2 of the significant supply indexes decreased on Thursday after touching document highs previously in the session. Nvidia’s (NVDA) record-breaking rise– which catapulted it to the title of globe’s most important public firm– additionally kicked back.

The S&P 500 (^ GSPC) shed around 0.2% after briefly going across 5,500 for the very first time, as the index could not improve a 31st document close of the year. The tech-heavy Nasdaq Compound (^ IXIC) touched brand-new highs previously in the session however shut dramatically down, nearly 0.8%. The Dow Jones Industrial Standard (^ DJI) climbed about 0.7%, or regarding 300 factors.

After a vacation break on Wednesday, Wall surface Road had a hard time to proceed its winning methods 2024. Supplies’ development tale this year has actually been mostly driven by the exhilaration around AI’s possibility, and no firm has actually recorded the cumulative interest like Nvidia. For some time, it appeared like the AI celebration would certainly proceed.

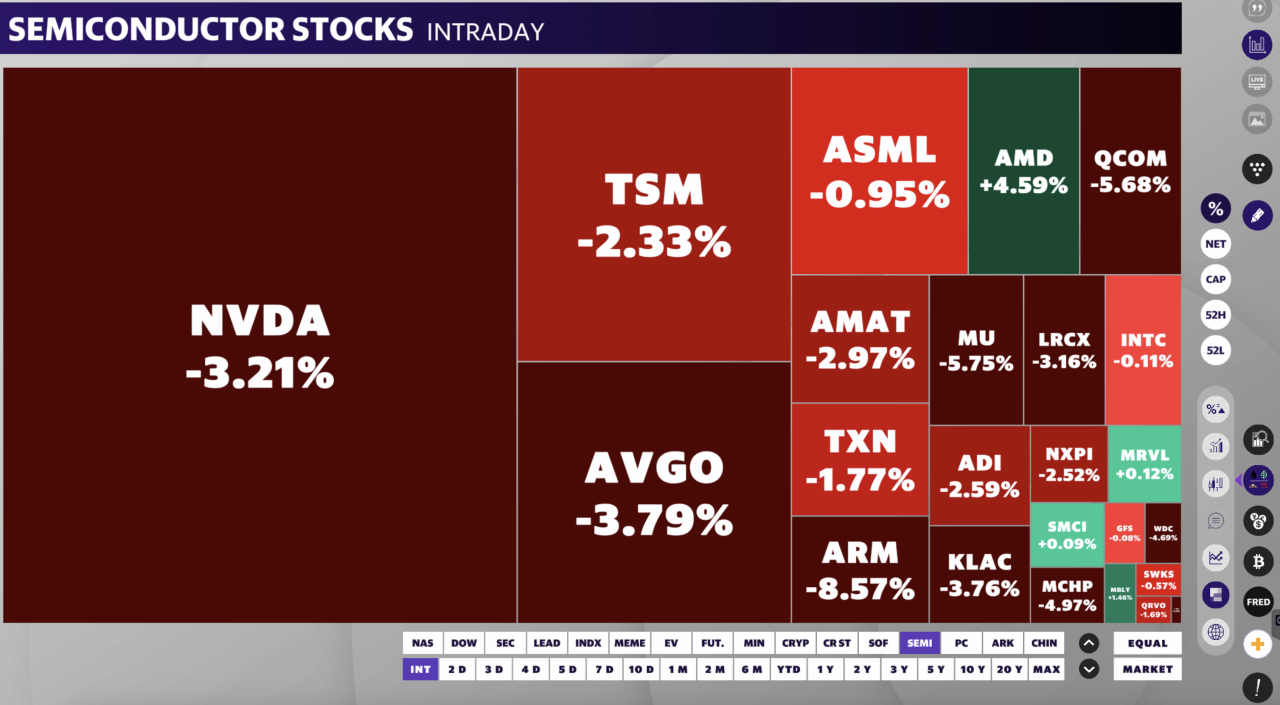

However shares of the chip titan dropped greater than 3% on Thursday. Regardless of the dip, the supply is still up greater than 170% until now this year.

On Tuesday Nvidia finished an extremely fast rise to momentarily appropriate Microsoft (MSFT) as one of the most important firm on the planet– simply 2 weeks after it uncrowned Apple (AAPL) as the No. 2 most important firm. Its surge to the top has actually come so quickly, Yahoo Money’s Jared Blikre composed, that some even more easy capitalists have not had the ability to maintain.

In Other Places on Thursday, international reserve banks remained in emphasis as the Swiss National Financial institution reduced prices for the 2nd time this year. The Financial institution of England maintained its benchmark price at a 16-year high, however signals indicated a price reduced in the summertime.

In the United States, on the other hand, the majority of investors remain to bank on a Fed cut by September, according to theCME FedWatch tool The greatest item of financial information can be found in the kind of once a week out of work cases, which revealed a dip of 5,000 to 238,000 recently versus an agreement assumption of 235,000.

Live 12 updates

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.