On June 20, Surge Labs Inc. racked up a crucial success in its recurring lawful obstacles, especially in the government course activity fit submitted in the Northern Area of The Golden State. The case (4:18-cv-06753-PJH), commanded by Court Phyllis J. Hamilton has actually been very closely kept an eye on by the XRP area as a result of its possible ramifications for the category of the electronic property under United States protections legislation.

Right here’s What The Judgment Indicates For XRP

Court Hamilton’s judgment provided Surge’s recap judgment movement, rejecting both government and state course declares that XRP was marketed as a non listed safety and security. Fred Rispoli, a singing pro-XRP attorney, explained the relevance of this using social media sites: “Win for Surge in the Oakland course activity. Court gives Surge’s recap judgment movement on government course cases for non listed protections along with the state legislation protections cases. Yet these were step-by-step victories.”

Although Surge has actually efficiently disregarded the course activity cases, the court avoided making a clear-cut lawful resolution on whether XRP makes up a protection. Rather, it was specified that it is for a court to choose if XRP fulfills all 3 prongs of the Howey examination, which establishes what makes up a protection under United States legislation.

This leaves a significant component of Surge’s lawful fight unsettled, as Rispoli kept in mind: “The course activity is currently over at the area court degree. Regarding whether XRP is a protection, nevertheless, the Court held it is for a court to choose whether all 3 prongs of the Howey examination are fulfilled.”

Rispoli included, “that case, a private case by one complainant, will certainly most likely to test though probably, will certainly work out offered the incredibly reduced problems and extremely negative court decision that can result if complainant victories. To summarize: Court claims whether XRP is a protection in the context of retail customers on an exchange is for the court to choose and not an issue of legislation.”

The viewpoint has actually stimulated different feedbacks from various other lawful specialists. Marc Fagel, one more attorney in the crypto industry, explained an opposition with one more judgment, recommending intricacies in the lawful analysis of electronic possessions: “Simply check out the viewpoint. Straight negates Torres on programmatic sales (however would certainly’ve been extra intriguing if the court had actually gone an action better and located them to be protections sales as an issue of legislation as opposed to punting to the court).”

While Surge has actually attained a step-by-step success, the unpredictability over XRP’s category remains to cast a darkness. Rispoli’s remarks underscore the minimal extent of the judgment: “Unfortunately, it depends. XRP (using Court Torres) has lawful quality just (1) as it entails the SEC making claims of government protections infractions and (2) in the Southern Area of New York City, which various other courts can neglect in non-SEC instances.”

The termination of the course activity declares versus Surge supplies a short-lived reprieve for the business, yet the overarching lawful inquiries bordering XRP and its standing as a prospective safety and security stay unanswered. The forthcoming court choice on the application of the Howey examination to XRP will certainly be critical.

As Rispoli sums up, the more comprehensive problem at risk is the requirement for government regulations to resolve the regulative therapy of cryptocurrencies: “Inevitably, crypto globe requires to maintain stress on obtaining government regulations, due to the fact that we get on track to having XRP be a protection in The golden state yet not in New york city.”

Thorough Assessment Of The Judgment

The legal action entails course activity declares versus Surge Labs Inc., its subsidiary XRP II, LLC, and Surge’s chief executive officer Bradley Garlinghouse. The fit is fixated claims associated with the sale and advertising of XRP, an electronic property, which complainants suggest was provided and marketed as a non listed safety and security.

The vital problems in the lawsuits consist of whether XRP ought to be taken into consideration a protection under United States legislation, and subsequently, whether Surge’s activities of offering XRP to the general public breached protections regulations. This instance has actually seen numerous lawful maneuvers, consisting of activities for course qualification, which were provided, permitting the instance to continue as a course activity. This implies people that acquired XRP throughout a given duration and experienced economic loss can be stood for jointly.

In the judgment, Court Phyllis J. Hamilton made numerous vital choices.

Factors for Surge:

- Federal Claims Rejected: The court used the “first-offered” policy under the law of repose, wrapping up that the government protections cases associated with the non listed deal and sale of XRP were prevented due to the fact that the offering took place greater than 3 years prior to the legal action was launched.

- State Insurance Claims Rejected: Comparable to the government cases, the state declares for failing to sign up XRP as a protection were disregarded. The court located that the complainant did not appropriately show privity, an essential component for these cases under The golden state legislation.

- Course Claims Rejected: The court disregarded all course declares for both government and state claims, substantially minimizing the extent of the legal action versus Surge.

Details Surge Lost:

- Misinforming Statements Insurance Claim Profits: The court rejected Surge’s movement for recap judgment on the private case versus chief executive officer Garlinghouse for making apparently deceptive declarations concerning his financial investment in XRP. This case will certainly continue to test, concentrating on whether Garlinghouse’s declarations affected capitalists’ assumptions and financial investment choices.

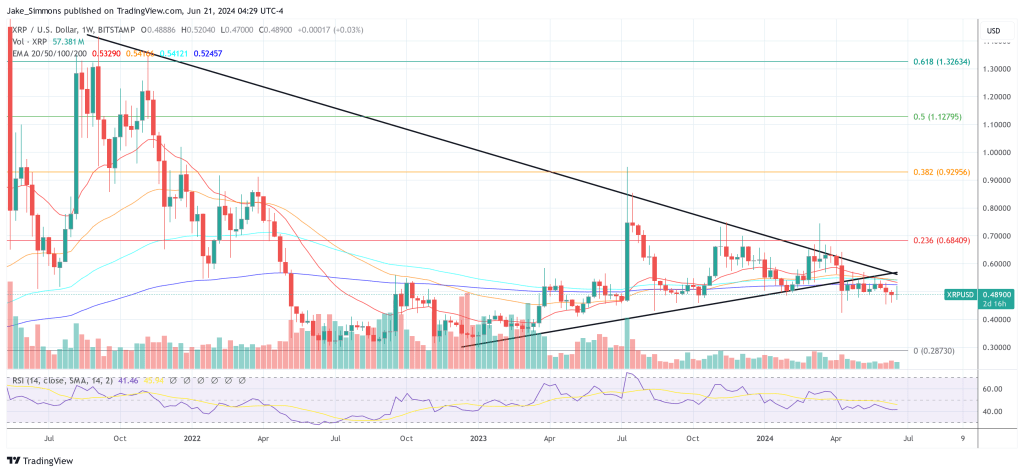

At press time, XRP traded at $0.4890.

Included picture produced with DALL · E, graph from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.