This is The Takeaway from today’s Early morning Quick, which you can join to get in your inbox every early morning together with:

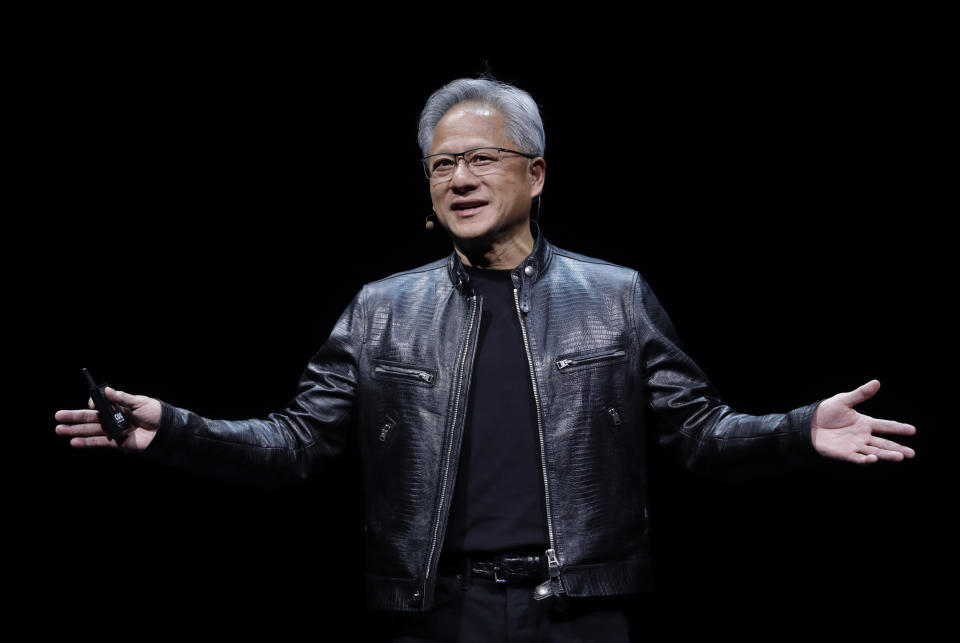

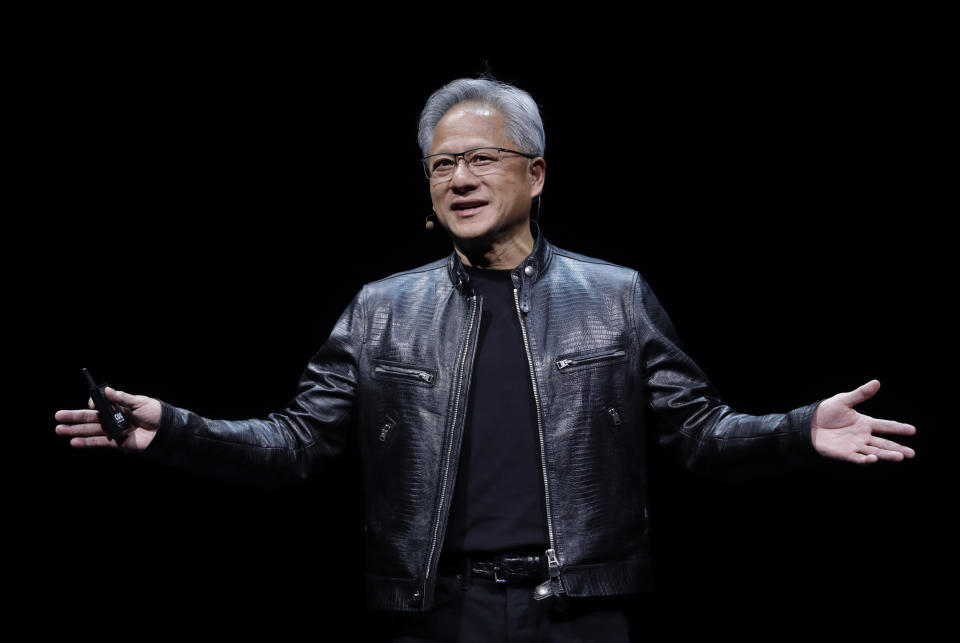

Nvidia (NVDA) scratched its 43rd document shutting high up on Tuesday, bringing its 2024 return near to 175%.

Sadly, easy capitalists counting on common funds and ETFs as financial investment automobiles have not had the ability to take part in every one of these gains.

Micron (MU), Qualcomm (QCOM), KLA Corp (KLAC), and Lam Study (LRCX) likewise shut at all-time high up on Tuesday, catapulting the wider S&P 500 Technology Index to its very own document and bumping up its year-to-date go back to an excellent 31%.

Yet the closest investable suit– the Innovation Select Market SPDR Fund (XLK)– is underperforming its technology industry criteria by over 10 percent factors this year.

And the concern develops from the really success of the biggest technology names.

The heart of easy investing is predicated on taking care of danger with diversity. Theoretically, a varied technology index is “more secure” than one in which 3 supplies control the index.

Yet over the last 4 years, Apple (AAPL), Microsoft (MSFT), and Nvidia have so completely trounced the remainder of the market that ETFs are bumping up versus regulations and laws that restrict the weight of private supplies in funds.

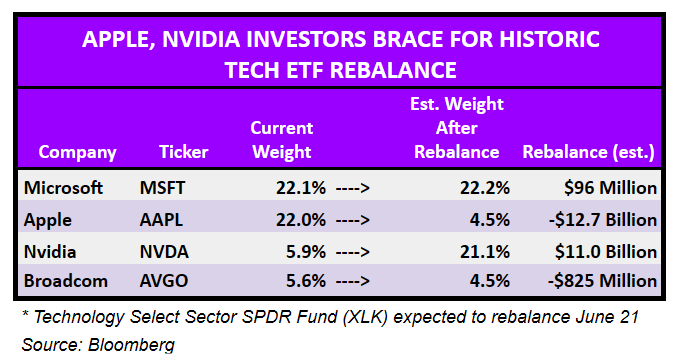

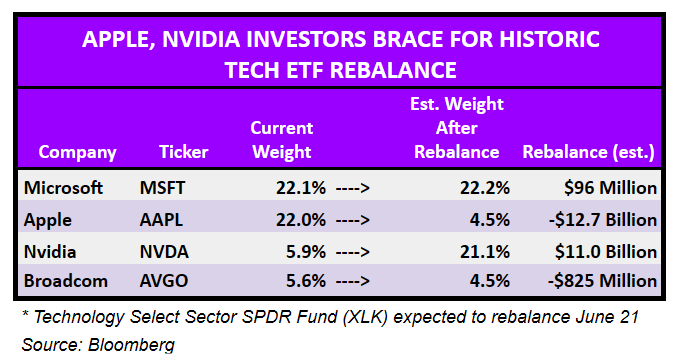

Theoretically, each of these 3 leviathans need to be weighted at simply over 20% of the XLK fund– if it matched the criteria. Nevertheless, several capitalists (including this writer), were lately amazed to find out that Nvidia just consists of 5.9% of the ETF.

This state of events will certainly quickly alter– dramatically. With it, nonetheless, will certainly develop one more difficulty: Apple’s weight going down dramatically.

After the close Friday, the XLK ETF will certainly be rebalanced to go down Apple’s 22% share to 4.5% and rise Nvidia’s 5.9% share approximately 21.1%, based upon Bloomberg quotes.

Every one of this comes from Great Depression-era investor protection laws, which call for that indexes restrict the focus of private supplies to gain the tag “varied.”

Financiers that like reviewing syllabus could delight in the rickety legalese that describes the requirement for these adjustments as revealed in this FAQ and matching index methodology released by S&P Dow Jones Indices.

Quickly specified, there are 4 business– Nvidia, Apple, Microsoft, and Broadcom– that overwhelming the vital 4.8% limit for private names in a varied index. And due to the fact that they jointly go beyond 50% of the whole index by weight, the weights of the tiniest participants are minimized according to a formula up until every one of the lawful limits are appreciated.

All informed, Friday’s rebalance need to compel $12.7 billion in Apple supply to be marketed and $11 billion of Nvidia to be gotten.

That’s close to the buck quantity of Apple shares that trade any kind of provided day, and concerning one-quarter of the buck quantity that Nvidia trades daily. To put it simply, these are worldly quantities.

Thankfully for capitalists, these are extremely fluid supplies, and the financial investment neighborhood will certainly have had a complete week to absorb the circumstance by the time the rebalancing enters into result Friday.

Certainly, there are lots of business not in the trillion-dollar club– and business that aren’t specifically AI plays– that have actually compensated capitalists handsomely this year.

Dow part Walmart (WMT) is up virtually 30%. GameStop (GME) is up 40%. And Abercrombie & & Fitch (ANF) supply has actually returned a monstrous 110% this year.

Yet the rebalance does elevate the concern of an ignored danger for the easy investing method chosen by the masses, which is that they might lose out when just a couple of names are lugging the whole lot.

Click On This Link for the most up to date stock exchange information and thorough evaluation, consisting of occasions that relocate supplies

Review the most up to date economic and service information from Yahoo Money

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.