The Stocks and Exchange Compensation (SEC) might decide not to appeal the recap judgment ruling from Court Analisa Torres partly preferring Surge Labs, indicating a critical change to stay clear of developing a possibly undesirable criterion in greater courts. This opportunity has actually emerged as the crypto area waits for the court’s treatments stage judgment anticipated by the end of Summertime 2024, after which the SEC’s home window to appeal will certainly open up.

Why The SEC May Wish To Prevent A Charm Vs. Surge

Kristina Littman, previous head of the SEC’s Enforcement’s Cyber System, considered in on the SEC’s prospective strategy throughout a current seminar on electronic possessions. She hypothesized that provided the blended judicial point of views in comparable situations, the SEC may select to approve the area court’s choice.

She kept in mind, “I’ll claim on the Surge allure factor, I’ll wonder to see whether the celebrations appeal there.” Her monitoring indicate the unpredictability and critical estimations at play behind the scenes.

Additional specifying on the prospective judicial dispute that makes complex the allure choice, Littman said, “I believe there’s some supposition that since Court Rakoff and the Terra point of view clearly differed with Court Torres’ reasoning from the Surge point of view, and after that Coinbase does not actually deal with the Surge point of view as much however you recognize quite clearly embraces the Terra reasoning.”

She proceeded by highlighting the reduced possibilities for an allure, “I believe there’s some supposition that the SEC may simply allow the Surge point of view remain there as an area court point of view and not risk you recognize boosting it to a circuit degree where they might possibly evoke poor legislation when they have or else positive judgments in the results of the Surge lawsuits.”

Did Kristina Littman of the #SEC simply validate that the #SEC is NOT appealing the #Ripple instance?

We understand exactly how these suppositions have actually gone, she recognizes! pic.twitter.com/ilzqC74Ho3

— wEeZiE {X} John Deaton 4 Us Senate (@NerdNationUnbox) June 19, 2024

What goes to Risk

The first judgment in July 2023 discovered that Surge’s programmatic sales and second market purchases were not categorized as safety purchases. The business dominated on 3 of the 4 objected to factors. Court Torres just wrapped up that the sales of XRP to institutional customers did certify as safety purchases.

This was viewed as a significant success for Surge, among a historical dispute over the category of XRP as safety. The judgment rested on comprehensive analyses people protections legislations, especially exactly how they put on electronic possessions, which are not clearly covered under existing laws.

Contributing to the intricacy are different judgments in various other associated situations. As an example, in the SEC vs. Terraform Labs instance, Court Rakoff denied Court Torres’ thinking used in the Surge instance. Furthermore, significant crypto exchange Coinbase has actually straightened itself a lot more very closely with the judgment in the Terraform Labs instance instead of referencing the Surge choice, more making complex the regulative landscape.

Littman’s statements mirror a wider critical factor to consider within the SEC to possibly stay clear of screening unclear lawful waters at the appellate degree, which might strengthen negative criteria that may prevent the firm’s capability to control in the market properly. Rather, by not appealing, the SEC could be aiming to preserve an extra versatile regulative position.

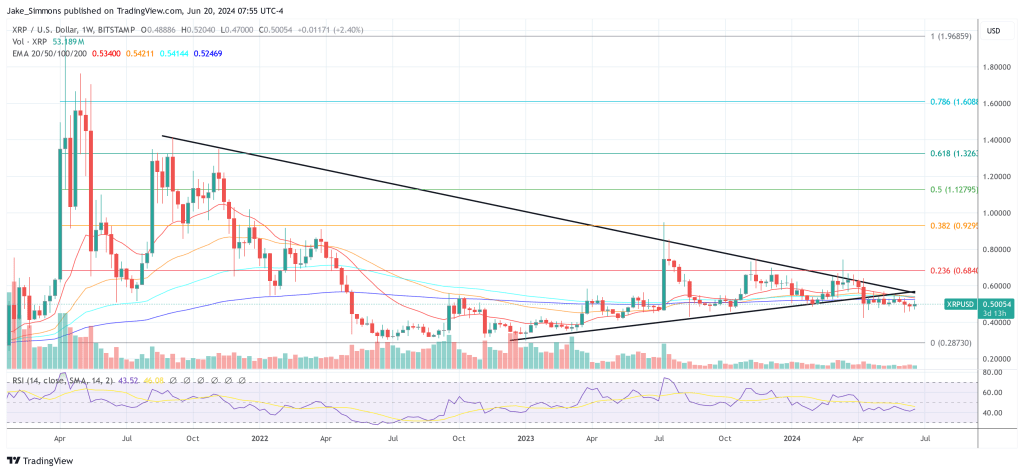

At press time, XRP traded at $0.50054.

Included picture developed with DALLE, graph from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.