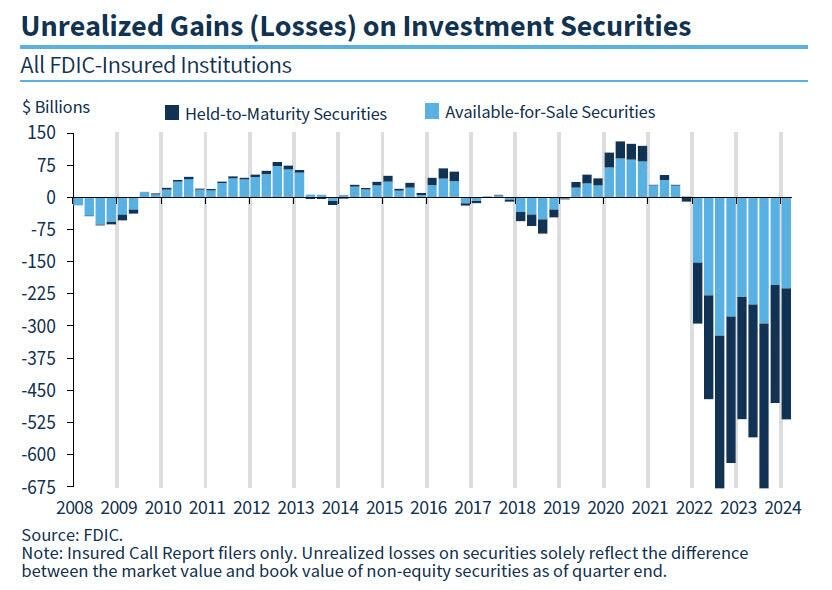

Requiring To X, one onlooker notes a Federal Down Payment Insurance Policy Company (FDIC) record reveals that 68 financial institutions in the USA are resting on over $500 billion in latent losses. A lot of these losses in their varied profiles are from financial investment protections and are worsened by climbing home loan prices.

In their record, the FDIC keeps in mind that this is the 9th successive quarter where financial institutions remain to hold “uncommonly high latent losses.” If this continues, there is an actual danger of these financial institutions destabilizing the monetary markets in the USA.

The existing state of financial institutions in the USA has actually attracted parallels with the 2008 GFC. Nonetheless, any type of financial instability might prefer Bitcoin and safe-haven properties like gold. As background has actually revealed, complying with the collapse of the Silicon Valley Financial Institution (SVB), Silvergate Financial Institution, and Trademark Financial Institution, BTC and ETH costs rallied.

Supervisors may be required to reassess their settings if the fad of climbing latent losses in the USA FDIC proceeds in the coming quarters.

Eyes On The BTFP Program And CRE: Time To Think About Bitcoin?

In this situation, the USA Federal Book’s emergency situation Financial institution Term Financing Program (BTFP), released in feedback to the financial institution failings of very early 2023, might play a substantial function.

This program, which uses unstable small business loan for security, might highly sustain the financial system, affecting BTC costs.

Yet, the business realty (CRE) market seems a lot more distressed. While Neel Kashkari, the Head Of State of the Reserve Bank of Minneapolis, lately downplayed the danger of an extensive dilemma, it prevails expertise that some huge financial institutions, consisting of those battling with even more latent losses, have substantial direct exposure.

Though carrying out more stringent laws after the 2007-08 GFC assists, it continues to be to be seen exactly how the system will certainly soak up shocks need to there be fractures. If it occurs, BTC will likely gain from the existing debt consolidation.

Function picture from Canva, graph from TradingView

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.