Ethereum is the home of decentralized financing (DeFi), taking a look at the more than $100 billion in complete worth secured (TVL). Although the number varies, mostly relying on the efficiency of ETH, it is clear that DeFi has actually confirmed advanced, opening brand-new usage situations extending several industries, consisting of financing and insurance coverage.

Are Ethereum DeFi Protocols Undervalued?

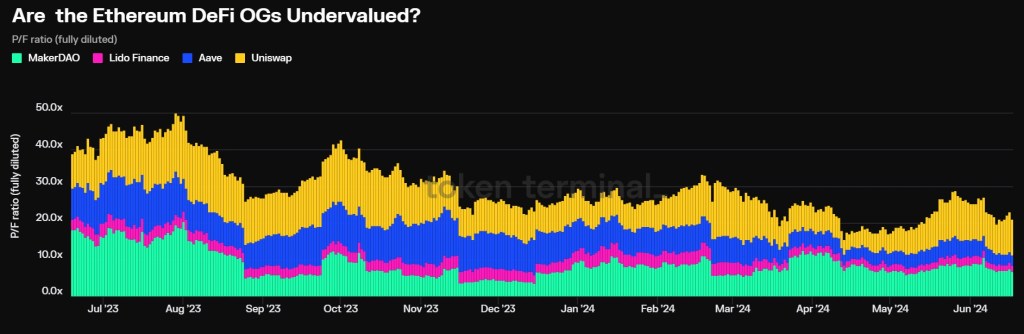

Requiring To X, one expert is currently convinced that a team of recognized DeFi methods on Ethereum, consisting of Uniswap and Aave, are very most likely to be blatantly underestimated.

To place it in context, DeFiLlama information shows that Uniswap, a decentralized exchange, Aave– a decentralized cash market, and Lido Financing– a liquidity betting system, are amongst the biggest by TVL.

The expert kept in mind that these methods’ price-to-fees proportion, a statistics made use of to determine monetary health and wellness, is abnormally high and method much better than leading conventional financing systems noted on bourses throughout the USA.

Of the determined, Uniswap has a price-to-fees proportion of 9.6 x from the $807 million in costs accumulated over the previous year. Nevertheless, according to LinkedIn information, the DEX uses about 137 individuals.

At The Same Time, Manufacturer, a borrowing and loaning system and the company of the mathematical stablecoin DAI, has a price-to-fee proportion of 6.9 X. The method created $252 million in costs in 2014 from a group of about 100 staff members.

The very same fad can be seen in Aave and Lido, where their price-to-fees proportion stood at 2.8 X and 1.5 X, specifically, though their group stays reasonably little.

To comprehend the prospective undervaluation of DeFi methods, the expert after that contrasted these price-to-fee proportions with TradFi titans. The AI titan Nvidia has a price-to-sales proportion of 40X– more than Uniswap’s.

Nevertheless, the Wall surface Road gigantic uses a bigger labor force of around 32,000. The very same fad can be seen in Robinhood. Though the brokerage firm has a price-to-sale proportion of 9.8 X, it created $2 billion in earnings however with a bigger labor force of over 3,300 staff members.

Prospective For Development, Governing Quality, And Continual Scaling

Though Nvidia might have a greater proportion than Uniswap, DeFi methods are naturally a lot more scalable than conventional banks. As necessary, as Ethereum locates regulative quality, it will likely remain to bring in a lot more costs and range to offer brand-new vectors.

Besides the regulative quality that includes the USA Stocks and Exchange Compensation (SEC) authorizing an area Ethereum exchange-traded fund (ETF) and determining to quit their examination right into Ethereum 2.0, the more comprehensive Ethereum environment is scaling.

According to on-chain data, the mainnet, layer-2, and layer-3 remedies procedure around 300 purchases per 2nd (TPS).

Function picture from Canva, graph from TradingView

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.