Information reveals the Bitcoin Web Taker Quantity has actually been mainly at unfavorable degrees just recently. Below’s what this might indicate for the property’s cost.

Bitcoin Web Taker Quantity Has Actually Been Mainly Unfavorable In The Past Month

As CryptoQuant neighborhood supervisor Maartunn mentioned in a message on X, the Web Taker Quantity recommends an absence of solid taker acquire quantity in the previous month.

The “Web Taker Quantity” is an indication that keeps an eye on the distinction in between the Bitcoin taker buy and taker offer quantities. Normally, both quantities gauge the deal orders filled up by takers in continuous swaps.

When the worth of this statistics declares, it indicates that the taker acquire quantity is more than the taker sell quantity today. Such a fad suggests most of the marketplace shares a favorable belief.

On the various other hand, the sign under the no mark recommends the prominence of a bearish mindset in the industry, as the brief quantity exceeds the lengthy quantity.

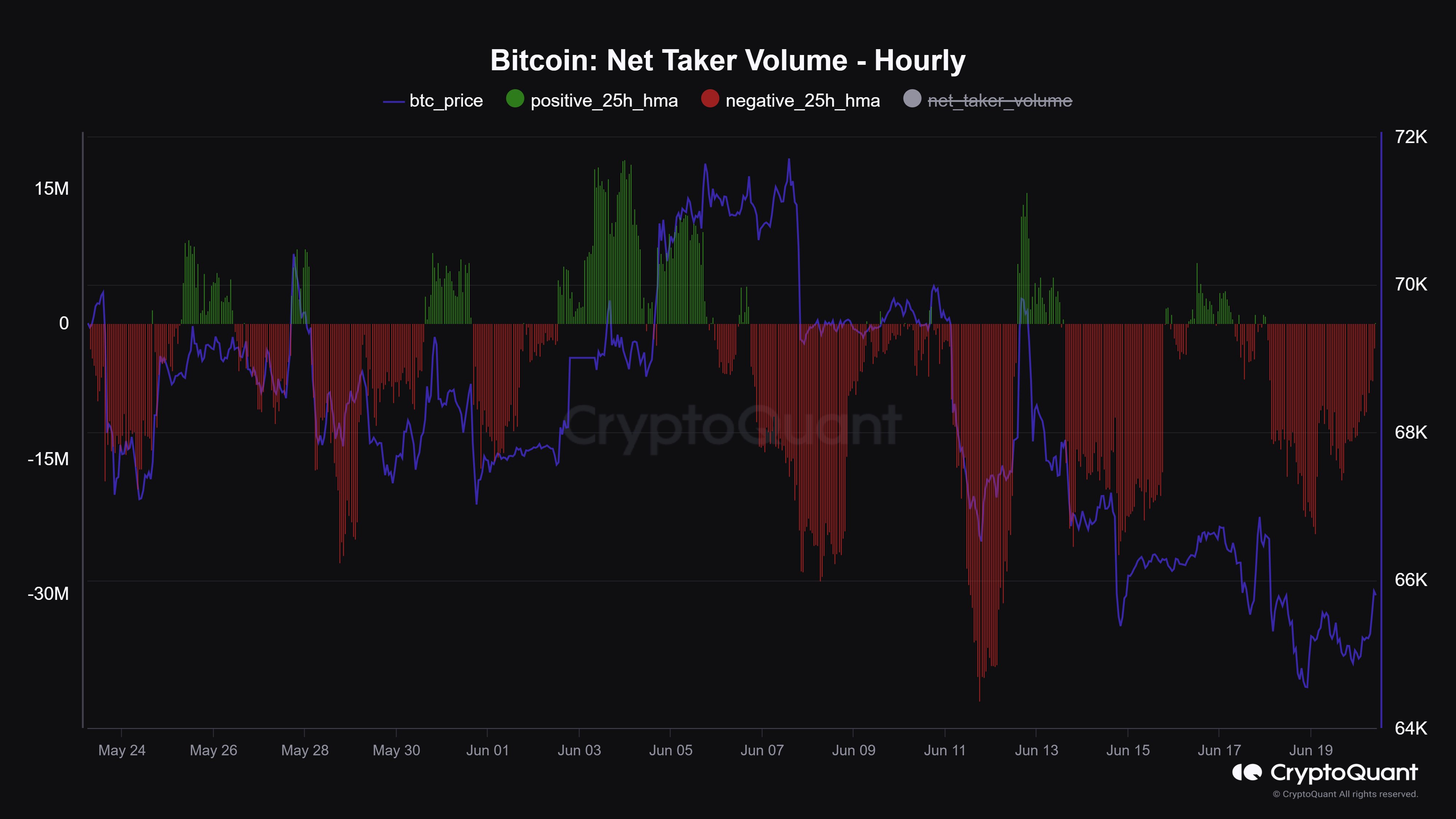

Currently, right here is a graph that reveals the fad in the Bitcoin Web Taker Quantity over the previous month:

The worth of the statistics shows up to have actually been unfavorable in current days|Resource: @JA_Maartun on X

As presented in the above chart, the Bitcoin Web Taker Quantity has actually seen simply a couple of spikes right into favorable region throughout this home window, and the range of these spikes has actually likewise not been undue.

The sign has actually been inside the red area the remainder of the time, typically observing dramatically unfavorable worths. Thus, it would certainly show up that taker sell quantity has actually controlled the marketplace in the last month.

The chart reveals that the one stage in this duration where favorable worths got to a noteworthy range went along with an increase in the cryptocurrency’s cost. Thus, the metric might require to turn environment-friendly once more if BTC needs to make some healing.

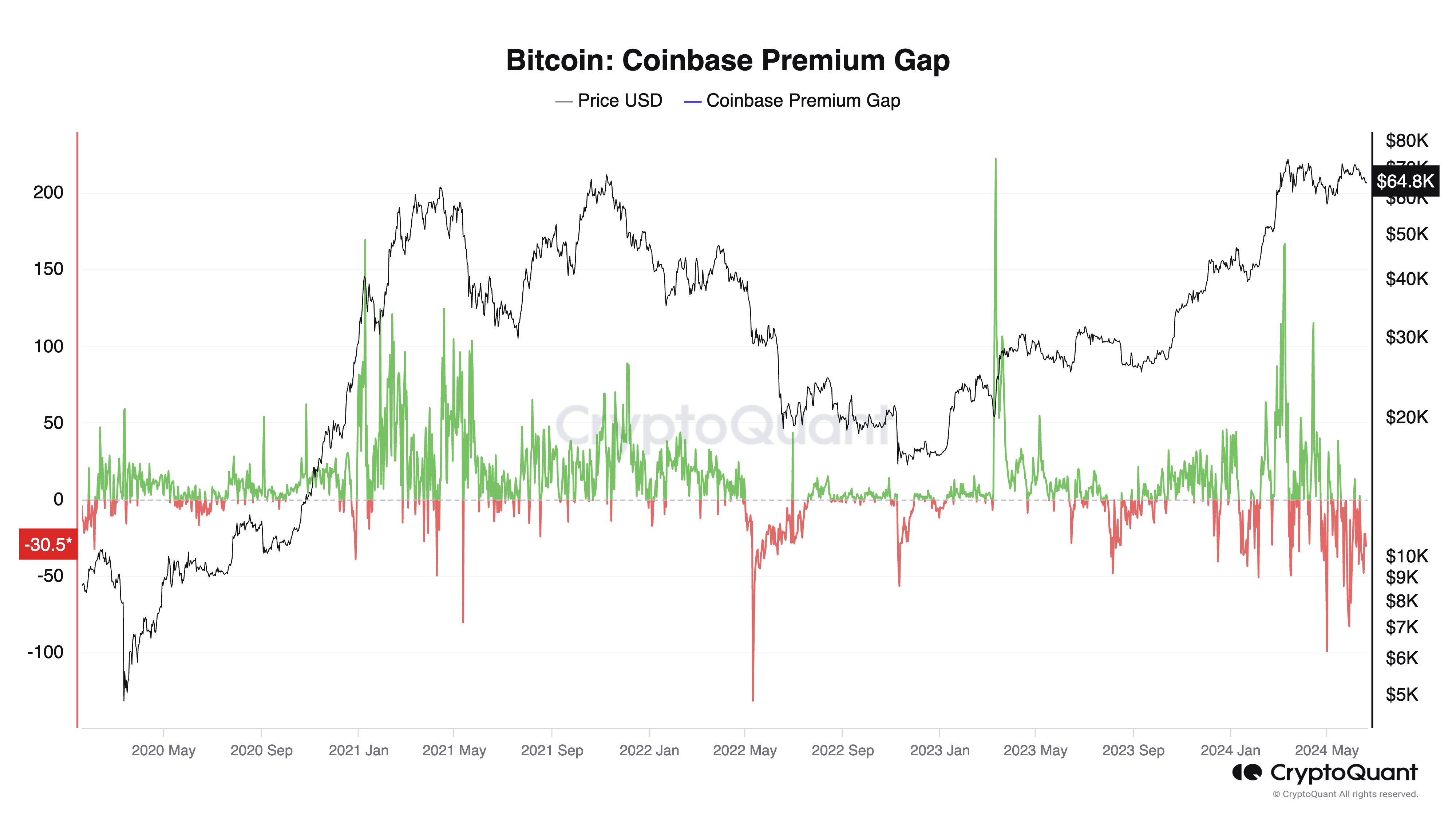

The internet taker quantity hasn’t been the only sign that has actually been bearish for Bitcoin just recently; it shows up that the Coinbase Costs Void has actually likewise been unfavorable, as CryptoQuant creator and chief executive officer Ki Youthful Ju cooperated an X post.

Resembles the worth of the statistics has actually been fairly red in current weeks|Resource: @ki_young_ju on X

The Coinbase Costs Void keeps an eye on the distinction in between the Bitcoin costs detailed on the cryptocurrency exchanges Coinbase (USD set) and Binance (USDT set). The sign’s worth shows exactly how the capitalist actions on Coinbase varies from that on Binance.

As the graph reveals, the Bitcoin Coinbase Costs Void has actually been being in undersea region just recently, recommending that Coinbase has actually been seeing even more marketing stress than Binance. This marketing might be among the reasons the property has actually been embeded debt consolidation recently.

BTC Rate

Bitcoin is trading about $64,800, which is within the variety the property has actually been relocating sidewards inside for some time currently.

The cost of the property appears to have actually been dropping just recently|Resource: BTCUSD on TradingView

Included picture from Dall-E, CryptoQuant.com, graph from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.