Market specialist and Bitcoin supporter Timothy Peterson has actually highlighted the value of Bitcoin’s development price in problem as a prospective indication for a rise in its cost in the middle of a sharp improvement in current days that resulted in a rate decline listed below $65,000 for the biggest cryptocurrency on the marketplace.

In a current social media sites post, Peterson recommended that the network’s increasing problem, an essential metric that gauges the computational initiative called for to extract brand-new blocks on the blockchain, can lead the way for Bitcoin to get to $100,000 by the end of the year.

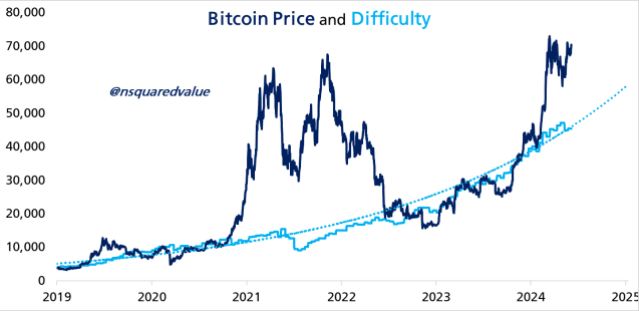

Bitcoin’s Difficulty-Price Partnership

Peterson kept in mind that BTC’s problem is an essential facet of its decentralized nature, immediately readjusting every 2 weeks to keep a typical block production time of around 10 mins.

It operates as a automatic system, replying to modifications in the variety of miners and their computational power. When even more miners sign up with the network, the problem raises, and when miners departure, the problem lowers. This makes sure that no solitary entity can control the network’s procedures.

This relationship in between Bitcoin’s problem and cost is substantial for the expert. As the problem increases, the power expense per extracted Bitcoin additionally raises.

Peterson additionally suggested that Miners should stabilize their electrical power and equipment expenditures versus the possible incentives.

When Bitcoin’s cost is high, it validates these prices, making mining rewarding in spite of rising problem. On the other hand, a rate decline may force some miners to leave the network, minimizing computational power and consequently decreasing the problem degree.

Peterson Establishes Year-End BTC Rate Quote

Peterson kept in mind that Bitcoin’s problem is greater than simply a technological statistics. According to his evaluation, it holds innate worth for the cryptocurrency. Comparable to exactly how products gain worth via the sources needed for removal, each Bitcoin stands for a measurable quantity of initiative and power expense.

Additionally, greater problem indicates an extra protected and durable network as raised computational power strengthens the blockchain. This intense protection imparts self-confidence amongst financiers, driving need and possibly improving Bitcoin’s cost.

According to Peterson, a “cooperative partnership” exists in between BTC’s cost and problem. Greater costs bring in even more miners, bring about a rise in problem. This, consequently, additionally sustains greater costs.

On the other hand, greater problem and connected prices drive miners to enhance effectiveness, which, consequently, sustains greater costs as the network reinforces. The marketplace constantly looks for a stability where Bitcoin’s cost offsets the power prices miners sustain.

Thinking about these complex characteristics and existing market fads, Timothy Peterson uses an affordable year-end cost quote variety for BTC, predicting in between $60,000 and $90,000. Furthermore, power prices act as a flooring cost for Bitcoin.

Nonetheless, the possibility for raised fostering and favorable market belief can thrust the cost also greater, possibly getting to the substantial turning point of $100,000.

At the time of composing, BTC was trading at $64,480, down 2.5% in the previous 1 day.

Included picture from Shutterstock, graph from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.